Dear reader,

In 1893, the battle for the future of the U.S. – and the world – was underway in Chicago.

The World's Fair was accepting bids to provide power for the international exposition, and inventors Thomas Edison and Nikola Tesla were both eager to prove the superiority of their electrical systems. Tesla teamed up with engineer George Westinghouse to promote alternating current. Edison was the proponent of direct current and was backed by his nascent manufacturing firm, General Electric (GE).

Edison was a rising star... He took up the electric torch from Benjamin Franklin and went on to invent the lightbulb, the phonograph, and the motion picture camera. However, the one invention he failed to create was invented by his protégé, Nikola Tesla...

Tesla was working for the Edison Machine Works when his boss offered him $50,000 if he could improve upon direct current. Tesla delivered his invention – an alternating current solution for power generation and distribution. Edison said that Tesla didn't understand American humor, and offered him a raise of $10 dollars.

Thus the battle lines were drawn for the "War of the Currents"... While Tesla sold his technology to Westinghouse, Edison wanted to prove his direct current could still compete. As part of his campaign to show the dangers of alternating current, popular myth says Edison publicly electrocuted an elephant... filming the debacle on his new motion picture camera.

However, the true winner was proven by the ultimate arbiter – cold, hard cash. While GE bid $554,000 to power the Chicago World's Fair, Westinghouse submitted a bid for only $399,000, thus winning the battle. The U.S. is powered by alternating current to this day.

However, that didn't stop GE from switching to alternating current three years later in 1896. That same year, it registered as one of the 12 original companies on the newly formed Dow Jones Industrial Average. Despite leading the electrical revolution, Tesla died penniless, while Edison launched an American institution.

Since 1896, GE has been pushing the barrier of technology. In 1943, its Lynn, Massachusetts plant built the first jet engine for the U.S. Air Force. In the 1950s, GE was the largest user of computers outside of the U.S. government, eventually building its own operating system and mainframes for data processing.

After growth slowed in the 1980s, CEO Jack Welch proved to the world that an aging conglomerate could still grow, and entered the company into a multitude of business lines.

However, the 21st century has not been as kind to the industrial conglomerate... And GE has faced many issues.

I was at one of our clients' offices last week discussing GE and received a question I often hear whenever the company comes up: "Is GE a fraud?"

It's a question that comes up regularly, especially since accounting expert Harry Markopolos published his report accusing GE of fraud in its long-term care insurance business.

GE isn't fraudulent. The company has just executed poorly over the past two decades, and it's shown...

- Pressures to aviation in 2001 after 9/11 impacted its aerospace business.

- The Great Recession cut the legs out from its financial-services division, GE Capital.

- Poor timing in infrastructure and oil and gas investments led to the destruction of billions of dollars of shareholder wealth.

- Selling its content arm NBC Universal before the content revolution meant the company missed out on the opportunities in media.

GE has had a rough past 20 years...

And this pressure came to a head in 2017. After shrinking its balance sheet by up to 20% over the past five years, the company was still laden with debt, a sizable dividend, and large pension obligations.

Welch's successor, Jeff Immelt, stepped down after GE's core Power & Energy businesses came under serious pressure. Furthermore, the company was forced to book $6 billion in losses from its poor insurance policies written over the past 20 years.

