The U.S. is turning to a new source to solve its manufacturing woes...

The U.S. is turning to a new source to solve its manufacturing woes...

Unless you've been living in a cave for the past two and a half years, you probably know that the pandemic caused supply-chain issues around the world.

One of the first (and biggest) examples of this was in the semiconductor industry. COVID-19 made it clear just how delicate our supply-chain infrastructure is – and how an unexpected problem can have lingering effects for years.

These days, chip companies are reconsidering their providers. China and East Asia currently dominate production. The chipmaking industry in China and Taiwan alone is worth $60 billion. In the U.S., that number is only $3 billion.

U.S. companies are looking to reduce their dependance and shore up supply chains. There's clearly room to grow in this industry. And Mexico could be the perfect solution...

Factories in Mexico could drastically reduce manufacturing and shipping costs – not only for semiconductors, but for other goods like vehicles and clothing. And thanks to the recent CHIPS Act and Inflation Reduction Act, which allocated billions of dollars to improving U.S. infrastructure, there's plenty of money to spend.

But there's still a big hurdle for U.S. companies investing in the south... the Mexican government.

Mexican officials have expressed concerns about U.S. investment. The country's nationalist policies could thwart any developments.

The Biden administration has been in contact with the Mexican government regarding this issue. Talks have reportedly been progressing well. Still, we can't be sure that this will lead to full cooperation.

What we can be sure of is this...

There is money to be made from a potential U.S. manufacturing hub in Mexico...

There is money to be made from a potential U.S. manufacturing hub in Mexico...

If factories are going to sprout up across Mexico, they'll need steel. A lot of it.

That's where Simec (SIM) comes in.

Simec is one of the largest steel producers in Mexico. If the U.S. builds manufacturing hubs in Mexico, it will rely on Mexican companies for steel. It's much cheaper than transporting materials from the U.S. And Simec will likely be a key supplier.

That means Simec is almost guaranteed to benefit if plans for foreign investments come to fruition.

In fact, we've already seen what widespread infrastructure investments can do for Simec's returns...

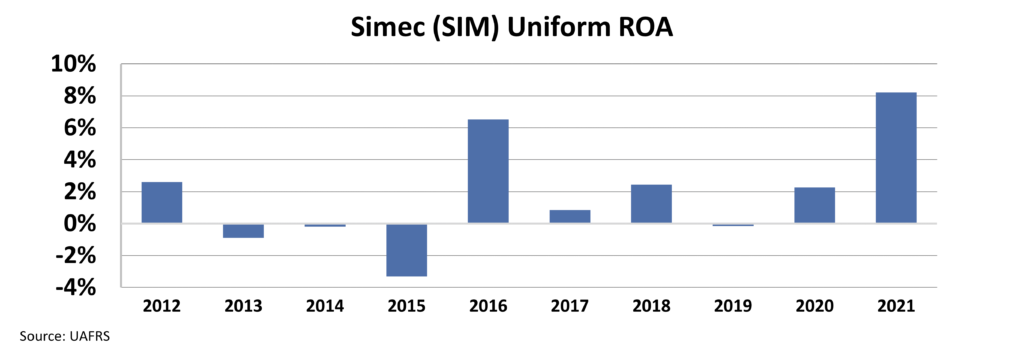

The company's Uniform return on assets ("ROA") has historically been below the cost of capital.

But that changed when Mexican President Andrés Manuel López Obrador announced the National Private Sector Infrastructure Investment Agreement in 2020. The plan provides more than $44 billion of funding to 147 projects through 2024.

It's no coincidence that Simec's returns reached 8% the year after the agreement was announced. That's significantly higher than the company's 10-year average return of 2%. Take a look...

It's clear that Simec does well when infrastructure investment grows. And U.S. investments could be greater than anything the company has seen before.

But the market is underestimating this upside potential.

Investors are distracted by Simec's history of subpar returns...

Investors are distracted by Simec's history of subpar returns...

As we've shown you, the next few years for this company will likely be very different than the past 10 years.

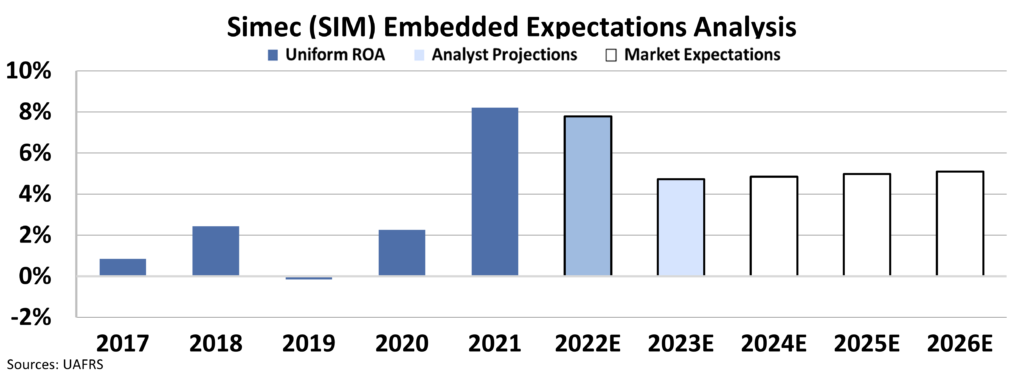

Still, investors don't appear to realize that Simec will benefit from massive infrastructure spend. To understand how the market is valuing this company, we can look at its Embedded Expectations Analysis ("EEA").

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of the stock.

But we know models with garbage-in assumptions only come out as garbage. So we use the current stock price to determine what returns the market expects.

Here's how it looks for Simec...

Analysts think Uniform ROA has room to stay high through at least 2022 (we believe they'll raise estimates for 2023, too). But the market expects a reversal. Right now, investors believe Uniform ROA will fall to around 5% in the coming years.

That's not as low as it was before 2021. But if we're heading for a huge investment cycle on Mexican soil, returns should stay elevated for a long time.

If the U.S. transforms Mexico into a global manufacturing hub, Simec will almost certainly be one of the biggest winners. Yet the market holds a much more pessimistic view of the company. This could be an opportunity for savvy investors.

Regards,

Rob Spivey

October 12, 2022

The U.S. is turning to a new source to solve its manufacturing woes...

The U.S. is turning to a new source to solve its manufacturing woes...