Offshore drilling is back in the game...

Offshore drilling is back in the game...

After years in the shadows, deepwater drilling is re-emerging as a key focus for oil majors. It seemed like the industry had left offshore drilling behind for much of the past decade.

The oil-price crash back in 2015 sent shockwaves through the sector. Offshore projects were expensive. Many believed they'd never be economical again.

But they're being proved wrong today. Thanks to massive improvements in technology, companies have figured out how to make offshore rigs faster... more efficient... and less harmful to the environment.

This renewed push has reignited interest in places like the Gulf of Mexico. For the first time in years, companies are spending big on deepwater drilling – and it's creating opportunities for the players that endured the storm.

If you're following the offshore drilling industry, you might know Valaris (VAL) by its old name, Ensco Rowan...

If you're following the offshore drilling industry, you might know Valaris (VAL) by its old name, Ensco Rowan...

Valaris is a contractor that operates offshore rigs, leasing its platforms to oil companies.

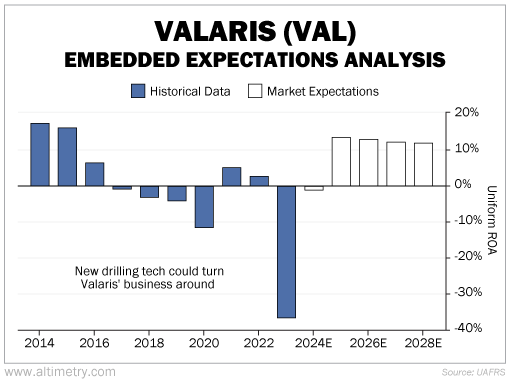

The company had a remarkable performance prior to 2016. Uniform return on assets ("ROA") reached around 17% in 2014 and 2015.

It has had a rough ride since oil prices collapsed, though. Demand for its rigs evaporated. The company has struggled to stay afloat ever since.

The numbers tell the story. Valaris hasn't turned a profit in years. Uniform return on assets ("ROA") hit its lowest point ever in 2023 at negative 11%.

But things are starting to change...

With deepwater drilling back in focus, companies are spending more on offshore projects than they have in nearly a decade.

This isn't the same offshore drilling we saw in the 2000s. Oil companies have introduced advanced technology to improve efficiency and cut costs.

Take Shell's (SHEL) "Vito" platform in the Gulf of Mexico. It's a leaner, more advanced rig that produces the same output as its predecessors... at a fraction of the size and emissions.

Chevron (CVX) is also pushing the boundaries. Its "Anchor" platform is designed to operate under unprecedented pressures, unlocking reserves that were once inaccessible.

For contractors like Valaris, these innovations are a lifeline...

For contractors like Valaris, these innovations are a lifeline...

As oil majors invest in cutting-edge deepwater technology, demand for rigs is rising. Valaris is in a unique position to capitalize on this resurgence.

Investors seem to realize what's going on. Take a look at our Embedded Expectations Analysis ("EEA") for Valaris...

The EEA works a lot like a betting line in a sports bet. We use Valaris' current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Projections indicate a massive leap for Valaris in 2025, showcasing a dramatic turnaround from its previous performance. Take a look...

And this improvement is only the beginning.

If current trends continue, Valaris could see its Uniform ROA recover to 2014 levels. That kind of turnaround could transform the company's prospects – and its stock price.

The deepwater renaissance is in full swing...

The deepwater renaissance is in full swing...

For the first time in years, offshore drilling is seeing meaningful investment. Companies like Valaris are ready to reap the benefits.

While a turnaround won't happen overnight, the outlook is improving as this industry revival gains traction.

This could be an opportunity for investors to get in on a recovery story that's still in its early stages. As the decade of deepwater unfolds, Valaris could become one of the biggest beneficiaries.

Regards,

Joel Litman

December 10, 2024

Offshore drilling is back in the game...

Offshore drilling is back in the game...