The U.S. dollar has been the global reserve currency since World War II...

The U.S. dollar has been the global reserve currency since World War II...

And the BRICS want to change that.

Last year, some of America's biggest economic rivals made a push for the world to de-dollarize. Brazil, Russia, India, China, and South Africa sought to create a new reserve currency that could replace the U.S. dollar.

Experts were skeptical. Many said it was unrealistic for smaller countries to link their monetary policy to the Chinese economy. (And if you've been keeping up with our research, you know we feel the same way about China.)

Even so, this initiative still scared a lot of investors. The U.S. dollar had a weak 2023... and folks started worrying about both the currency and U.S.-based investments.

It has been almost a year since the BRICS first announced their grand plan. And since then, pretty much nothing has changed.

As we'll cover, the U.S. is just as prominent in global trade. And the BRICS aren't any closer to shaking up the reserve-currency status quo...

While the dollar fell last year, the currencies of the BRICS did even worse...

While the dollar fell last year, the currencies of the BRICS did even worse...

The dollar lost 2% of its value last year, in part due to high interest rates. Yet when the BRICS tried moving in while the dollar was weak... they performed even worse.

The Chinese yuan fell 2.8% versus the dollar. The Indian rupee fell 0.5%. And thanks to sanctions from the war with Ukraine, the Russian ruble fell 18%.

Almost a year after we warned you not to bet against the U.S. dollar... the BRICS haven't made any progress. The world still runs on America's currency.

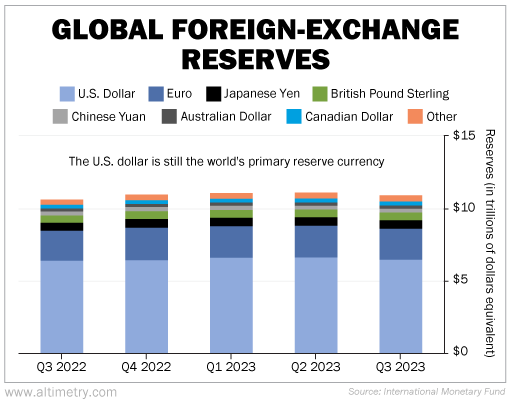

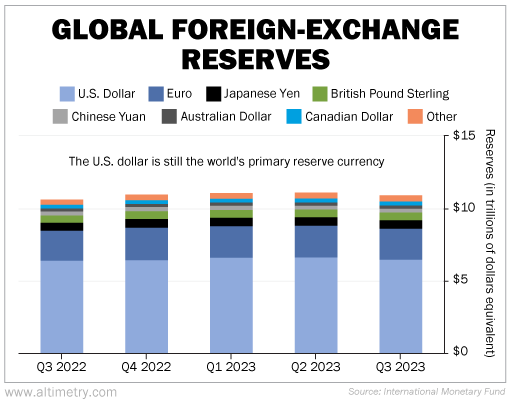

We can see this through data from the International Monetary Fund ("IMF"), which tracks how much money is kept in reserve for foreign-exchange purposes.

In each of the past five quarters (not including the fourth quarter of 2023, which hasn't been released), the U.S. dollar represented about 59% of global reserves. That's even after the BRICS started pushing de-dollarization.

Take a look...

The world is relying on U.S. dollars just as much now as it was in 2022. Meanwhile, it's relying less on the Chinese yuan... down from 3% in 2022 to just 2% toward the end of 2023.

China just isn't a great market to invest in right now. As we covered last week, its millionaires are leaving as fast as they can. And it's struggling with serious real estate issues.

The U.S. has its short-term problems, of course. Yet it also has more long-term opportunities... and investors have taken notice.

The BRICS are building up their allies in 2024...

The BRICS are building up their allies in 2024...

They officially added Egypt, Ethiopia, Iran, and the United Arab Emirates on January 1.

Don't worry about the U.S. dollar, though. Pretty much the entire rest of the world still relies on it as the reserve currency. Argentina is even considering adopting the U.S. dollar as its currency in the near future.

And as for the world's reliance on the economies of the BRICS? It doesn't hold a candle to global reliance on the U.S. economy.

The U.S. dollar's critics are getting louder. That's not a reason to worry about the dollar losing its place in the global economy, though... or the U.S. stock market losing its global relevance.

Wishing you love, joy, and peace,

Joel

March 8, 2024

The U.S. dollar has been the global reserve currency since World War II...

The U.S. dollar has been the global reserve currency since World War II...