Not all exchange-traded funds ('ETFs') are created equal...

Not all exchange-traded funds ('ETFs') are created equal...

Back in 2015, activist investor Carl Icahn and BlackRock (BLK) co-founder and CEO Larry Fink walked on stage for Delivering Alpha, a CNBC conference. Fink expected he and Icahn were going to have a friendly debate about activism, and he'd have a rare opportunity to score some points against Icahn.

That's not to be taken lightly... Many financiers would crave that opportunity, and Icahn doesn't always play nice in the sandbox.

But Icahn, as he's wont to do, flipped the script. He navigated the conversation instead to focus on the perils of ETFs on the world of finance. His specific concern was that BlackRock and others had created ETFs for fixed-income instruments which made these assets appear far more liquid than they really are – offering moment-by-moment liquidity.

This was creating a bubble in the bond market in his view... one that could burst and significantly disrupt the economy. If there was ever aggressive selling in these bond ETFs, then the forced selling of bonds – which are less liquid – would lead to rapid drops in prices.

The gambit threw Fink off for some time, and he eventually tried to refocus the conversation back to what he'd originally expected it would be about. But it did raise some warranted questions.

One of the other biggest ETF providers, along with BlackRock, even published an essay on this issue earlier this year, in the midst of the market panic in late March...

State Street's think piece on the issue highlighted how investors should treat dislocations between net asset values ("NAVs") for bond funds, and where the ETFs were trading.

The essay highlighted that these dislocations could happen because of lagging pricing for bonds, and that there are methods – such as using limit orders and avoiding more volatile trading times – that could reduce the risk of being punished by these dislocations.

It's just another reminder that sometimes financial markets don't operate as efficiently as we all believe...

Some of the best companies use a crisis as an 'agent of change'...

Some of the best companies use a crisis as an 'agent of change'...

I'm sure you've heard some of the cheesy anecdotes floating around about how you should use your time in quarantine to do something productive.

Apparently, it was a quarantine order from the bubonic plague that led William Shakespeare to draft King Lear.

Decades later, Isaac Newton created some of his mathematical theories while his university studies were canceled for another plague-related quarantine.

Of course, we would love to see our readers change the world with their newly found free time... but most of us have other priorities.

For many corporations, this environment is a completely new challenge. Different firms will react in various ways to the unique pressures of coronavirus... Some companies will fail, some will eventually bounce back, and some will manage to grow stronger.

The last category is particularly interesting to us...

We've seen examples in history where companies have a "Shakespeare moment" – meaning that they're faced with uncertainty but they use it to define their future.

A great example is pharmaceutical giant Johnson & Johnson (JNJ).

In 1982, the company had a full-blown crisis on its hands – its flagship Tylenol product was killing people.

It seemed as though someone (or a group of people) was going around and replacing Tylenol capsules with cyanide-laced capsules. Seven people died in the Chicago area, which was devastating to JNJ's executive management.

Then-CEO James Burke was able to navigate JNJ through the crisis and have it emerge stronger than ever. Rather than risk anybody else getting poisoned, Burke ordered all Tylenol pills to be pulled off the shelves – a multimillion-dollar recall.

Beyond that, JNJ did everything in its power to signal that it was going to protect the public...

The company worked with the FBI in order to help track down the culprit, and though the killer was never found, this signaled to the public that JNJ was doing everything it could to help the situation.

After the incident, JNJ began releasing all Tylenol products in tamper-proof packaging to prevent something like that from ever happening again. Not only that, but as a gesture of goodwill to win customers back, the company discounted Tylenol to re-establish the product.

Nearly 40 years later, the Tylenol incident remains a defining moment for JNJ as a company. JNJ regained all of its market share... and then some.

Another great example is Arthur Andersen's consulting business.

You may recall Arthur Andersen as the accounting firm that was brought down by the famous Enron accounting scandal, but it actually had a consulting business which was in the process of separating during the Enron years.

Andersen Consulting used the crisis as a way to create more separation and rebrand as Accenture (ACN).

In the years since, Accenture has transformed itself into the envy of the consulting world... and the corporate world in general.

