U.S. consumer debt is hitting record levels today...

U.S. consumer debt is hitting record levels today...

Mortgage balances, which make up the biggest chunk of consumer debt, reached an all-time high of $12.14 trillion in the third quarter.

Auto loans, which have been climbing since 2011, came in at a record $1.56 trillion.

And credit-card debt – arguably the biggest threat to consumers' wealth – hit an all-time high of $1.08 trillion in the third quarter. For comparison, that's $154 billion higher than the same period last year and marks the most substantial annual increase in credit-card debt since 1999.

Worse yet, after more than a year of grappling with stubborn inflation, more folks are rolling their credit-card debt month to month. Currently, 47% of cardholders carry their debt over from the previous month – up from 39% back in December 2021.

Then, there are student-loan payments... which just picked back up in October.

Student-loan debt came in at $1.7 trillion in the third quarter, dropping by nearly $28 billion. While that marked the biggest decrease in student-loan debt since 2006, the total balance is only down slightly from the all-time high of $1.77 trillion set in the second quarter.

Overall, American households are now sitting on $17.3 trillion in debt.

As we'll explain, investors are getting nervous about companies that are on the hook for these huge credit balances... and rightfully so. Today, we'll look at one company in particular that's likely to suffer as consumer credit health deteriorates.

Capital One Financial (COF) lives and dies by the consumer...

Capital One Financial (COF) lives and dies by the consumer...

It's one of the largest credit-card issuers in the U.S. And it offers a variety of other consumer products, too... like checking and savings accounts, certificates of deposit, and auto loans.

Unlike some banks that have huge investment- and commercial-banking units, Capital One's consumer-banking and credit-card segments account for a majority of its revenues... Last year, for instance, they accounted for 93% of total revenues.

Unfortunately, consumer banking and credit aren't looking too good today. Car loans, student loans, and credit-card debt are all piling up... and delinquency rates are rising.

That means, if and when a recession hits, all the places Capital One relies on to make money are going to struggle.

That will cut into Capital One's profitability... and investors seem to realize that.

That will cut into Capital One's profitability... and investors seem to realize that.

Historically, banking is a high-return business.

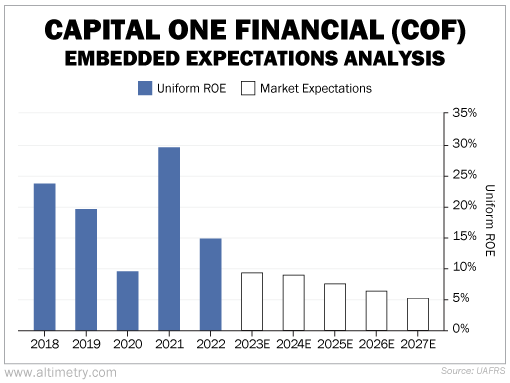

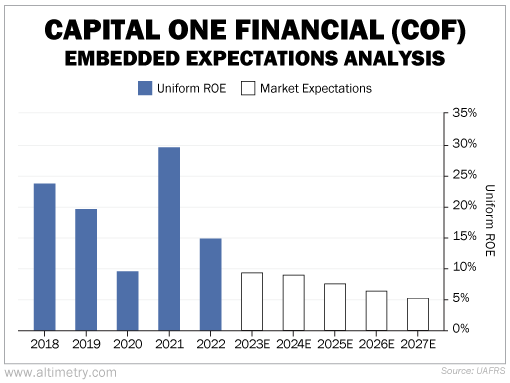

Capital One has averaged Uniform return on equity ("ROE") of 19% over the last 10 years. Yet, the market isn't forecasting those high returns right now...

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At its current stock price, the market expects Capital One's Uniform ROE to fall below 10% starting this year.

Take a look...

This makes sense. Capital One is a consumer-driven bank. And all the major places it relies on for revenue are likely to feel some pain as folks struggle to pay their bills... It's no wonder the market expects such low returns over the next few years.

And though this might seem like a great opportunity to buy the stock while expectations are low – don't be fooled. When you've got problems like Capital One has, low expectations aren't enough to make for a good investment.

Ultimately, the market isn't going to trust Capital One until consumer health improves.

The market's consensus looks spot on...

The market's consensus looks spot on...

Capital One's revenues are facing serious challenges today.

And plenty of other consumer companies just like this one are in the same boat. They're expected to perform worse than they have in years.

Investors are being cautious. But remember, just because expectations are low does not make these good investment opportunities.

Consumer-focused companies are going to struggle as Americans' balance sheets get weaker. In other words, expectations are low for a reason.

Regards,

Joel Litman

December 14, 2023

Editor's note: Joel and our friend Marc Chaikin, founder of Chaikin Analytics, just issued a critical warning about where the Federal Reserve will send the stock market in the early days of 2024.

And in the wake of their announcement, the clock is officially ticking...

Joel and Marc say you must move your money out of these doomed stocks while there's still time. They also share a groundbreaking discovery... that could forever change the way you think about making money during bear markets, crises, and everything in between. Get the full details here.

U.S. consumer debt is hitting record levels today...

U.S. consumer debt is hitting record levels today...