Oil supply continues to lag demand...

Oil supply continues to lag demand...

You've probably noticed this any time you filled your gas tank this year.

Folks enjoyed pretty cheap gas prices during the pandemic because demand was low. Nobody was leaving home... And they didn't need to fuel up.

This year, we've had the opposite issue. Folks are back on the roads. And the world has lost a huge supply of oil because of the Russia-Ukraine war.

The price for a gallon of gas surged across the country earlier this year. It peaked above $6 in California. While they've come down a bit since then, prices are still much higher than they were for most of last year.

That's because not all fuels have followed the same trend as what you're getting at the pump.

The price of diesel, for example, is still high. It might even be north of $6 per gallon at some gas stations.

The issue with diesel again comes down to supply and demand.

We simply aren't making enough diesel...

We simply aren't making enough diesel...

Diesel powers our road infrastructure, tractor trailers, as well as many farm and construction vehicles that drive the American industrial sector.

Even more important, many folks use heating oil (closely related to diesel) to heat their homes in the cold winter months.

Despite this, no one wants to build new refineries to increase diesel production.

They're worried that high demand is only temporary. Diesel could become less important as we continue to move toward cleaner energy solutions.

However, the fact remains that we need diesel today. That's why prices are elevated – and will likely remain high for the foreseeable future.

That's bad news for consumers and logistics companies alike. Still, not everyone is losing out over high diesel prices. Just take a look at the refining industry...

It's currently profiting from an imbalance in what's known as the "crack spread."

The crack spread is the difference between what a refiner pays for a barrel of oil and what it sells the refined products for. (Refined products can include everything from gasoline and diesel to jet fuel and many types of plastics.)

Refiners don't really care which good they're producing. As long as they're refining something, they'll make money.

And refiners are making a lot of money based on the current crack spread. Refining stocks – as measured by the VanEck Oil Refiners Fund (CRAK) – are up 23% this year. The S&P 500 is down 17%.

You'd likely be happy as an investor owning any refining stock this year... and going forward. That's because, while choosing great individual stocks is important, it's not the main driver of investing success.

What really matters is getting the industry right.

That's where our brand-new tool comes in...

That's where our brand-new tool comes in...

It's called the ETF Analyzer. And we're confident it could be a huge asset to any portfolio.

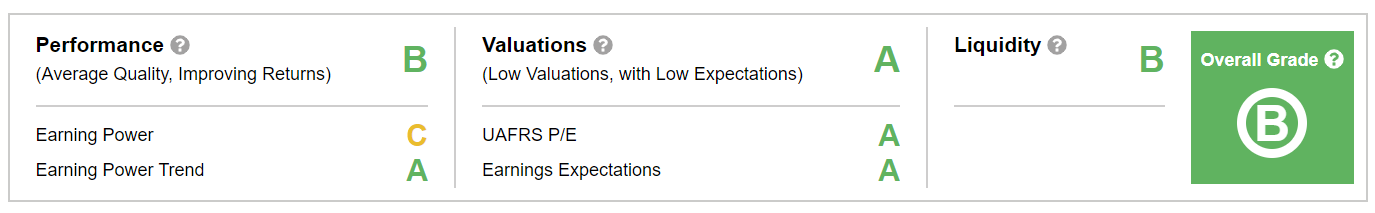

The ETF Analyzer works a lot like the Altimeter. It uses the power of Uniform Accounting to show us easily digestible grades based on real financials.

Only instead of analyzing the Performance and Valuations metrics of individual stocks, it looks at exchange-traded funds ("ETFs") and mutual funds.

You see, you're much more likely to find a winning stock when you're already in a winning sector. In fact, more than 50% of a stock's movement can be explained just by its underlying sector...

As the saying goes, "a rising tide lifts all boats." And when a certain industry does well, many of the companies within it are also successful.

The energy sector has had a great year so far. It looks like high diesel prices and natural gas tailwinds (which we discussed back in July) are setting the industry up for another great run in 2023.

And our new ETF Analyzer tool shows just how much momentum this sector has. To see this, we can look at the Energy Select Sector SPDR Fund (XLE). It's an ETF that tracks the performance of the broader energy sector.

The ETF Analyzer shows us that XLE's performance is on an upswing. Higher energy prices will lead to higher returns for energy stocks... So XLE receives an "A" grade for Earning Power Trend.

And despite strong and rising performance, the energy sector is cheap today. XLE's Uniform price-to-earnings ratio, which measures how much investors are willing to pay for a sector's earnings, is only 17 times today. That's lower than the 20 times market average, earning an "A" Valuations grade.

These grades paint a bright picture for XLE's performance...

Our ETF Analyzer points to even further upside ahead in the energy sector. And it's not the only corner of the market that's grabbing our attention today...

Using this brand-new tool, we've identified two other sectors that will take off in 2023. We believe a number of key tailwinds will push them to new heights.

And the stocks within these industries will come along for the ride.

I recently put together a brand-new collection of special reports detailing exactly what sectors have the most potential today... and the corresponding stocks that are set to soar.

Plus, I put the ETF Analyzer tool to work so you can see the power of sector analysis in action. Learn more right here.

Regards,

Joel Litman

December 1, 2022

Oil supply continues to lag demand...

Oil supply continues to lag demand...