Dear reader,

We live in a cyclical world.

Consumer trends are a great example. During the 2000s, we couldn't wait until the next generation of cellphones came out... with each phone smaller than the previous one. The Samsung Juke, released in 2007, had a 1.4-inch display.

Today, each generation of smartphone is bigger than the last. Apple's newest iPhone model, the iPhone 11 Pro Max, has a 6.5-inch screen.

Fashion trends, believe it or not, also follow a cycle. Birkenstocks, the iconic sandal of the psychedelic late 1960s and early 1970s, are back and more popular than ever. And "athleisure" is just the fitness craze of the 1980s repackaged for modern times.

Business trends obviously follow cycles. Just a few weeks ago, we discussed human-resources company Automatic Data Processing's (ADP) cyclical profitability trends. The company's return on assets ("ROA") fluctuated with job data and the economy.

Some business cycles are longer than others, and it appears we're reaching the end of another large cycle: that of corporate conglomerates.

A conglomerate is a corporate structure where one corporation owns and operates a number of unrelated business units. The structure has been wildly popular over the last several decades because it provides diversity, stability, and scale.

General Electric (GE) is the poster child of the conglomerate model. From aviation to health care, finance, energy, and appliances, GE is diverse. Other companies like Honeywell (HON), United Technologies (UTX), Carlisle (CSL), and 3M (MMM) follow the same philosophy.

With GE under pressure in the news recently, public sentiment has turned against the value of conglomerates. There's an economic concept called the "conglomerate discount," which means that the value of the overall company is less than the value of each individual business.

The cycle of corporate conglomerates appears to be coming to an end. GE, Honeywell, United Technologies, and many other firms have begun breaking up their business units because they think this will create more value.

Despite their best efforts, most of these companies still suffer from the conglomerate discount. But not all of them deserve this treatment...

In particular, Carlisle should be viewed as a model for the next generation of conglomerates. The company operates in four segments: Construction Materials, Interconnect Technologies, Fluid Technologies, and Brake & Friction.

Similar to other large conglomerates, Carlisle grows its segments through strategic acquisitions. The difference is, Carlisle's strategy creates value – its portfolio should be more valuable than the sum of its parts.

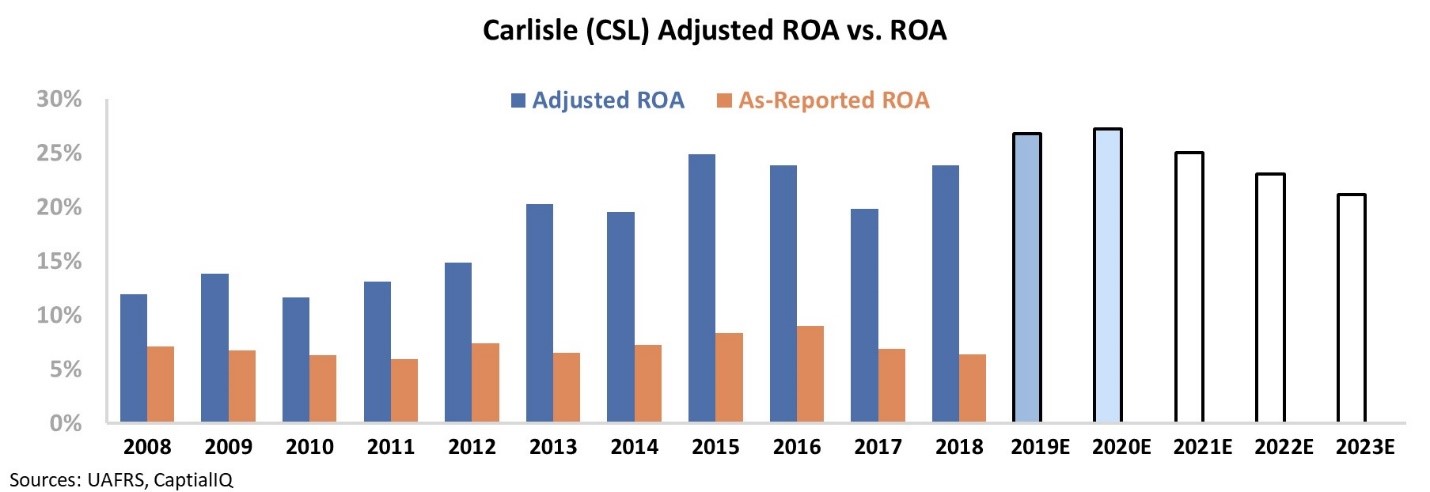

It's easy to see why investors are missing this... just take a look at the company's as-reported ROA over the past decade.

