Dear reader,

If Mickey Mouse is the face of American culture over the past century, then Coca-Cola (KO) is its lifeblood.

Through the signature contour bottle and the "Teach the World to Sing" campaign in 1971, Coke became America's beverage. However, no Coca-Cola marketing initiative has struck the public conscience like its basic premise: the secret recipe.

Rumors abound to the mystery of the Coke formula, known as "7X" internally.

One rumor states that only two Coca-Cola executives know the formula, and each of them only knows half of the ingredients. These men – whose identities remain anonymous – are forbidden from flying in the same plane, in case it crashes and they take the secret of Coke to their graves.

Another rumor states that the 7X concentrate is made by lifetime Coca-Cola employees across several rooms at Coke's Atlanta headquarters. Each room doesn't interact with any other room in the manufacturing process. The individuals in each room don't even know what chemicals they're adding, because these are marked with merchandise numbers as opposed to ingredient names.

Despite the romance of this story, these rumors are unfounded.

While Coca-Cola has never gone to such lengths to preserve the recipe, the company has remained tight-lipped for more than 125 years about the secret. When the Indian government demanded that Coca-Cola reveal the recipe, the company simply left India for nearly 20 years until the government acquiesced.

Not only is the formula under tight scrutiny, it would be impossible for any firm to replicate the product. To this day, Coke is still flavored with the coca leaf. No, it isn't so good because it contains cocaine... However, Coca-Cola is the only business in the U.S. to be able to incorporate coca flavoring into its products.

Coca leaves are imported primarily from Peru into Maywood, New Jersey. After every pallet of the leaf is accounted for by the Drug Enforcement Administration, chemical manufacturer Stepan processes the leaf, sending the "de-cocainized" version to Coca-Cola.

Altogether, Coca-Cola's assets are more than just the manufacturing plants it owns. The true value for the company is the flavor it has cultivated, and the mystique surrounding the origins.

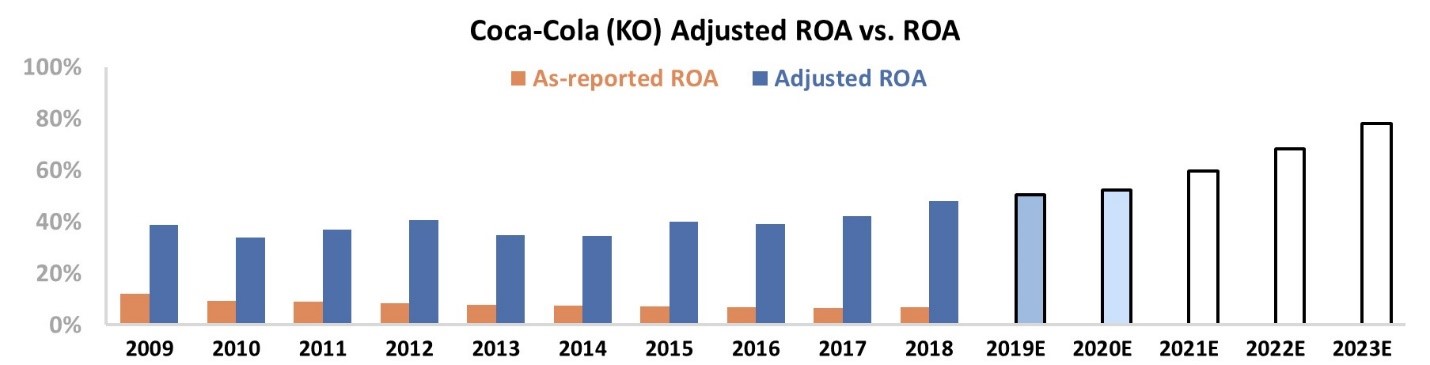

However, looking at the as-reported metrics, it is unclear why Coca-Cola would fight so hard to defend its secret. From 2016 to 2018, the company's as-reported return on assets ("ROA") was near cost-of-capital levels, stagnating around 7%.

With such a meager return, Coca-Cola should have pivoted away from its landmark beverage into other products. If the company is still just investing in its same brands, then it must be missing something. The fact that Coca-Cola stays focused on those brands likely means that, as usual, as-reported reporting has missed the mark on this all-American firm.

