Based on Nielsen ratings, one cable news channel had the highest ratings on election night...

Based on Nielsen ratings, one cable news channel had the highest ratings on election night...

Fox News captured the top spot by far with a massive 14.1 million viewers. CNN came in second place with 9.4 million, and MSNBC took third place with 7.6 million.

All three of these cable news channels bested the broadcast networks, including ABC at 6.3 million, NBC at 5.7 million, CBS at 4.5 million, and the Fox broadcast network at 3 million.

Broadcast TV faces secular headwinds not only from news networks, but from online alternatives. As USA Today highlighted earlier this month, TV viewership was down across the board.

In 2020, 56.9 million people watched prime-time coverage, compared with 71.4 million in 2016. That's a 20% drop.

The reduced viewership isn't coming from a lack of interest in the election. In fact, the 2020 race shattered turnout records. And while every election is often declared "most consequential election of our time," I'm sure many folks would agree that was the case this year.

Rather, viewers today consume news and sports from alternative outlets. The newest contender is social media.

For example, Twitter (TWTR) saw a massive surge in usage over the past few months and on election night. The platform has become the main place for breaking news, replacing the need to pay for a cable bundle. It's easy to follow big events, with videos of key moments posted almost instantly.

The strength of cable news networks on election night was another indication of broadcast networks' long secular decline. Considering all the options available to viewers, it looks like this trend is unlikely to change anytime soon.

And ratings aren't the only thing that has turned against the large broadcast networks...

And ratings aren't the only thing that has turned against the large broadcast networks...

Equity and credit markets have also become skeptical of the broadcast affiliate businesses.

Network affiliates are local broadcasters that carry all or some of the TV networks' programming. They typically have three- to five-year contracts in which they agree to broadcast to local consumers.

Today, one of the largest affiliates is Meredith (MDP).

Seeing the long-term shift away from print media, the company sought to diversify revenues away from its magazine and lifestyle brand business and into what was viewed at the time as a longer-lasting format: broadcast TV. From the 1990s through the mid-2010s, Meredith bought up television stations to diversify its income streams.

However, this has meant that the company just moved from one "melting ice cube" – a business whose value is expected to decline over time – to another.

So it's no surprise that the credit-rating agencies are pessimistic about Meredith's debt. Moody's (MCO) gives the firm a "B2" high-yield credit risk, and believes that Meredith has a roughly 25% chance of defaulting on its debt in the next five years.

However, the ratings agencies use GAAP metrics... which we know are full of distortions. So here at Altimetry, we can look at Meredith's Credit Cash Flow Prime ("CCFP") to get a better sense of the company's real credit risk.

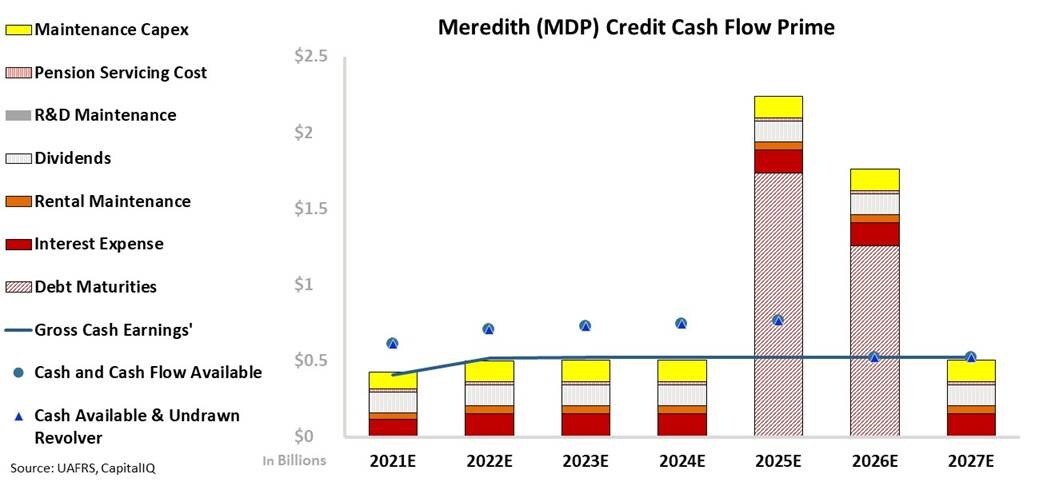

In the chart below, the stacked bars show Meredith's obligations each year for the next seven years. We compare this to the company's cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest for the company to "push off" – costs such as debt maturities and interest expense. The higher bars represent more flexible obligations, like maintenance capital expenditures ("capex") and share buybacks.

As our CCFP analysis highlights, Meredith has a sizeable cash build to meet obligations until 2025. Cash flows should meet all obligations before Meredith runs into a series of debt maturities in 2025 and 2026. This long runway should provide Meredith with ample time to refinance.

And if Meredith can still generate cash flows that exceed its operating obligations – the obligations other than debt maturities – lenders will likely look at the company as an ongoing concern rather than a bankruptcy risk once its big debt comes due. This means that they'll let Meredith refinance its debts.

While broadcasting is in secular decline, profits won't collapse before 2025.

So here at Altimetry, we rate Meredith as an "XO-" due to its cash flows above obligations and modest cash build. This is equivalent to a "Ba1" rating, which is well above the high-yield rating assigned by Moody's.

That means Meredith has a roughly 10% chance of going bankrupt in the next five years – far more reasonable than the odds Moody's is giving the company.

Ultimately, credit-ratings agencies are far too pessimistic... By looking beyond the "noise" of as-reported metrics, investors can see that Meredith is less risky than it appears.

Regards,

Rob Spivey

November 18, 2020

Based on Nielsen ratings, one cable news channel had the highest ratings on election night...

Based on Nielsen ratings, one cable news channel had the highest ratings on election night...