Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from today's episode, which airs at 8 a.m. Eastern time.

Read on below for our take on the dollar's recent troubles...

OK, even we have to admit it... The U.S. dollar is slipping fast...

OK, even we have to admit it... The U.S. dollar is slipping fast...

If you've been following our work for a while, you know my team and I are more than bullish on the dollar.

The world's reserve currency attracts plenty of naysayers. But we still believe its dominance isn't going anywhere anytime soon.

That said, there's no denying the numbers. Since President Trump returned to office, the dollar is down more than 10% against a basket of major global currencies from the euro to the Swiss franc.

It's a sharp reversal from the strength we saw just months ago.

Aggressive tariffs, a pressured Federal Reserve, and a "big, beautiful" tax plan have foreign investors spooked.

Many are dumping dollar-denominated assets. They're betting the Trump administration's policies will weaken demand for U.S. Treasurys and widen the budget deficit.

As usual, Wall Street is a cacophony of alarm bells. Analysts are floating the phrase "dollar collapse." Currency traders are on edge.

But amid the panic, there's a quieter story playing out that could catch investors off guard this earnings season.

Dollar weakness is nothing new...

Dollar weakness is nothing new...

It happens in cycles... often in response to major policy shifts, trade disputes, or macro uncertainty. We're seeing all three of those factors nowadays.

Those occasional setbacks don't change the dollar's dominant global position. They certainly don't mean its death.

But as the dollar weakens (for now), smart investors won't panic their way out of the market. They'll look for areas that will benefit.

Right now, that means multinational corporations.

Many large-cap U.S. companies generate a big portion of their sales abroad.

When the dollar falls, that foreign revenue becomes more valuable. This straightforward mechanical boost often shows up in financial reports before investors have time to adjust.

The U.S. Dollar Index is down more than 5% since the first quarter. That's not unprecedented. But it's meaningful... especially given the timing.

We're heading straight into earnings season, and nobody seems to be covering this story...

We're heading straight into earnings season, and nobody seems to be covering this story...

Wall Street is too focused on the "death of the dollar" narrative. The headlines aren't all that interested in the beneficiaries.

That gives careful investors an opportunity to identify surprises and maximize gains.

