The economy ended the year on a solid note...

The economy ended the year on a solid note...

Not only did the stock market close up double digits... we're just getting started.

We often like to say that bull markets live and die by credit creation. Banks finally stopped tightening their lending standards for companies in 2024, which should help spur earnings growth this year.

For now, all signs point to the economy expanding this year. We're only just getting to the meat of the current bull market.

But there's one lingering issue that still stands to cause some trouble in 2025... and that's student debt.

Last September, we warned that the federal 'on ramp' period for student loans was running out of time...

Last September, we warned that the federal 'on ramp' period for student loans was running out of time...

To be frank, nothing has come of this news... yet.

While the on-ramp did end, the Department of Education ("DOE") has done everything in its power to give borrowers more time. It wants them back in good standing before delivering any bad news.

We're only just starting to get data from the milestones used to measure consumer health. According to the DOE, as the on-ramp ended, the clock restarted on all student loan payments.

That means most borrowers still had 90 days until those payments were considered delinquent... effectively delaying when they'd enter default by a full fiscal quarter.

January is a big month for a lot of folks with student debt...

January is a big month for a lot of folks with student debt...

If they haven't started paying off their student loans yet, creditors can finally start pushing for mandatory collections.

This is going to be a major test for the U.S. economy. If there's a wave of consumer defaults, that could dampen what looks like a strong market.

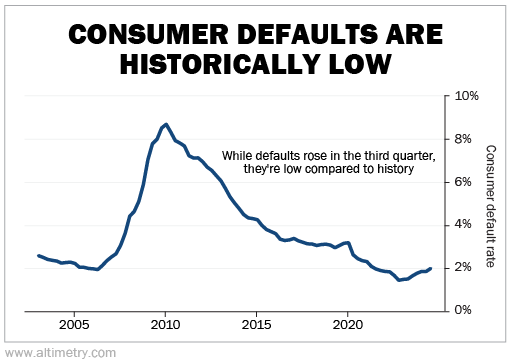

Things could go either way right now. Defaults rose across every category in the third quarter. But consumer defaults are still low compared to history.

Take a look...

Remember, student loan defaults are artificially low...

Remember, student loan defaults are artificially low...

So it's just a matter of how much default rates rise.

A big rise in defaults could signal that consumers are way weaker than we realize, which spook the market.

We could get student loan default numbers as soon as this month... or it could be delayed up to another quarter until the Federal Reserve publishes its quarterly report.

Keep an eye on the news for all sorts of default data as it comes.

If defaults in other areas like auto and credit-card loans keep rising, it could be a signal that student loans look similar behind the scenes.

Regards,

Joel Litman

January 2, 2025

The economy ended the year on a solid note...

The economy ended the year on a solid note...