I want to be young... Or I at least want to feel it. Who doesn't?

I want to be young... Or I at least want to feel it. Who doesn't?

I began a research journey into what my friends have called "bio-hacking." I simply called it a search and a test for ways to be, feel, and heal like when I was younger...

This study and self-interest began with an acute pain in both of my elbows that was so debilitating that it would sometimes actually hurt to shake hands. This occurred on days after any gym exercises that included elbow bending.

I had to cut down on going to the gym by at least 75%. I stopped doing any exercises that involved bending my elbows. I stopped practicing karate and other martial arts, as my elbows just couldn't take it anymore.

Apparently, what I experienced was a combination of tennis elbow and golfer's elbow. Not that I golf or play tennis much... These are just the names given for the severe pain that people experience in their elbows – on both the inner and outer sides – when the joints simply refuse to heal after heavy use.

I searched "Your Orders" in my Amazon account, as I was curious to see how much I've spent on cures, supplements, or supports for joint or elbow problems. I reviewed a long list of all kinds of things I've spent hundreds of dollars (if not more than $1,000) on hopeful products with the words "elbow" or "joint" in it.

I'm sorry to say that they didn't help much.

So I thought I'd see what other people have done, and I began searching online to see if there was anything that might help.

I stumbled upon some powerful research that has changed my life... and my aging curve.

Actually, what I've felt is nothing short of a medical miracle in my joints – especially in my elbows.

A couple of years ago, I wrote up a note about all this called the "Fountain of Youth" that I shared with some friends and colleagues. I have to say the note has turned into a document, and now is more of a full essay about these bio-hacking tactics and methods I've tried and adopted.

I'm working on updating that document. But until then, I thought I'd share some ideas that I stumbled on, researched, and then personally tried and found success. Over the coming weeks and months I'll share insights on the research, tips, and tricks I've found.

Check back in coming Altimetry Daily Authority essays – I'll cover the first insight I saw next week. Let's just say that this specific tip is very relevant with Thanksgiving around the corner.

Our team at Valens Research spends a lot of its time seeking to provide different types of advantages in the investment process...

Our team at Valens Research spends a lot of its time seeking to provide different types of advantages in the investment process...

When we teach at an MBA program, we typically discuss how there are three types of advantages that create sustainable alpha in the market: emotional, analytical, and informational.

If you don't have one of those advantages when making an investment, there's no real reason to believe you're going to sustainably outperform the market.

An emotional advantage involves figuring out when the market is acting irrationally. This could happen when there's talk of a recession, or when CEO Elon Musk tweets that he's going to take electric-vehicle maker Tesla (TSLA) private.

Informational advantages involve legally obtaining important information before the market has a chance to react. For instance, if you had some way of knowing how much revenue a company was going to generate in a quarter based on how much traffic you saw going in and out of its stores, you would know something the market didn't.

While these are both important, we spend most of our time focusing on the analytical advantage, or seeing what the market should see. Regular readers are familiar with our charts featuring the orange and blue bars that show a company's as-reported and Uniform numbers, respectively.

Truthfully, that's a big part of our analytical advantage.

Having this type of advantage works better for some industries than others, and we've found that it can be incredibly important in the biotech industry.

Most investors think buying a biotech stock is like a coinflip. Many companies in this sector either go bankrupt or are acquired by larger pharmaceutical companies at huge discounts because they fail to create a drug before they run out of money. It's estimated that between 85% to 95% of all drugs fail to reach full U.S. Food and Drug Administration ("FDA") approval.

The few biotech firms that succeed, on the other hand, have huge upside potential. It's not uncommon for a biotech stock to rise or fall more than 50% in one day following news that its drug passed or failed FDA approval.

For example, earlier this month the FDA announced it was halting a gene therapy study for Solid Biosciences (SLDB)...

And the stock fell nearly 75% that day alone.

While it would be great to have a crystal ball to tell you which companies will make successful drugs and which will fail, that's not necessary in an industry with such massive swings in both directions.

Having a better than 50% chance of being right can be the difference between a winning and losing strategy – and that's exactly what our analytical advantage can help us achieve.

A great example of this is Ionis Pharmaceuticals (IONS). The company focuses on RNA-related drugs and therapies for treating everything from cystic fibrosis to various hepatitis infections.