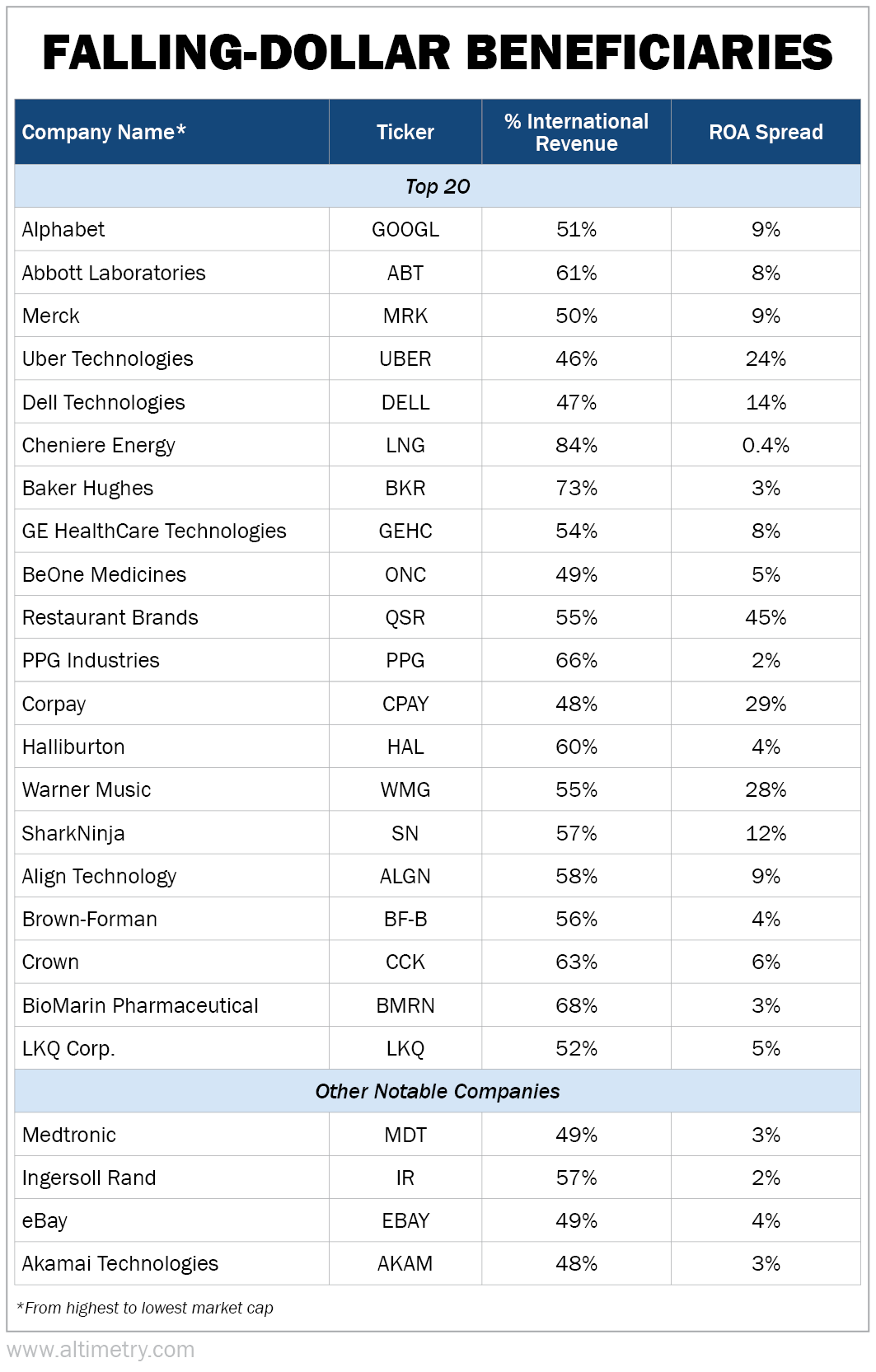

This setup got us wondering about what specific companies might surprise investors. We put together a scorecard with three criteria...

- Market cap above $10 billion. While smaller companies could also benefit, we kept this experiment to large caps only.

- International revenue exposure above 45%.

- Low investor expectations. We're looking for a disconnect between market expectations and forecast Uniform return on assets ("ROA") in 2025.

Using those factors, we compiled a list of the top 20 U.S. companies that should do well in today's environment (and a few extras that looked promising).

Here's what we came up with...

With the dollar under pressure, these companies are in great shape to outperform in the second half of the year.

They'll likely beat forecasts and drive revisions upward before the market adjusts to its new reality.

Investors tend to fixate on the dollar's symbolic power... and overlook its practical impact...

Investors tend to fixate on the dollar's symbolic power... and overlook its practical impact...

It's true that a weaker dollar can signal uncertainty. It can fuel inflation or strain government borrowing.

But in the near term, it also supports U.S. exporters. And it boosts reported earnings for companies with foreign sales.

That's exactly what we're seeing now.

The market would be wise to stop reading the headlines... and start reading the footnotes. Currency shifts hit earnings statements fast.

As earnings season kicks off, keep an eye on globally diversified companies. Pay particular attention to those with international operations and muted growth expectations.

When expectations are low, even a modest tailwind can have a big impact.

Regards,

Joel Litman

July 18, 2025

P.S. We'll dive deeper into the falling-dollar narrative in today's episode of Altimetry Authority. New episodes air every Tuesday and Friday at 8 a.m. Eastern time.

Check out our YouTube channel right here... and be sure to click the "Subscribe" button.

OK, even we have to admit it... The U.S. dollar is slipping fast...

OK, even we have to admit it... The U.S. dollar is slipping fast...