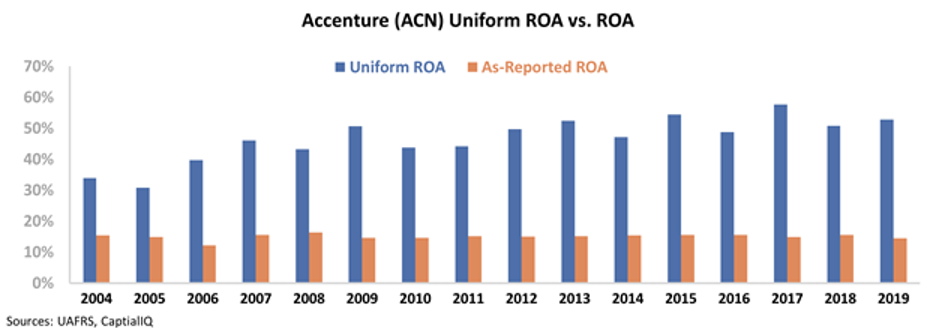

Since its formal separation in 2001, Accenture's returns have only improved. The company's Uniform return on assets ("ROA") is one of the strongest in our database here at Altimetry, and this gets stronger just about every year. In 2017, Accenture's ROA peaked at a massive 58% – roughly 10 times higher than long-term corporate averages.

Even though Accenture's as-reported ROA is misleading – remaining flat around 15% to 16% since 2007 – investors seem to understand just how profitable the business is...

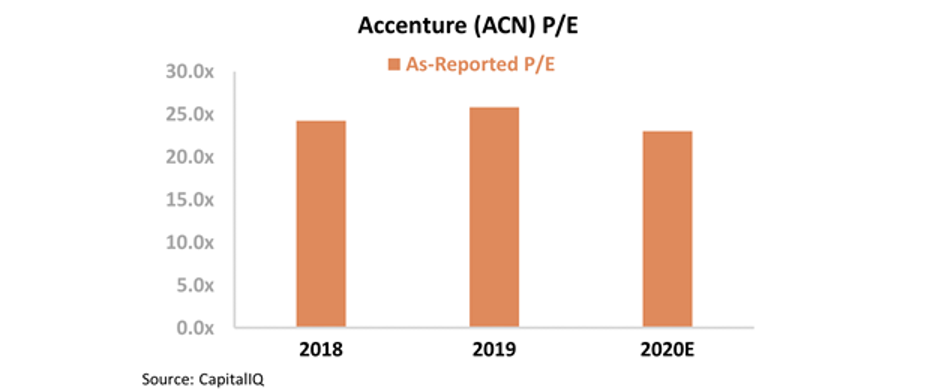

Even with the recent market volatility, Accenture's price-to-earnings (P/E) ratio is still 23 times, which is above market-average levels around 20.

Nearly 20 years after the company's separation from Arthur Andersen, it appears investors understand that Accenture is a world-class consulting firm.

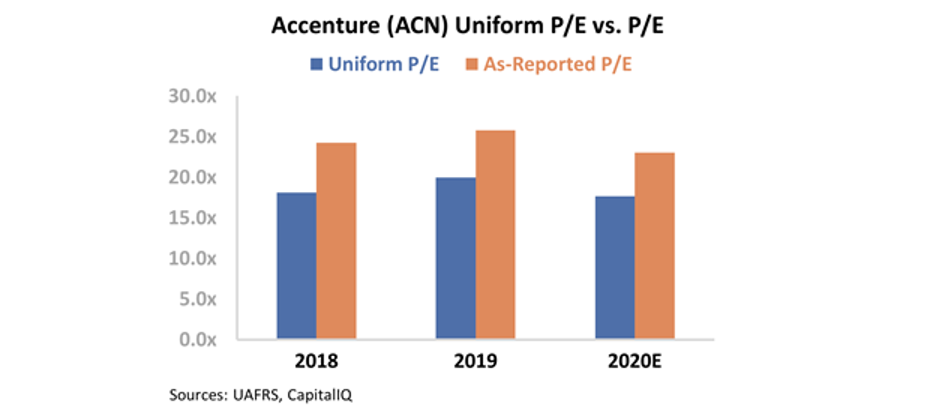

However, that might be oversimplifying the issue...

Looking at the company's Uniform P/E ratio, we can see that the market hasn't fully recognized how profitable Accenture is. In reality, the company's Uniform P/E ratio is just less than 18 – below market averages.

At these levels, investors have the chance to buy one of the highest quality companies in the world for a discount to market averages.

As-reported metrics may cause investors to walk away from the name, thinking "yes, the market gets it." But the Uniform numbers show the reality – Accenture is trading at discount valuations and might be a company to consider today.

Regards,

Joel Litman

April 30, 2020

Not all exchange-traded funds ('ETFs') are created equal...

Not all exchange-traded funds ('ETFs') are created equal...