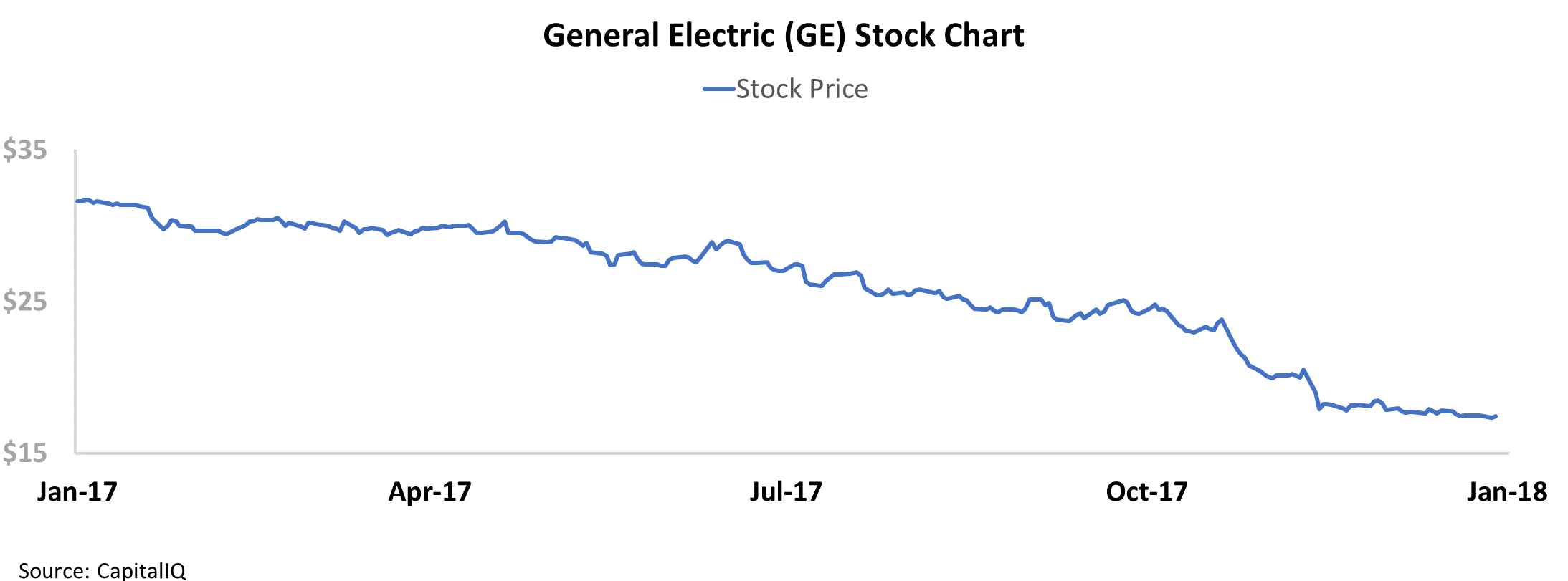

In 2017, GE shares fell from $31 to $17... in just one year.

Since then, GE has lost another CEO. The stock has come under more pressure, with shares declining further to $11.

Many sell-side analysts are confident that the worst is behind this storied company. CEO Larry Culp – the former head of Danaher (DHR) – is adopting a policy of austerity after having taken over GE. However, these analysts lack the clarity that Uniform Accounting provides for a savvy investor...

Under as-reported accounting, GE currently sports a price-to-earnings ("P/E") ratio of 16.6, well under market averages. However, under Uniform Accounting, GE is currently trading at a P/E ratio of 19.6 – right at current corporate averages. Even after the stock dropped in price by two-thirds – and considering the operating struggles and shrinkage the company has undergone – GE still isn't trading at cheap valuations.

And by looking at what the market is pricing in for the company – what we call "embedded expectations" – we can see the significant performance that the market still expects.

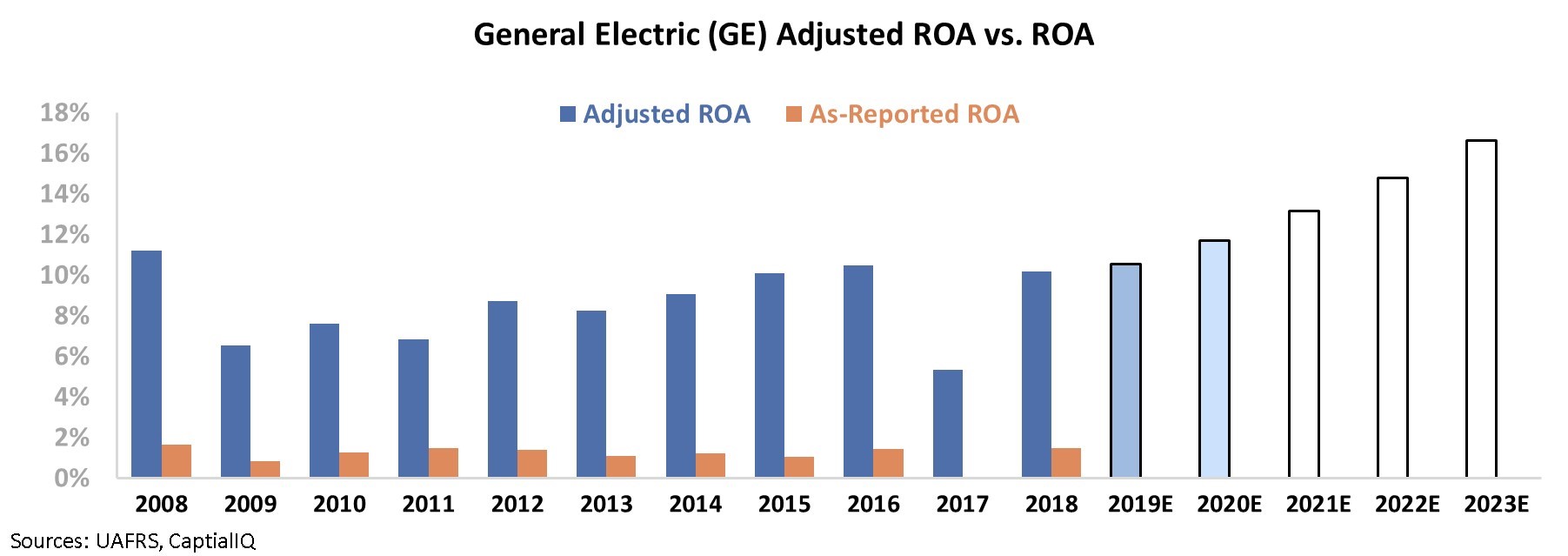

The chart below shows GE's return on assets ("ROA") compared with what sell-side analysts think the company is going to do over the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

In order to justify the current stock price, GE has to see returns improve to record-high levels of 17%. Take a look...

The company has come a long way from the Edison Machine Works. However, GE is no longer the business it was in its heyday.

While some may think they're buying GE at a value after the decline in share price, by using Uniform Accounting, we can see that GE still isn't a value today. The breakup and struggle of this conglomerate is still a story to watch from afar.

Regards,

Joel Litman

November 12, 2019

P.S. We'd love to hear your thoughts. Did you ever think GE would fall like this? Did you get burned by GE? Let us know at [email protected].