Mark your calendar right now...

Mark your calendar right now...

June 23 will be the most important trading day of the entire year.

No, I'm not predicting the recession will hit that day... or that some sort of "black swan" event will throw stocks into chaos, a la the COVID-19 panic of March 2020.

Even so, for a lot of microcap companies, June 23 will be just short of life or death.

It's guaranteed to be one of the busiest days in the market. And you need to be prepared. More than $10 trillion worth of investments will move during that one trading day.

It may seem odd that I'm so confident in the face of such an uncertain market. There's a simple reason, though...

June 23 is "reconstitution day."

It's a yearly event in which all of the Russell indexes are rebalanced to reflect market changes from the past 365 days. And that makes it one of the most anticipated, most followed events in the financial calendar.

Reconstitution day is only a little more than a week away. So today, we'll take a look at what's at stake for the companies fighting to join and keep their spots in these indexes... and how you can emerge as a winner.

The Russell rebalancing is a huge deal for small companies...

The Russell rebalancing is a huge deal for small companies...

The Russell indexes are a group of benchmark indexes used by investors around the world. They track the performance of the U.S. stock market.

There are three major ones to track...

- The Russell 1000 – The 1,000 largest publicly listed stocks in the U.S.

- The Russell 2000 – The 2,000 next-largest publicly listed stocks in the U.S.

- The Russell 3000 – The Russell 1000 and Russell 2000 combined.

These indexes cover the majority of U.S.-listed stocks by market capitalization that investors can buy. So a lot of folks track them. And pretty much all of these investors are watching – and waiting – to see what will happen on June 23...

That's when the team at FTSE Russell, which creates the indexes, will review the 3,000 or so largest companies in the U.S.

These folks will figure out which companies they're going to remove from the indexes because they've shrunk too much. They'll decide which companies will replace them. And the entire rebalancing happens in just one day.

This is different from the S&P 500 Index, which rebalances quarterly... so only a few companies fall off or get added. It's also a smaller universe of big, stable companies.

With only one rebalancing a year, a lot more companies flow in and out of the Russell indexes at a time. And we already hinted at another factor that makes a big difference...

The very smallest companies added to the Russell 2000 are all microcaps.

These tiny companies often experience much bigger price swings. Well over 200 companies can be added to or subtracted from the Russell 2000 each year. That's a lot of winners and losers.

Keep in mind, institutional investors need to own these stocks to track the index's performance...

Keep in mind, institutional investors need to own these stocks to track the index's performance...

So when a stock is added to the Russell 2000, it suddenly gets a ton of new buyers.

On the other hand, when a company is removed from the Russell 2000, it has the opposite effect. Many investors and fund managers will need to sell shares of that company in order to match the index. The stock price plunges.

Over the past six years, in the six months leading up to the Russell 2000 reconstitution, the average Russell addition outperformed the Russell 2000 as a whole by 23%. The average subtraction underperformed the market by 7%.

The Russell 2000 is the only index many microcaps qualify for. And that means reconstitution day can make or break these stocks.

Traders, investors, and speculators have a field day trying to figure out which companies will be added. They understand that what happens with the Russell 2000 can lead to massive moves in these companies' stock prices... and so do we.

In the lead-up to reconstitution day, we released three special reports for subscribers to our monthly Microcap Confidential advisory...

The first detailed our top candidates for Russell 2000 inclusion this year. The second listed some more promising microcaps to keep an eye on. And the third was our "blacklist" of stocks that could get dropped off the Russell... and that investors should stay away from at all costs.

We pored over hundreds of prospects to narrow down these picks...

We pored over hundreds of prospects to narrow down these picks...

And when the Russell released its preliminary list, we were thrilled to see our efforts bore fruit.

Every single one of our top picks and watch list ideas made the preliminary inclusion list. All but two of our blacklist stocks are being removed.

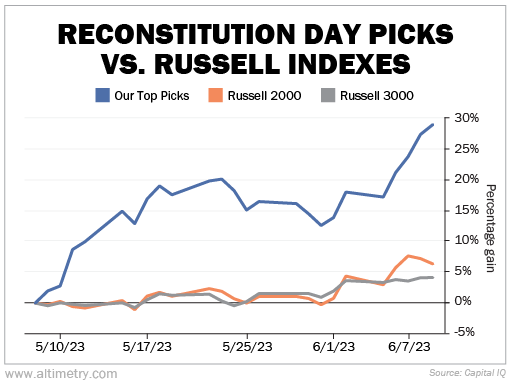

One of our recommendations is already up 61% in about a month... and three more are up double digits. They're up 29%, on average, since early May. The Russell 2000 is only up 6% in that time frame. The Russell 3000 is only up 4%.

Take a look...

And things don't look so good for the companies getting dropped from the indexes. The majority of our blacklist picks are down since we sounded the alarm. Two have fallen more than 20%.

All these big moves are only the beginning...

All these big moves are only the beginning...

On Friday, FTSE Russell will release its final preliminary lists. And it won't make its choices official until June 23.

That means you still have 10 days to pick up shares of the biggest winners... and get out of any potential pitfalls.

This is one of the best opportunities to find under-the-radar ideas in the microcap space. It only comes around once a year. So you can't afford to let it pass you by.

And check out the deletions list, too. If you're holding any of those stocks, you may want to reassess.

Regards,

Joel Litman

June 13, 2023

P.S. Our top reconstitution day picks are already up 29% on average... and there's still plenty of upside left. For a short time only, my team and I are offering access to a full year of Microcap Confidential – including all our latest reports – for 60% off the regular list price.

With the Russell rebalancing fast approaching, this is your last shot to prepare your portfolio. Plus, I'm giving away one of my top stocks to avoid for free. Click here to learn more.

Mark your calendar right now...

Mark your calendar right now...