Trouble has been brewing for years. And, once again, Blackstone is at the center of the drama...

Trouble has been brewing for years. And, once again, Blackstone is at the center of the drama...

The problems began with the Blackstone Real Estate Income Trust ("BREIT") back in 2022.

That November, BREIT decided to restrict investor withdrawals. The Federal Reserve had started hiking interest rates and real estate investors didn't want to stick around for the backlash.

BREIT's new rule meant that investors were limited to withdrawing 5% of their holdings each quarter.

That move kept money within the trust, but it damaged Blackstone's (BX) reputation... The stock dropped nearly 4% the day BREIT announced its withdrawal plan. This obviously worried investors.

Their fears are now coming to a head as another Blackstone real estate income trust ("REIT"), Blackstone Mortgage Trust (BXMT), has made its own big move... On July 24, BXMT cut its dividend by 24%.

The reason is simple... Borrowers are struggling to pay off their commercial real estate ("CRE") loans and defaults are skyrocketing.

Today we'll explain why this may just be the tip of the iceberg for the troubled CRE industry.

The majority of bad commercial loans are tied to office buildings...

The majority of bad commercial loans are tied to office buildings...

And they account for about a quarter of BXMT's total outstanding loans.

U.S. office buildings have suffered a 37% drop in value from their peak in 2022. All commercial properties have seen a 20% decline across the country.

As a result, BXMT is trying to reduce its exposure to office real estate... It has lowered that portion of its portfolio by about $1.4 billion since 2022.

That said, the fund's remaining office exposure is still problematic. About 7% of its portfolio currently earns the company's worst "risk" rating, based on a five-point scale.

That's why BXMT was forced to cut dividends back in July, from 62 cents to 47 cents – a rate it had maintained since 2015. The BXMT stock price dropped 11% the day after the dividend announcement.

The bright side is that this dividend cut will save the REIT approximately $100 million a year. Yet that's not going to be enough.

BXMT will require more than a dividend cut to stay afloat...

BXMT will require more than a dividend cut to stay afloat...

Simply put, the REIT won't have the cash flow it needs to meet all its obligations in any of the next three years.

In 2025 and 2027, it won't be able to pay dividends. And starting in two years, it won't have enough cash to cover its interest expenses.

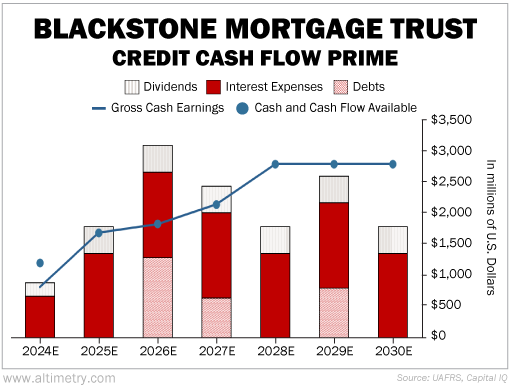

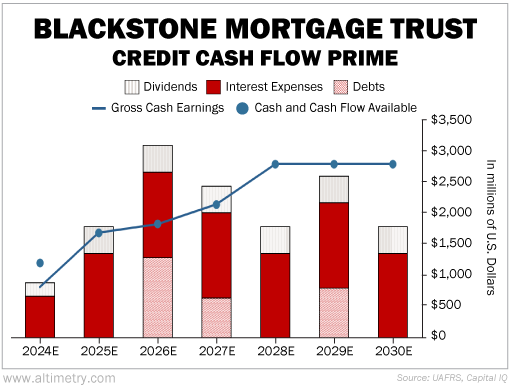

We can see this through our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us an accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent BXMT's obligations through 2030. These include dividends, interest expenses, and debts. It needs to cover all these items to keep the company solvent.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each year (the blue dots). Take a look...

These annual estimates assume that BXMT's loans will keep paying interest in the future. Yet even if that happens, the company's cash flow would be cutting it close next year.

If more commercial loans become impaired, the picture for BXMT could look even worse.

The outlook for commercial real estate is grim...

The outlook for commercial real estate is grim...

The bottom line is, BXMT has a huge amount of debt. And it can't generate enough cash flow to cover it all.

While it did cut dividends to handle some mortgage defaults, more CRE loan borrowers are set to default in the coming years. That means BXMT will need to take more action, like carry out refinancing.

On top of that, investor confidence is rapidly plummeting, and BXMT will have a harder time bringing in capital.

Things are unlikely to improve for the REIT, and the broader CRE industry, any time soon. So for now, you should keep your distance.

Regards,

Joel Litman

September 3, 2024

Trouble has been brewing for years. And, once again, Blackstone is at the center of the drama...

Trouble has been brewing for years. And, once again, Blackstone is at the center of the drama...