The days of unlimited growth are over...

The days of unlimited growth are over...

Global economists predicted that China would finish 2024 roughly on-target... with gross domestic product ("GDP") growth of 4.9%.

Yet the numbers released by Chinese officials last week showed it could narrowly miss that mark...

Through the first three quarters of 2024, the country’s GDP had grown just under 4.9%. And yet, China managed to have a barnburner fourth quarter.

The GDP allegedly grew 5.4% in that period – its highest rate in six quarters. That's just high enough to keep the economists at bay.

Although it raises some concerns among astute analysts...

You see, while China ultimately hit its growth target, 2024 was its weakest year since 1990, excluding outlier years during the COVID-19 pandemic.

As we'll explain today, this data highlights that the wheels are slowly coming off for this global leader...

Longtime subscribers know you can't always trust the numbers coming out of Beijing...

Longtime subscribers know you can't always trust the numbers coming out of Beijing...

Even China's allies have doubted its data for some time. Not to mention, independent research firms like Rhodium seem to think the country grew at half the rate it reported last year.

That makes a lot of sense when you remember a key fact about China's economy... Namely, its real estate sector is in shambles.

This sector comprises about 24% of the country's total GDP. And it has been propped up by debt for years.

The cracks began to show in 2021 when China's second-largest developer, Evergrande, defaulted on its loans. (It liquidated assets early last year.)

Since then, several other companies – including China's largest developer, Country Garden – have also defaulted.

Simply put, the real estate industry is overburdened by debt. And that's making it much harder for Chinese companies to borrow money.

This trend caused year-over-year investment in real estate to fall 10% through November 2024.

When nearly a quarter of China's economy loses so much capital, it's hard to imagine the country comfortably hitting its GDP goals.

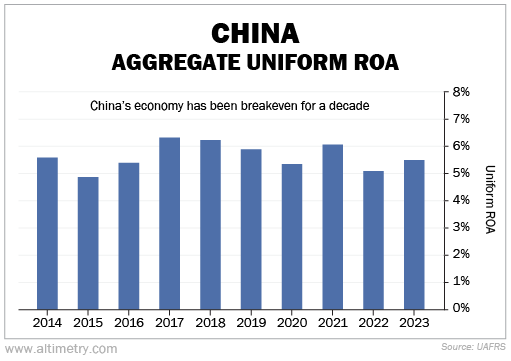

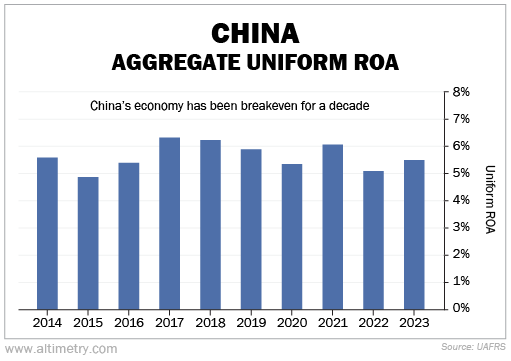

Not to mention, the economy isn't throwing off any extra cash to invest in its growth. Just look at the chart below... It measures aggregate Uniform return on assets ("ROA") for all major Chinese companies.

For the past decade, the country's ROA has averaged between 5% and 6%. That's right in line with its cost of capital, meaning China's economy is just covering costs… and nothing more.

In other words, the economy is basically breakeven.

No wonder the Chinese government's numbers are shrinking...

No wonder the Chinese government's numbers are shrinking...

China has relied on debt for far too long. The country simply doesn't produce enough cash to sustain investments through any other means.

Whether or not we can fully trust the country's data, two things are clear... China reported its lowest growth in more than 30 years (when excluding 2020 and 2022) and its third straight year of population decline.

And this may just be the beginning...

Now that President Donald Trump is back in office, the U.S. can put a lot more pressure on China... Since Trump plans to add tariffs on all kinds of goods, that could chip away at China's export numbers.

It has only been a few days, but we have reason to believe things are about to get even worse in China.

I'll cover the Chinese market and economy in much more detail tonight, in my latest Master Class series... "The Truth Behind the Numbers."

This two-part series kicks off at 6 p.m. Eastern time. I'll discuss why GDP metrics are misleading... the critical role of U.S. innovation... and how to leverage the right indexes for long-term financial success.

Our Master Class lessons are free for Altimeter Pro subscribers. You should have received your exclusive e-mail link yesterday at noon.

For everyone else, you can sign up for a 30-day trial of the Altimeter Pro – at a special discounted rate – right here. (And if you can't attend a live Master Class, a replay will be available within a day or two.)

In the meantime, be cautious when it comes to China's economic data.

We wouldn't get involved with a company that doesn't have enough cash to invest in itself... let alone a whole country.

Regards,

Joel Litman

January 22, 2025

The days of unlimited growth are over...

The days of unlimited growth are over...