Federal Reserve Chairman Jerome Powell has made it clear... He's prepared to keep interest rates high through 2024.

Federal Reserve Chairman Jerome Powell has made it clear... He's prepared to keep interest rates high through 2024.

Everyone else seems to think that's a mistake.

Last month, the Fed met for its sixth of eight annual meetings. And while Powell kept interest rates between 5.25% and 5.5% this time, his warning for the future spooked the entire financial sector...

Powell let investors know that he may raise rates one more time this year. He also suggested rates will stay above 5% at least through the end of 2024.

Private-equity giant Apollo Global Management (APO) didn't like that answer one bit. Apollo's chief economist, Torsten Slok, warned that another year of high interest rates could trigger an onslaught of corporate defaults.

And Slok is right...

High interest rates alone won't cause a recession. If nobody needs to borrow money, nobody will notice the higher rates.

That's the situation we were in for much of the back half of 2022 and the first half of 2023. Interest rates had shot up at the fastest rate ever. And yet, defaults didn't take off.

But while Powell is focused on keeping rates higher for longer... the data shows a concerning setup. Today, we'll explain why he may have to change his tune in the coming quarters.

Starting in 2024, corporate debt maturities – particularly those rated as 'speculative' – start rising fast...

Starting in 2024, corporate debt maturities – particularly those rated as 'speculative' – start rising fast...

U.S. companies have about $100 billion of speculative debt maturities coming due this year. Over the next two years, that figure nearly quadruples. Almost $250 billion in speculative debt maturities is due next year... and $389 billion in 2025.

Speculative debt default rates are already on the rise. They were just 2.5% back in March. They've since risen to 4%.

And it's about to get even worse...

With interest rates forecast to stay high, many companies can't afford to refinance. But companies need to do something... because starting next year, they won't be able to afford all their obligations, either.

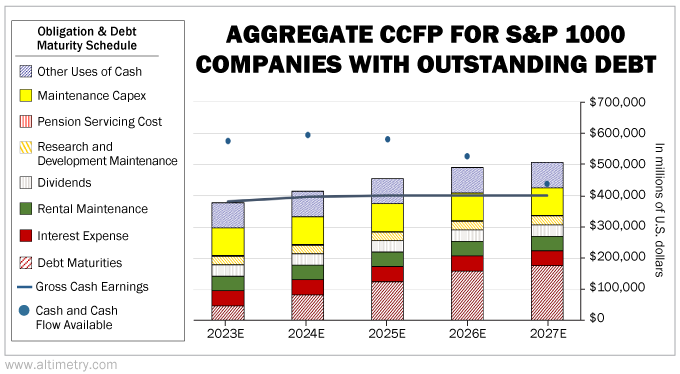

We can see how corporate cash flows measure up against debt obligations using our aggregate Credit Cash Flow Prime ("CCFP") analysis.

Our macro CCFP takes the Uniform cash flows and cash reserves for all nonbank and non-real estate businesses in the U.S. and compares them with their yearly obligations.

The chart below shows the current aggregate CCFP for the S&P 1000, which tracks 1,000 small- and mid-cap U.S. stocks.

This gives us a more accurate image of the companies likely to struggle in a downturn than the S&P 500. Banks are always more willing to lend to large-cap companies, as they have more room to raise equity.

If the dominoes start to fall, the smallest businesses topple first.

Over the next few years, debt maturities start ramping up... to the point where cash flows alone can't support all corporate obligations.

Take a look...

Starting next year, cash flows alone (the blue line) won't cover all obligations for the S&P 1000.

When lenders see this, they'll worry that companies won't be able to afford their debts... and that will make them less likely to lend in the first place.

This is what causes recessions...

This is what causes recessions...

Companies will need to refinance at the exact moment banks aren't willing to lend. These corporations won't be able to raise enough capital to pay back their debt obligations.

That's why default rates are starting to rise... and will likely keep rising.

Powell needs to keep interest rates high to cool off inflation and the labor market. But don't fall for the narrative that he'll manage to steer us toward a soft landing.

It's quite the opposite.

Regards,

Rob Spivey

October 9, 2023

Federal Reserve Chairman Jerome Powell has made it clear... He's prepared to keep interest rates high through 2024.

Federal Reserve Chairman Jerome Powell has made it clear... He's prepared to keep interest rates high through 2024.