While gold hit record highs this year, the shine didn't last long...

While gold hit record highs this year, the shine didn't last long...

The metal surged by as much as 35% in 2024, topping $2,700 per troy ounce... and grabbing headlines as one of the year's best-performing assets.

Investors piled into this "safe haven," even as inflation cooled and markets stabilized. But then the election came and went. And with no signs of runaway inflation or economic chaos, gold prices are about 4% off their all-time highs.

Gold's biggest cheerleaders are still holding on. These folks are convinced the metal is the ultimate store of value. It doesn't seem like anything could change their minds...

But we'll do our best.

Today, we'll explain why gold isn't the safe haven investors want it to be. And we'll reveal the type of business you should invest in instead.

As an investment, gold thrives on fear...

As an investment, gold thrives on fear...

Investors rush to the metal for stability when inflation spikes, markets tumble, or geopolitical tensions flare.

That's what we saw earlier this year. Between the upcoming election and fighting in Israel and Ukraine, folks were desperate for a low-volatility place to put their money.

However, while gold may hold its value during times of crisis, it doesn't create value over time. It just sits there, shiny but stagnant.

We can almost hear the gold bulls now... arguing that in 1980, an ounce of gold cost $533. The same ounce is worth more than $2,600 today – an impressive 390% return over nearly 45 years.

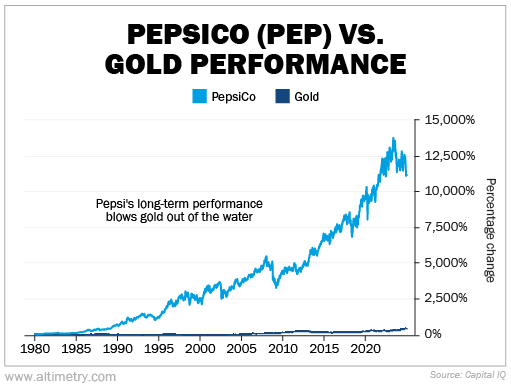

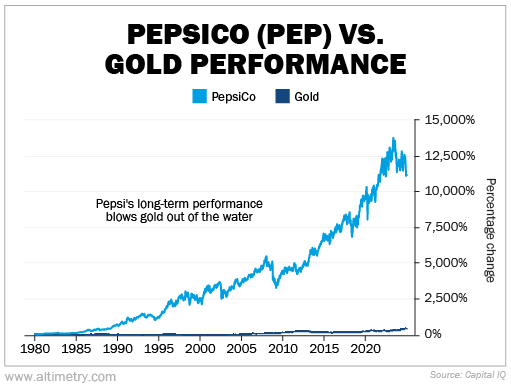

But compare that with a corporate mainstay like PepsiCo (PEP), one of the most consistent value creators in the stock market.

If you had put $533 into PepsiCo stock in 1980 and reinvested your dividends, your investment today would be worth more than $60,916... a return of more than 11,300%.

That's more than 23 times gold's performance over the same period.

Take a look...

And it's not just about the numbers. Gold is inert. It doesn't grow, adapt, or innovate.

An ounce of gold purchased in 1980 is still just an ounce of gold today.

PepsiCo, on the other hand, is a dynamic business. Over the past two decades, it has launched billion-dollar brands like Gatorade and Frito-Lay... expanded its global reach... and rewarded shareholders with consistent dividend payouts.

The beverage maker can reinvest profits and grow its operations. That's how it creates compounding value for investors.

Gold simply can't do what PepsiCo can for your portfolio.

As soon as investor confidence returns, gold's appeal starts to fade...

As soon as investor confidence returns, gold's appeal starts to fade...

And that's exactly what we're seeing now. The post-election drop in gold prices is a clear signal that fear is waning.

Inflation is under control, the economy is stabilizing, and corporate earnings are strong. The case for gold as a "safe haven" is crumbling.

Meanwhile, the stock market remains resilient. Major indexes are steady. And businesses are continuing to grow and reward investors.

Companies like PepsiCo thrive in stable markets like these. The choice is clear.

If you're looking for sustainable growth and compounding value, thriving businesses will always beat a lump of metal.

Regards,

Joel Litman

November 25, 2024

While gold hit record highs this year, the shine didn't last long...

While gold hit record highs this year, the shine didn't last long...