Three words come to mind when looking at this chart...

First – average. With its ROA between 6% and 10%, Carlisle is an average company.

Second – cyclical. Carlisle's ROA fluctuates between peaks and troughs, and the company is on its way towards trough levels.

Third – stagnant. Cyclicality is not inherently negative for a company, but we like to see businesses improve through each cycle. Carlisle seems to fail this test.

However, as-reported financials do not represent economic reality...

Once we apply our Uniform Accounting metrics – adjusting for inconsistencies like treatment of goodwill, stock option expenses, and operating leases – the real story begins to reveal itself for Carlisle.

Over the same time period, we can now see that the company is much stronger than as-reported metrics show. It has improved its profitability with each new business cycle. Clearly, Carlisle's acquisition strategy is adding value.

As you can see in the chart below, the company's ROA has doubled over the last decade from 12% to 24%.

Compare this with GE, which has not seen its ROA expand past 10% since 2008. Take a look...

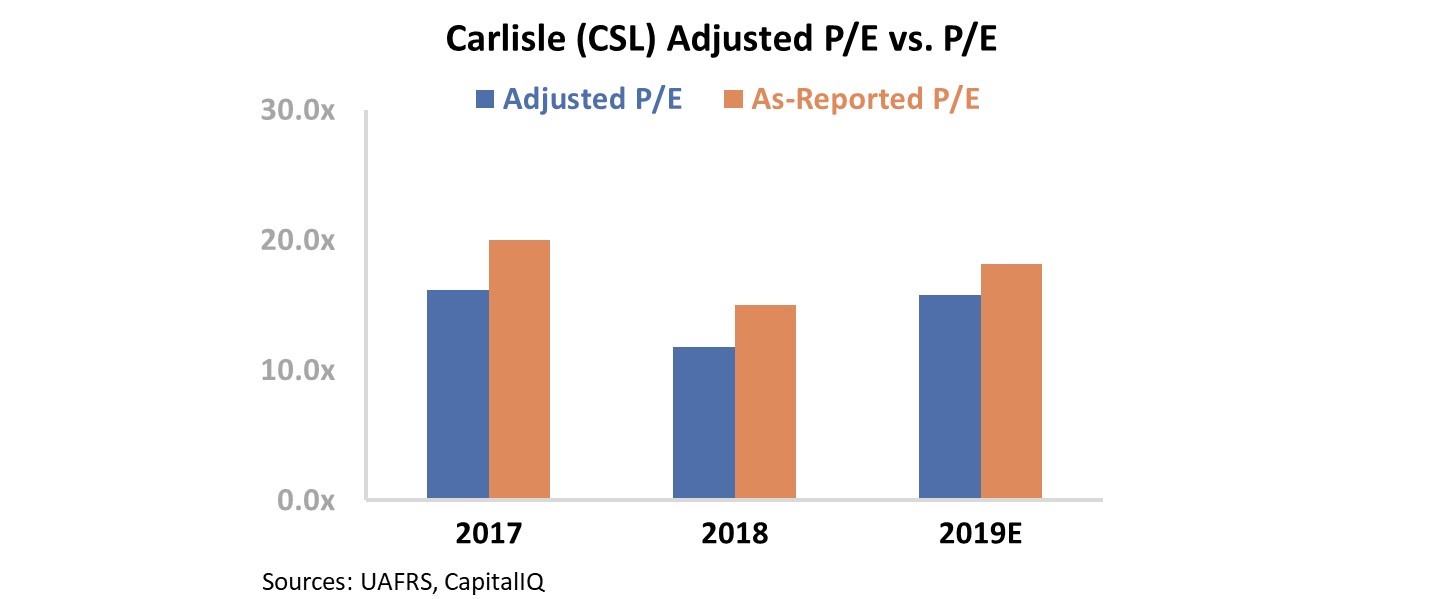

Clearly, one of these companies deserves the conglomerate discount while the other does not. And yet, Carlisle does trade at a discount to the market. The company's Uniform price-to-earnings ("P/E") ratio is just 16, while market averages are around 20.

Carlisle might look just like GE, Honeywell, and 3M when using traditional accounting standards. But this is a high-quality conglomerate that warrants a premium, not a discount.

Regards,

Joel Litman

November 13, 2019