Joe Biden's lead has widened over the past few months...

Joe Biden's lead has widened over the past few months...

According to statistics website FiveThirtyEight, Biden has a roughly 90% chance to win the presidential election. That's a big change from his 67% chance two months ago.

Similarly, FiveThirtyEight's senate forecasts have also shifted. Democrats now have a more than 75% chance to win a majority in the upper chamber. This is up from a 57% chance two months ago.

Both forecasts have shifted due to polls tightening in states that have traditionally voted for a particular party in the past decade. For example, forecasts have Biden winning Arizona and North Carolina. Both states voted Republican in 2012 and 2016.

In the Senate, we're seeing close races in Montana, Georgia, and Iowa. At the beginning of the year, these states appeared to be Republican strongholds. Now, it's possible Democrats could flip up to four seats in just these three states.

Of course, as the 2016 election showed, the polls aren't always correct... so anything can still happen tomorrow. Additionally, there's still uncertainty due to the coronavirus pandemic. The influx in mail-in ballots makes the turnout rate hard to predict and will likely push official results back. However, the data point to a "blue wave."

This means there could be a shift in tax policy... and it will be on the top of investors' minds between tomorrow and inauguration day if the Democrats gain power.

Most nonpartisan studies show Biden's policies will be a net positive for lower-income households... but higher taxes could hurt high-income households.

As The Hill recently highlighted, Biden's tax plan includes an increase in the corporate tax rate and the marginal tax rate for high earners. President Donald Trump did the opposite during his first term.

However, the most important effect on the market is likely to be related to investment tax rates. Biden has floated the idea of taxing long-term capital gains and dividends at the same rate as ordinary income for those with an annual income greater than $1 million.

The current long-term capital gains and dividend tax rate for the highest bracket is 20%. Under Biden, the benefits of stocks could change for the rich.

This could have big implications for the market.

As we've explained previously, the two biggest drivers of market valuations are inflation and tax rates...

As we've explained previously, the two biggest drivers of market valuations are inflation and tax rates...

Biden's proposed 40% capital gains and dividend tax for high earners sounds terrifying on paper. Some people think it means the market will crater if he wins the election.

However, it's important to note that the short-term capital gains tax rate is already the same as the income tax rate. That means the IRS taxes any stock sold less than a year after buying alongside income.

Additionally, less than 0.5% of Americans make $1 million annually, meaning the proposed change wouldn't harm most folks.

Biden also isn't taking the changes as far as some of the more progressive members of his party want him to. He has dismissed calls to tax unrealized capital gains.

Overall, the change isn't as dire as it looks.

Furthermore, we have a framework here at Altimetry to understand the implications of tax changes. We look at the inflation rate and the capital gains tax rate to see what the expected price-to-earnings (P/E) ratio for the market should be.

Right now, inflation expectations are low. We predict rates to stay between 1% and 2%. Additionally, the aggregate tax rate on short-term investments, long-term investments, and dividends is 20%.

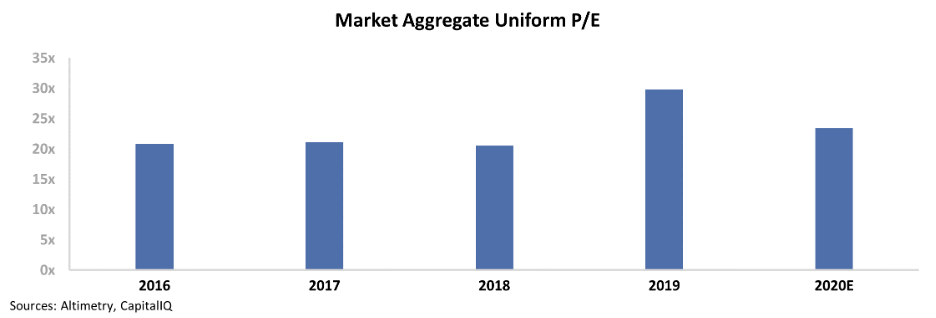

This translates to a P/E ratio of roughly 22. Unsurprisingly, this is near where the market's average Uniform P/E has been over the past four years. Take a look...

Now, to model the potential market impact, we need to adjust the tax rate. As the 40% rate isn't for all investors, but a large part of the investment in the market, we can model the average tax rate to rise to 35%. This would mean P/E multiples dropping to 17.6 times.

That's a significant dip in the market P/E ratio... and it would imply a 21% drop in the stock market.

For context, a tax rate of 30% would imply a 15% drop in the market. And if Biden's promises are moderated (which is likely), a realistic 25% tax rate would only mean an 8% drop in the market.

However, personal tax rates aren't the only factor...

Another piece of the puzzle is corporate tax rates. Biden wants to increase these rates from 21% to 28%, which could hurt companies' margins and profitability. If we apply the same potential multiples to this reduced earnings number, the potential drop in the market if some form of Biden's tax plan were put in place is between 8% and 32%.

However, we can see three important reasons why this isn't likely to happen...

First, a "blue wave" would be driven by moderate senators. The Democrats who can give their party a majority in the Senate are from more moderate or conservative states. If Steve Bullock from Montana or Theresa Greenfield from Iowa win their election bids, they may not be on board with raising the corporate tax rate... At least not if they want to eventually earn re-election.

As an example, Joe Manchin of West Virginia votes more conservatively than several Republican senators do... and so do Doug Jones of Alabama and Krysten Sinema of Arizona.

Second, it would only be a one-time drop in the market. A higher corporate tax rate would still be lower than it has been historically.

Earnings growth analysis from before and after the Trump administration's corporate tax cut doesn't show any meaningful sustained boost in earnings growth... so a tax raise would similarly be unlikely to hurt longer-term earnings growth. Organic corporate earnings growth could make up this type of drop in the market in short order.

Third, and most critical, these changes won't all happen at once. Bills take a long time to become laws. Therefore, wealth managers and intelligent investors usually don't react to changing tax policies until they become law.

Investors don't need to have their hands on the red "sell" button on November 4 if Biden wins the election. Tax laws contain plenty of nuances, so any reaction before a new tax law is official isn't a smart idea.

There's little to be afraid of tomorrow. While it's still important to watch the election results with your portfolio in mind, remember that the worst-case scenario is minimal.

If this scenario struck, a 32% drop would of course feel terrible in the short term. But again, this is low-probability...

And more important, if your money is in stocks because of the market's long-term potential, the stock market will rise again... So trying to time that kind of drop and getting back in has been shown time and again to be a fool's errand.

Continue to be smart... stick to a plan... and wherever your emotions take you regarding the election, remember that emotions and your money shouldn't mix.

Regards,

Joel Litman and Rob Spivey

November 2, 2020

Once the election results are in, how high do you think the markets could rise... or how low do you think they could fall? How are you positioning your portfolio? Let us know at [email protected].

Joe Biden's lead has widened over the past few months...

Joe Biden's lead has widened over the past few months...