The Federal Reserve is done with rate hikes for now...

The Federal Reserve is done with rate hikes for now...

But make no mistake – the central bank is still afraid of inflation risk. Fed Chair Jerome Powell plans to keep rates above 4.5% through the end of this year.

That's bad news for U.S. companies, which loaded up on cheap debt in 2020. Refinancing costs have soared since then. And the most common bond maturity is five years from the issuance date. So next year, a ton of bond repayments are coming due... at rates of up to 5% higher after the Fed's rate-hike spree.

Issuing high-rate bonds won't be enough to keep costs down. With no end to the pain in sight, companies are looking for alternative ways to refinance for lower than the market rate.

And if you're willing to step outside your comfort zone, it's great news for investors...

With a recession on the way, companies will have to keep sweetening the pot if they have any hope of refinancing...

With a recession on the way, companies will have to keep sweetening the pot if they have any hope of refinancing...

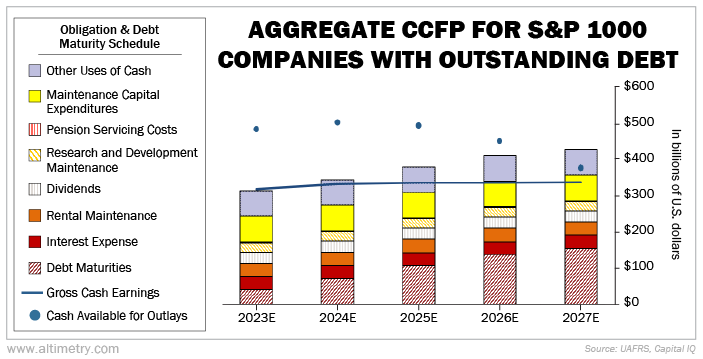

We can see this by looking at our aggregate Credit Cash Flow Prime ("CCFP") analysis.

Our macro CCFP takes the Uniform cash flows and cash reserves for U.S. companies outside the banking and real estate sectors and compares them with their annual obligations.

The chart below shows the aggregate CCFP for the S&P 1000 Index, which tracks 1,000 small- and mid-cap companies in the U.S... the part of the market that's more likely to struggle during an economic downturn.

The blue dots represent the total cash in aggregate, while the blue line represents cash flow in relation to the obligations.

As you can see, debt maturities keep rising over the next four years. And companies are already running out of cash...

Cash flows alone could fall below corporate obligations this year. By 2027, many companies will be in big trouble.

In short, a huge portion of corporate America will have to refinance soon... or risk bankruptcy. But as we mentioned, not all of them can keep up with the market rate. So they have to get creative.

A business can do more than just raise the coupon rates on its bonds to attract investors...

A business can do more than just raise the coupon rates on its bonds to attract investors...

Borrowers can get around these difficulties by making their bonds safer through stricter covenants... requirements for how much cash a company keeps in its accounts, or how it spends that money.

If two bonds have the same yield, the one with the stricter covenants is often a better deal because it offers more security for investors.

On the other hand, companies can also promise more upside by selling what are called "convertible bonds."

Convertible bonds act like normal bonds... at first. Investors buy the bond in exchange for regular interest payments, and the company gets cash to use at its discretion.

They also offer the same protections as other bonds. They're still legal contracts, meaning investors are promised their money back as long as the company doesn't go bankrupt.

But convertible bonds come with a key difference. If investors believe the business will do well in the future, they have the option to exchange their bonds for stock.

Investors like convertible bonds because they have the flexibility to pursue greater upside potential. And because of that higher upside potential, companies can keep the coupon payment lower than the market rate... typically two to three percentage points lower.

That means the company isn't on the hook for as much in interest expenses.

Last year, companies issued 77% more convertible bonds than in 2022...

Last year, companies issued 77% more convertible bonds than in 2022...

That's also far more than any time from 2009 to 2018. And if rates stay this high, you can expect the trend to pick up even more... particularly with investment-grade companies.

As a recession draws closer, the opportunities won't be limited to convertible bonds. All kinds of bonds will keep looking sweeter. No matter how companies choose to refinance, they're offering better terms to investors.

I've been studying the credit market for a decade and a half... and this is one of the best setups I've seen in a long time. Start preparing your portfolio while you have the chance.

Regards,

Rob Spivey

January 17, 2024

Editor's note: Between sky-high interest rates and a looming recession, Rob is confident we're about to see one of the best bond-buying opportunities since the Great Recession. Back then, perfectly safe bonds were trading for pennies on the dollar... with some yielding close to 20% or more.

This is the same strategy that billionaires like Howard Marks and Warren Buffett turn to in times of crisis. Now, Rob and Altimetry founder Joel Litman are "pulling back the curtain"... to share exactly how the world's top investors profit while everyone else is panicking. Get the details here.

The Federal Reserve is done with rate hikes for now...

The Federal Reserve is done with rate hikes for now...