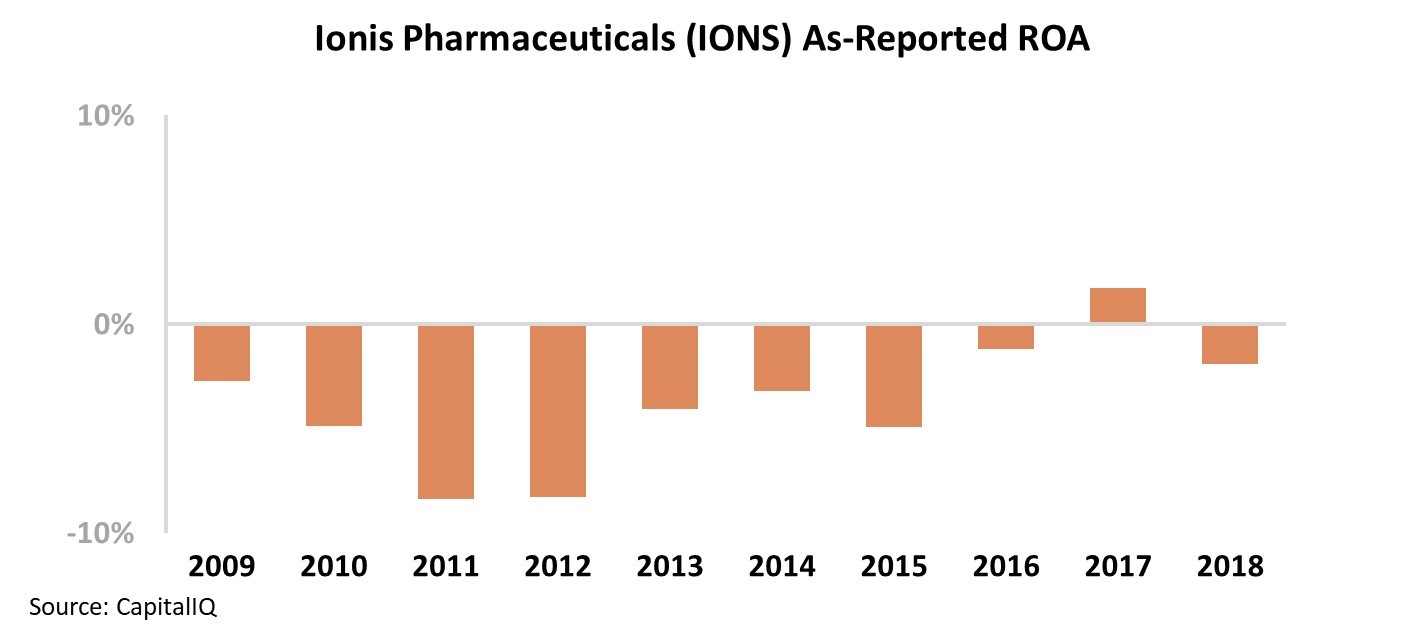

When looking at Ionis through traditional financial statement analysis, it looks pretty much like any other early stage biotech company. The as-reported numbers show massively negative returns over the past 10 years because Ionis is investing all of its cash in research.

Even though the company managed to squeeze a tiny profit in 2017, Ionis looks like a coinflip at best. Maybe it'll hit on a successful drug, but realistically this looks like a losing proposition nine out of 10 times.

But there's a catch...

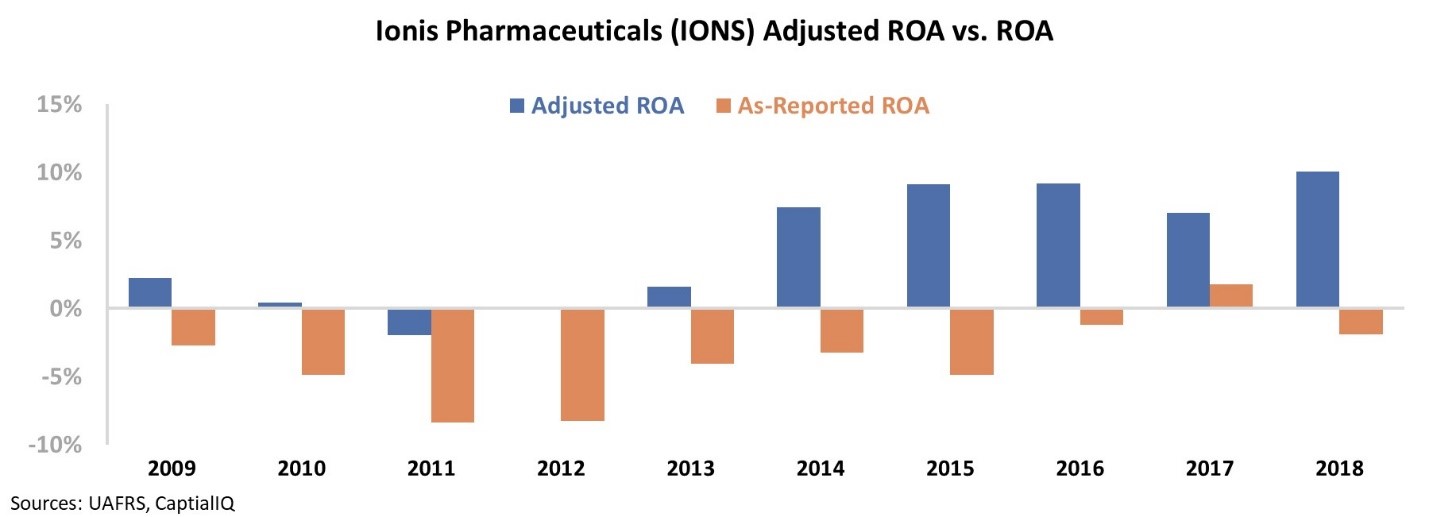

Traditional accounting metrics severely misrepresent the real profitability of a lot of biotech companies, because they treat investments in research and development as an expense instead of what it actually is – an investment. As a result, some biotech firms end up looking like they're losing money hand over fist when in reality they're actually profitable.