By using our Uniform Accounting metrics, we can see the true picture of Coca-Cola's returns by removing such distortions as goodwill and excess cash. Rather than stagnate at 7%, the company's Uniform ROA has instead stayed strong – increasing over the past three years. Take a look...

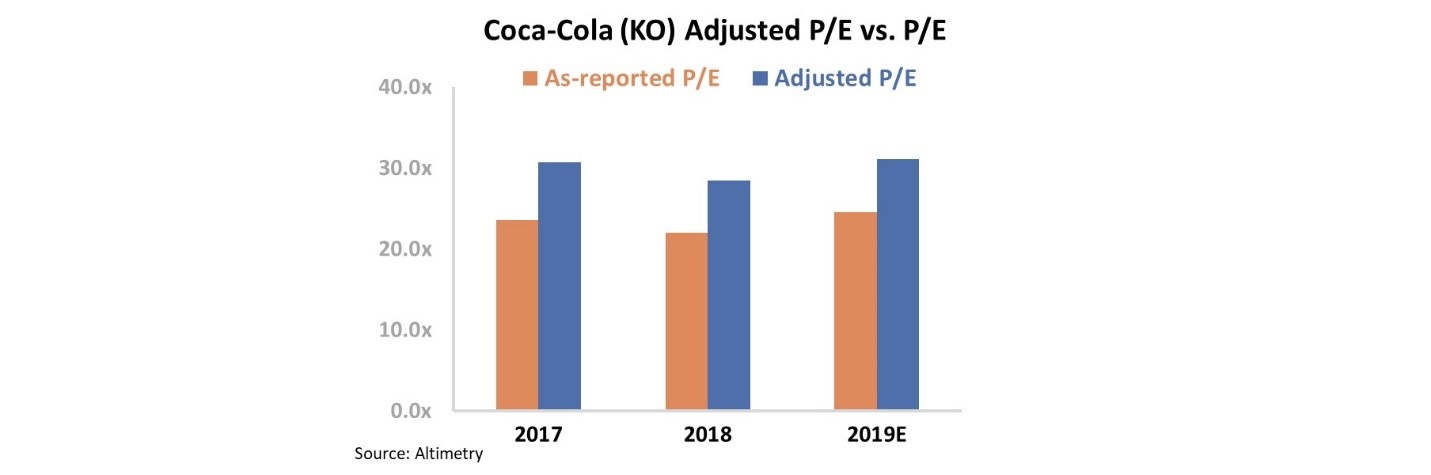

And yet, in recent years the market has bought too heavily into the myth of the Coke advertising machine. As you can see in the chart below, Coca-Cola's as-reported price-to-earnings ("P/E") ratio is 24.4, which has deceived the market into believing the business is priced near corporate averages. But Coca-Cola is trading at higher Uniform P/E ratio of 30.8... making it materially more expensive.

Looking at the next chart, you can see how much the market is expecting from Coca-Cola. The blue bars represent historical returns, which have ranged from 35% to 48% over the past 10 years. The abruptly climbing white bars represent the market expectations for the company at its current stock price. At around $53 a share, the market is expecting Coca-Cola's ROA to climb all of the way to 78%, far above historical highs.

Through brilliant marketing and shrewd protection of its trade secrets, Coca-Cola has maintained significant profitability over the past 127 years. The company is an institution of the American corporate landscape, and has a steady return stream to show for it. As-reported metrics misunderstand how profitable this business is.

But while institutional investors using bad GAAP data appear seem to recognize that Coca-Cola's returns aren't as bad as they appear, investors now are overhyping the stock. They are pricing in expectations for the company to find yet another revolutionary product. There's no other way for Coca-Cola to see returns expand from the historical 40% level up to around 80% over the next several years... But that's what the market is pricing in.

While Coca-Cola has come out with new products over the years – like Dasani, Fanta, Honest Tea, and Powerade, to name a few – none have rivaled the signature Coke. And none of these products has enabled the company to see returns double over a five-year period.

In order for its ROA to soar to current market expectations, Coca-Cola would need to repeat its 1892 innovation. It's unlikely that the company can deliver on that, which is why we'd be staying away from the stock.

By using Uniform Accounting, you can not only see how as-reported accounting statements are giving bad data, but you can also get ahead of the curve and realize the market's mistakes before anybody else.

Regards,

Joel Litman

October 16, 2019