Elon Musk seems to be getting cold feet...

Elon Musk seems to be getting cold feet...

The serial entrepreneur's relationship with social media giant Twitter (TWTR) has been rocky from the start. It started when Musk bought a 10% stake in Twitter and hinted at joining the board.

Days later, Twitter CEO Parag Agrawal insisted Musk would not be joining the board. And just a few days after that, Musk decided to buy the whole company.

Back in April, the Twitter board accepted Elon Musk's offer of $54.20, a 40% premium to the market value. Musk hinted at several changes he'd make, like adding an edit button to posts and introducing a paid subscription model.

With buy-ins from other investors and the board, it looked to be a surefire deal... until it wasn't.

Now, it looks like Musk is trying to blow up the deal from within...

Now, it looks like Musk is trying to blow up the deal from within...

No matter your thoughts on Musk, he's a smart man. He knows that if he simply walked away from the deal, Twitter could sue him for at least $1 billion in termination fees.

So instead, he keeps changing his acquisition requirements. First, he announced that he'd only agree to the deal once Twitter proved that fewer than 5% of accounts were "bots."

Twitter's official count has bot accounts pegged at 5%. Musk said he suspected the social media giant used flawed methods to determine bot count. He tweeted that his own estimates put bot accounts closer to 20%.

Analysts believe Musk is focusing on bots in an effort to negotiate a discount... or get out of the deal entirely.

But Musk has a point...

You see, advertising is Twitter's primary source of revenue. Advertisers pay for humans to see their ads... So if more than 5% of Twitter accounts are bots, it could be a problem. Advertisers likely won't be willing to pay nearly as much if their ads are going out to fewer people.

So if the number of bots is higher than Twitter says, the company might be worth less than Musk initially thought.

Plus, with the markets slumping, Musk's various equity stakes have taken a major hit. This means the equity he put up as collateral for the Twitter deal has fallen. And Tesla (TSLA) stock is down 29% since Musk first announced the acquisition.

Between Musk's lower net worth and rising interest rates, financing for the deal becomes even more expensive – eating into possible returns for Twitter. No wonder Musk is looking for a way out.

At this point, Musk might have to decide whether the billion-dollar break-up fee is worth it...

At this point, Musk might have to decide whether the billion-dollar break-up fee is worth it...

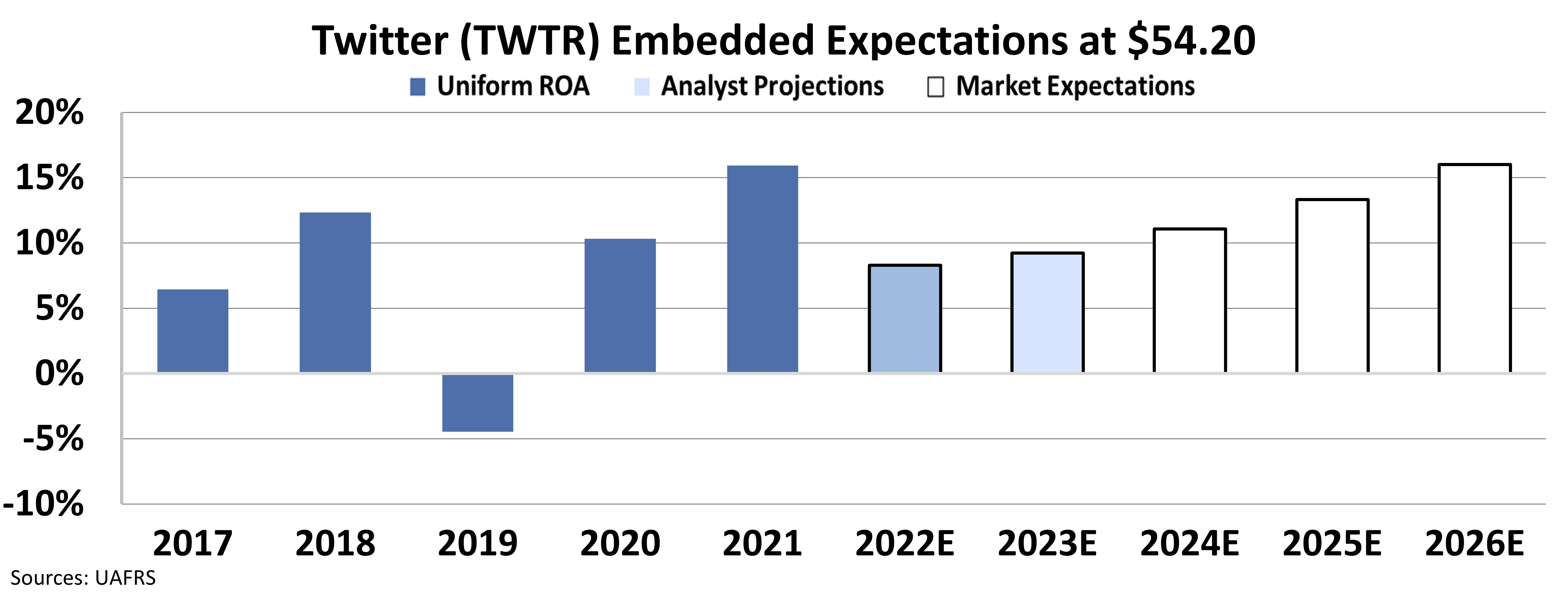

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what returns Twitter would need to justify its stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the intrinsic value of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted generally accepted accounting principles ("GAAP") metrics only come out as garbage. Therefore, we use the current stock price with our EEA to determine what returns the market expects.

Looking at historical returns, we can see that Twitter's average Uniform return on assets ("ROA") is around 12%. This is in line with corporate averages – much lower than one might expect from such a large technology company.

Because of competition from other social media platforms, analysts project Twitter's Uniform ROA will fall to between 8% and 9% over the next two years.

Meanwhile, to be worth Musk's proposed purchase price of $54.20, Twitter's returns would need to reach all-time highs of 16%.

Musk may be getting cold feet due to the number of bot accounts... or he may simply be experiencing buyer's remorse. But no matter the reason, he would be right to back out – even if it means paying a large fee.

Thanks to Uniform Accounting and the EEA framework, we can see at a glance that $54.20 is an expensive price for Twitter stock.

Sure, $1 billion is a lot of money. But if it means Musk can renegotiate – or leave the deal entirely – it doesn't seem like too big a price to pay.

Best,

Joel Litman

June 7, 2022

Elon Musk seems to be getting cold feet...

Elon Musk seems to be getting cold feet...