Our economy operates on a brilliant concept...

Our economy operates on a brilliant concept...

Two important inventions – debt and money – make our modern economy function. Not only do we collectively agree to assign value to otherwise valueless pieces of paper, but we are comfortable selling things without actually being paid yet.

The loan is a brilliant concept.

In many instances, it can allow you to pay for something you're economically capable of affording without needing to amass the total cash required to make that purchase.

For the seller, little changes. But the buyer can afford much more. Sure, they may be leveraged, but far more goods trade hands under this system, giving the economy more steam.

Our most expensive purchases, homes and cars, are often bought with a loan. Many businesses start with a loan. Even consumer goods like guitars and TVs can be purchased with this financial vehicle.

Of course, to give a loan, a business needs assurance it will be paid back. This is where the brilliance shows. There are a consistent set of rules to grade our financial habits. When we want a loan, that grade determines the interest rate and the amount of the loan, if we can get one at all.

The FICO credit score has become hugely important to the stability of the economy...

The FICO credit score has become hugely important to the stability of the economy...

Credit scores are nearly unavoidable. If you want to make a large purchase on loan, it's good to have a strong credit score. That's why millions of Americans are constantly looking for ways to improve their scores.

This is why there are so many articles and news stories on building your credit score. Morning Brew recently published a great educational segment about the best tricks to maintain or enhance good credit, including keeping credit card utilization at less than 30% and keeping your oldest line of credit open.

These are a few of the factors that go into the credit bureaus' calculations.

Should these calculations get things wrong, overall default risk could increase (which can lead to financial disaster, as we saw in 2008). Or they could underutilize the total economic lending power by grading people too harshly.

However, FICO is not just some standard agreed upon by all financial institutions. It is a product sold by San Jose, California-based Fair Isaac (FICO), a data science and software company.

Every time a lender uses the FICO score to evaluate a borrower, Fair Isaac gets paid.

The business has deep penetration into the economy, as 90% of lenders are its clients. Through the years, the FICO had become the gold standard for lending-risk reduction and analytics. Recently, the firm built a cloud-based analytics platform that goes far beyond just grading borrowers.

This is why Fair Isaac's stock has quintupled in value over the past five years.

But despite the company's dominance, cracks are beginning to show...

But despite the company's dominance, cracks are beginning to show...

It's commonly thought that you need to do the following to get a good credit score: never miss a payment, have a credit history, and avoid pulling too many credit inquiries.

Fair Isaac has more than fifty scoring algorithms, all of which employ advanced machine-learning tools to understand which features about our financial histories explain default risk.

Most of those features are not widely understood. So, that explains the need for so many educational materials and news stories on the subject.

A lot goes on under the FICO hood. With the democratization of data over the past decade, the industry has begun to peel the onion layers. It is becoming evident that Fair Isaac may have some problems in store.

Most notably, it fails to represent the financial merits of those with atypical credit pictures accurately, as well as the unbanked and underbanked. Although Fair Isaac is pushing a newer scoring system to address these challenges, it may be too late.

It's easier than ever for banks to implement proprietary software to do an in-house credit risk analysis. So, many now only use FICO in conjunction with other signals rather than exclusively.

Capital One Financial (COF) and Synchrony Financial (SYF) have largely moved away from FICO for consumer-facing credit decisions. Bank of America (BAC) incorporated its own analysis into its decisions. Word on the street is that Fannie Mae (FNMA) and Freddie Mac (FMCC) may allow their lenders to use alternate scoring methods.

To sum it up, the FICO score's grip on the credit scoring market is weakening. The shift is happening because banks have uncovered some inconsistencies with the FICO score.

For example, scores changed when applicants transferred debt between places, even though the total leverage and interest rates are the same. The FICO score doesn't reflect deferment or forbearance programs or make behavioral inferences that reflect financial habits.

Various agencies and nonprofit organizations report that FICO could unfairly reduce access to capital for people of color.

Given the problems Fair Isaac faces, let's look at what could be in store for the stock...

Given the problems Fair Isaac faces, let's look at what could be in store for the stock...

Here at Altimetry, we've seen some Fair Isaac coverage that claims the stock is undervalued. But let's cut through the noise to understand what is going on.

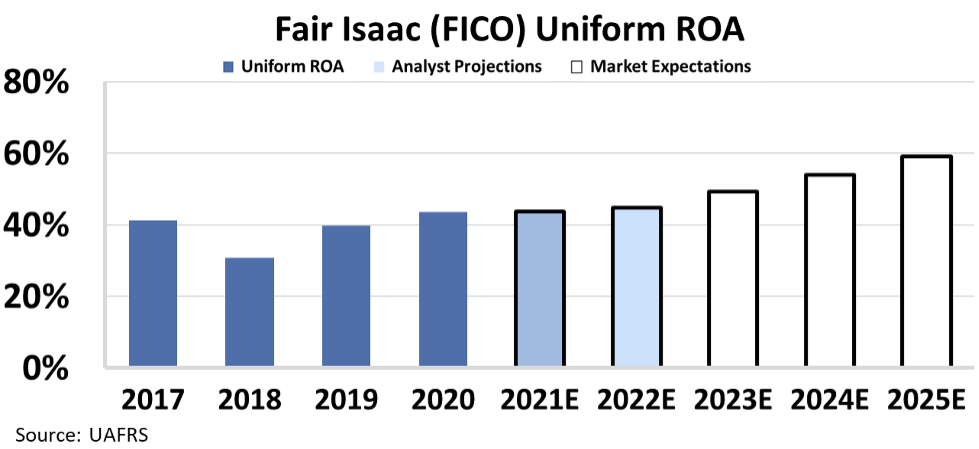

In the chart below, the dark blue bars represent Fair Isaac's historical corporate performance levels in terms of Uniform return on assets ("ROA").

The light blue bars are Wall Street analysts' expectations for the next two years, and the white bars are the market's expectations for how Fair Isaac's ROA will shift over the next five years.

Fair Isaac currently boasts an impressive 44% Uniform ROA, which is reasonable for a lean software company.

Analysts who work every day to predict sales and growth by deeply understanding industry-specific conditions overall believe Fair Isaac will maintain its current Uniform ROA for the next two years.

The market is pricing in Uniform ROA to hold steady and expand significantly to 66%.

Given that analysts don't expect to see this sort of growth in the company's future, paired with the industry shift away from FICO-dependence, these lofty embedded expectations seem too optimistic.

For context, if Uniform ROA holds steady at 45% for the next five years, as analysts expect it will over the next two years, the stock should be worth 35% less than its current trading value.

Currently, Fair Isaac is priced for perfection. It would be difficult to justify a situation that leads to big upside... And even the slightest misstep could send the stock lower.

However, there are rich opportunities in the data industry with more reasonable valuations...

However, there are rich opportunities in the data industry with more reasonable valuations...

We have identified several companies positioned to win in the data-driven economy, and the market hasn't fully come to its senses.

Using the power of Uniform Accounting – which removes the distortions in as-reported financial metrics – we can analyze stocks based on their real financials.

After we clean up the GAAP numbers, we can see which companies are misunderstood and are poised for massive upside.

Subscribers who followed our data-industry stock recommendations in our Altimetry's Hidden Alpha newsletter have seen gains of 34%, 40%, and 117%.

And in the August issue – published just last week – we leveraged our Uniform Accounting analysis to identify another mispriced stock poised for big upside ahead as its industry evolves.

To learn more about Hidden Alpha – and find out how to gain instant access to our full portfolio of open recommendations – click here.

Regards,

Rob Spivey

August 10, 2021

Our economy operates on a brilliant concept...

Our economy operates on a brilliant concept...