I've never met a balanced fund I liked...

I've never met a balanced fund I liked...

Early next year, I'm speaking at #FREECON. It's an online convention for freelancers and business leaders hosted by MBO Partners, a firm we work with extensively, which offers a marketplace platform for independent contractors.

The event, which you can learn more about here, aims to help freelancers and aspiring business professionals maximize work opportunities and create more acceptance for the freelancing model.

Naturally, I will speak on investment strategies... specifically for independent business owners and contractors. Wealth creation isn't just about making money. It's also about knowing how to invest so that your money works for you.

Since freelancers don't work for anyone but themselves, many of the attendees don't receive the same guidance on their investments as someone working for a big firm with a 401(k) plan.

While freelancers may view this as a downside, it's not necessarily a bad thing. It means you don't need to be "untaught" from bad advice.

Investment advice that corporate 401(k) plans provide to their workers can be misleading. It almost always starts with the incredibly misguided question, "Are you a conservative or aggressive investor?"

Even if you aren't a corporate employee and using a brokerage account from one of the many firms that offer brokerage services, you'll likely face the same question.

For most people, the answer is somewhere in between conservative and aggressive. Few people think of themselves as overly aggressive or unreasonably conservative. This leads people to choose the balanced option that fits their investment personality.

And that invariably guides them to choose a balanced fund. These types of funds are mutual funds that contain a mix of stocks and bonds. Asset management firms market these products to investors who seek a mixture of safety with modest growth.

With this approach, we get bad investing. That's a big problem.

First, you find yourself wondering what goes into these balanced funds. Is a 60/40 portfolio split between stocks and bonds truly balanced for a 25-year-old beginning their career? Or is it better suited for a 50-year-old nearing retirement? Both may consider themselves to be balanced investors.

Neither your personality nor your age should define your investing strategy. That's right... neither of them. Any financial advisor worth their salt should ask you this question instead, "When will you spend your money?"

Money that has a spending horizon of more than 10 years from now should be heavily weighted toward equities, with a few exceptions.

If you need to spend the money within the next year or two, it needs to stay in cash or money market funds.

The market has proven that volatility and downside risk in bonds and equities can create depressed values in the next 12 to 24 months without time for a rebound.

The second big reason to stay away from balanced funds is that these products are hard to benchmark accurately.

Because a balanced fund is a mix of equities and bonds, it can't be compared with an index like the S&P 500 Index to gauge performance.

This makes it difficult for retirement savers to gauge how their money is doing.

So often, these funds underperform the mix of benchmarks that they are designed to beat.

All of this doesn't even cover how the management fees on investment funds can slowly but surely eat away at returns long term. That's also hard to see when it's buried in some balanced level of performance.

Was a balanced fund's 8% performance good in 2019? The stock market was up around 30%. Would that 8% have been 10.5% if it weren't for fees? It's hard for the typical investor to decipher.

So, in reality, independent contractors who haven't been steered toward investing in a balanced fund are often much better off...

Fund managers make a killing on balanced and target-date funds...

Fund managers make a killing on balanced and target-date funds...

You don't have to take my word on how much investment managers make on products like balanced funds and target-date funds, which change their weighting of stocks and bonds based on age.

Just take a look at BlackRock (BLK), the world's largest asset manager, which provides target-date funds for around 20% of Fortune 100 companies.

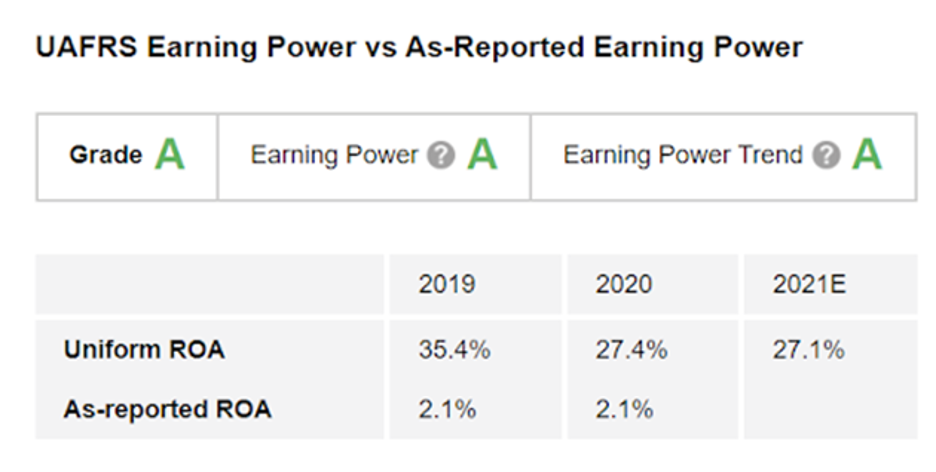

Thanks to The Altimeter – which shows users easily digestible grades to rank stocks on companies' real financials – we can see just how profitable BlackRock's massive money management empire truly is.

Last year, the company generated a Uniform return on assets ("ROA") of 27%, well above corporate averages of 12% in the U.S. As Blackrock is forecast to do so again this year, it earns an "A" grade across the board for performance.

Managing these funds is clearly a great business for the investment management industry, even if it's not necessarily great for your own personal investing strategy.

Does this mean BLK stock is a buy?

Does this mean BLK stock is a buy?

You may be thinking, "If you can't beat them, join them," and believe buying shares of BlackRock is the answer.

But remember, we don't just buy companies based on performance alone. We need to look at valuations as well.

Readers who are subscribed to The Altimeter can click here to see how Blackrock is valued based on Uniform Accounting... and if the company is worth your investment.

Using our Uniform Accounting analysis, we've applied this type of analysis to more than 4,500 companies. And with this method, we've selected more than 20 great large-cap stock picks in our Hidden Alpha newsletter... all with tremendous upside.

To gain access to our most recent issue of Hidden Alpha and view the complete portfolio of recommendations – click here.

Regards,

Joel Litman

October 14, 2021

I've never met a balanced fund I liked...

I've never met a balanced fund I liked...