So let's take a look at how Ionis looks through our Uniform Accounting lens... After making the proper adjustments, we can see that the company has actually had steady, positive returns on assets ("ROA") since 2013.

You see, Ionis already has three drugs on the market: Spinraza, Tegsedi, and Waylivra. When looking at traditional financial metrics, investors would think the company had been wasting its time with the development of these drugs and that time would run out until the company was out of funding.

We can see instead that this is an already profitable company that can continue to invest in future blockbuster drugs. Today, Ionis has a pipeline of more than 20 drugs at various stages of approval. Given all of this growth opportunity, it might only take one or two big approvals before the market really catches onto what's going on.

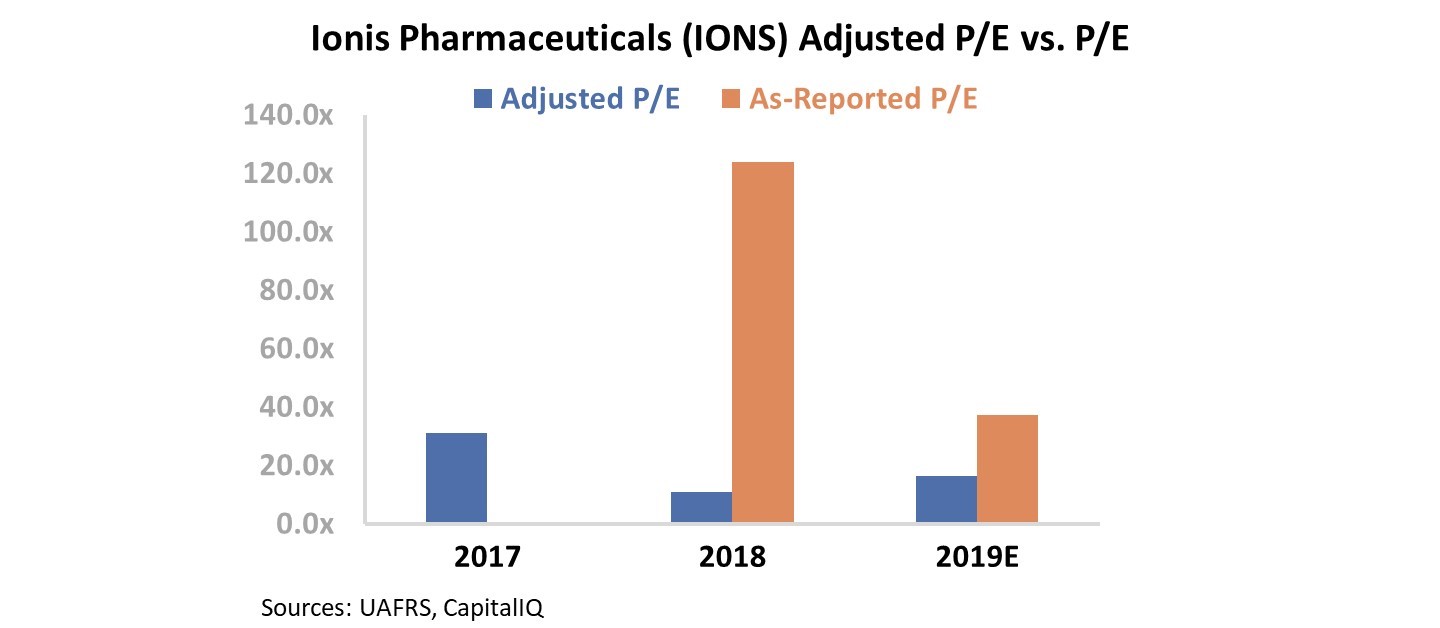

And valuations for the company start making a lot more sense when we're looking at Uniform metrics...

When it looks like Ionis is losing money, its price-to-earnings ("P/E") ratio is useless because it will be a negative number. As soon as the company made a small profit on an as-reported basis, its P/E ratio spiked to more than 120 – far above market averages.

When we look at its adjusted numbers, we can see Ionis actually trades at much more reasonable levels near a Uniform P/E ratio of 16. Not only is Ionis a strongly profitable company, but the market isn't paying up for that profitability.

Armed with the right financial data, it's clear that not all biotech companies are like betting on a coinflip.

Regards,

Joel Litman

November 22, 2019

I want to be young... Or I at least want to feel it. Who doesn't?

I want to be young... Or I at least want to feel it. Who doesn't?