The world of content and streaming has been upended once again...

The world of content and streaming has been upended once again...

One of the biggest news stories in the business world over the past few weeks has come from a huge reshuffling of digital content – the virtual gold of the streaming era.

Over the past few years, Netflix's (NFLX) aggressive partnerships and robust in-house content generation have allowed the company to remain the king of streaming. Meanwhile, Disney (DIS) has successfully weaponized its huge catalog of intellectual property to create its Disney+ platform. Other content creators are just looking to keep up.

Two streaming services, HBO Max and Discovery+, have both been trying to find their footing in this new world order. However, AT&T (T) is spinning off its content arm of WarnerMedia to merge with Discovery (DISCA) – bringing all of this content under one roof.

The new Discovery will have everything from high-class movies and HBO's TV content to CNN, Cartoon Network, TBS, TNT, and Discovery's own top-tier documentary and reality-TV content.

This new portfolio runs a wider breadth across the entertainment spectrum than many of its competitors. For example, while Disney has focused, high-quality content, it can't rival WarnerMedia and Discovery's upcoming expansive catalogue.

No matter who wins this next battle of the streaming wars, the rest of the digital content industry is on the defensive.

While AT&T may have been struggling, this didn't extend to Discovery...

While AT&T may have been struggling, this didn't extend to Discovery...

For AT&T, the upcoming deal has been a lifeline to streamline the business and get back to focusing on 5G investment and competing in its core telecom space.

For Discovery, it's the next puzzle piece to improving an already powerful business.

The company's Discovery+ streaming service already has 15 million subscribers worldwide, with 13 million acquired in the few months before the merger was even announced.

In the streaming era, content is king. Discovery has been able to stay competitive with its library of distinct content – building a brand around its documentaries and unscripted shows, which are a relatively underserved market in the streaming world.

With the power of WarnerMedia behind it, there's no sign of this historically strong showing slowing down. Of course, to give this news context, we have to turn to the numbers...

Our Altimeter tool breaks down the true fundamentals...

Our Altimeter tool breaks down the true fundamentals...

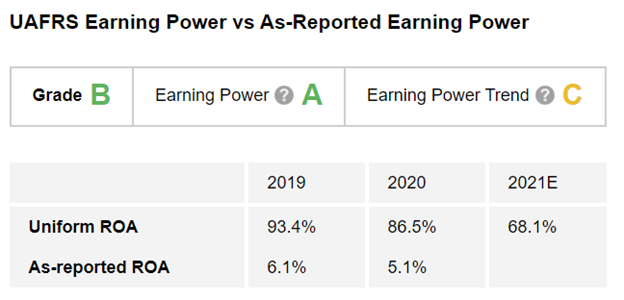

Using the power of Uniform Accounting – which removes the distortions in GAAP financial metrics – The Altimeter shows users easily digestible grades to rank stocks based on their real financials.

After we make the Uniform adjustments to clean up the numbers, we can see that Discovery has historically printed money from its unique brand offerings. The as-reported numbers put the company's return on assets ("ROA") in the single digits... But in 2020, Discovery's Uniform ROA was a robust 87% – more than 7 times the corporate average of just 12%.

Even with returns expected to drop to 68% in 2021, this strong performance means Discovery earns an "A" for Earnings Power.

Meanwhile, since returns have been pressured over the past few years before launching a streaming service of its own, Discovery earns a "C" for Earning Power Trend.

Putting it all together, Discovery earns an overall "B" for Performance in The Altimeter. And yet, this might understate the strength of the name – especially as analyst forecasts all came in before the recent WarnerMedia merger announcement.

Thanks to The Altimeter, we can see Discovery's true performance and get a better understanding of the scope of the upcoming Discovery+ growth.

But before buying the stock, know that there's more to the story...

But before buying the stock, know that there's more to the story...

If the market is already pricing in a move higher in profitability, the stock might have limited upside. But if not, the stock could be poised for a big move higher as the market comes to its senses.

Altimeter subscribers can click here to see how Discovery is valued based on Uniform Accounting... and whether the market is pricing in the beginning of this turnaround or not.

If you aren't an Altimeter subscriber, click here to find out how to gain instant access to the rest of the Uniform data for Discovery... as well as how to compare the stock to other content giants like Netflix and Disney.

Regards,

Rob Spivey

June 3, 2021

The world of content and streaming has been upended once again...

The world of content and streaming has been upended once again...