This year's 'October surprise' may not come as much of a surprise...

This year's 'October surprise' may not come as much of a surprise...

The phrase refers to any breaking-news event that may sway the results of an upcoming November presidential election.

It dates all the way back to the 1980 election, when President Jimmy Carter was trying to broker the release of American hostages from Iran.

His competition, Ronald Reagan, believed that Carter's goal was to secure a last-minute deal to win votes. William Casey, Reagan's campaign manager at the time, called it Carter's potential "October surprise."

Given that Carter failed to get the hostages home prior to the election and that the U.S. economy had weakened during his presidency, Reagan won by a landslide.

This year, there's a good chance the surprise will be an economic one...

By several metrics – including unemployment data and the U.S. Treasury yield curve – we're on the verge of a recession. One more bad report could send the market reeling...

The most likely culprit is student-loan data. While student-loan payments resumed nearly a year ago, we still don't have the full picture of how consumers have handled that extra expense.

Namely, we still don't have student-loan default data.

When we do eventually get those numbers, it could set the tone for the economy and the stock market heading into November.

So far, student-loan borrowers have had a lot of wiggle room...

So far, student-loan borrowers have had a lot of wiggle room...

Even after payments resumed, default reporting is still on pause.

Student-loan borrowers were required to start paying back their loans starting October 2023. But the Department of Education instituted what it calls a 12-month "on-ramp" to repayment...

That means borrowers who miss monthly payments on their loans won't be marked as "delinquent," reported to credit bureaus, placed in default, or referred to debt-collection agencies.

Another program called "Fresh Start" helps those who have defaulted on their loans get back in good standing.

Borrowers who enroll in the program can have their loans transferred to another loan servicer and reset to "in repayment" status. They'll also benefit from the default on their credit report being removed.

These programs were designed to provide some relief to consumers coming out of the pandemic, as well as to minimize the number of student-loan defaults.

However, both programs end on September 30.

That means, starting October 1, the market could be in for a rude awakening... as consumer defaults may be far worse than anybody realizes.

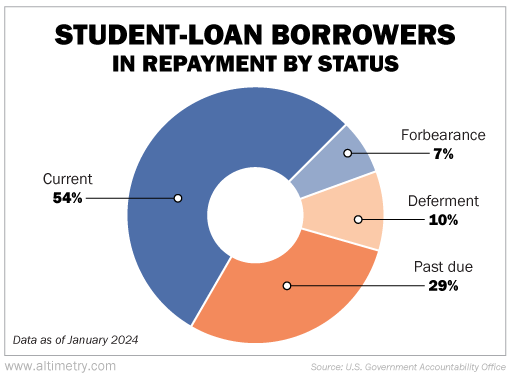

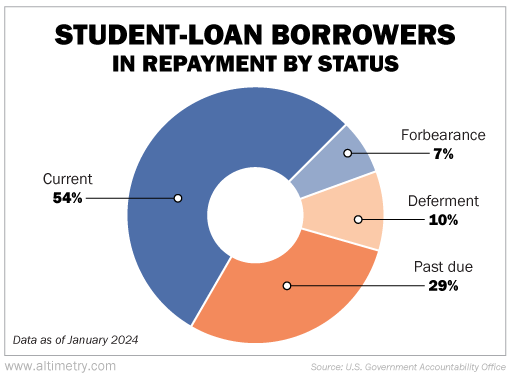

The U.S. Government Accountability Office recently reported that as of January 2024, nearly a third of all student-loan borrowers were "past due" on their payments, while another 17% had deferred payment agreements.

In other words, just under half of all borrowers still weren't paying their loans.

Take a look...

That means, when these two student-loan programs come to an end later this month, a lot more defaults could be reported... practically overnight.

There's no way to know exactly how many borrowers are still past due today...

There's no way to know exactly how many borrowers are still past due today...

But odds are, defaults will be high.

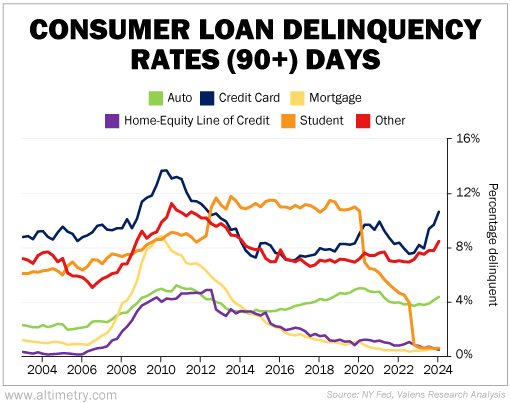

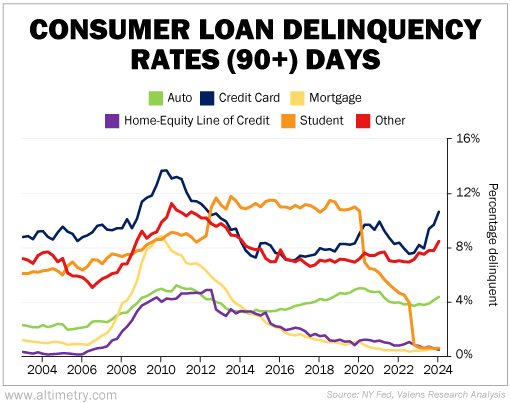

Almost every other type of loan delinquency has risen over the past few quarters.

Part of the reason is that consumers had to make room for student-loan payments starting in the third quarter of last year.

Credit-card, mortgage, and auto-loan delinquencies were all at multiyear highs as of the first quarter of 2024...

Student loans seem like the outlier here. However, that's only because defaults weren't being reported.

There's a strong likelihood that student-loan delinquencies are also on the rise. And once this data becomes common knowledge, it could spook the market.

Now, it's unclear if loan agencies will start reporting defaults on day one... or if we'll have to wait a full 90 days to understand how bad the picture really is.

Either way, this "October surprise" has the potential to shake the economy and the stock market... and it will certainly play a big role in this November's presidential election.

Regards,

Joel Litman

September 5, 2024

This year's 'October surprise' may not come as much of a surprise...

This year's 'October surprise' may not come as much of a surprise...