The fight against inflation continues on all fronts...

The fight against inflation continues on all fronts...

Despite a full year of interest-rate hikes, we're still nowhere near target 2% inflation levels.

The Federal Reserve just raised interest rates for the 10th consecutive time. And yet, inflation sits at 5% today. That's way higher than the 0.1% inflation rate we saw in May 2020... and it's closer to the 9.1% peak in June 2022.

There are countless debates over why prices have skyrocketed. Even so, there seems to be a consensus about why inflation is slowing.

The Fed's rate hikes are helping. And the government's pro-deflationary legislation has helped as well, even if it hasn't been as fast as folks wanted.

Take the Inflation Reduction Act ("IRA"), for example, which President Joe Biden signed into law in August 2022. It aims to curb inflation by reducing the deficit, lowering prescription-drug prices, and investing in domestic energy production.

There's also a huge incentive for the renewable-energy industry...

The IRA includes $370 billion in spending, tax credits, grants, and loans for clean-energy projects... including electric vehicles, clean technology, batteries, and solar panels.

So far, it has worked like a charm. The IRA has already helped create more than 100,000 new jobs in the clean-energy sector... and that was just in the first six months since its implementation. Plus, it accomplished this with one-quarter of the allocated budget – about $90 billion.

In short, money is flooding into clean energy. And it has been a boon for many companies in the space.

But one part of the clean-energy industry has been left behind...

Today, we'll reveal why the market is ignoring this key part of the "green transformation." And we'll explain why that could mean big upside for investors down the line.

There's one essential – and often overlooked – commodity that electric vehicles and solar energy need...

There's one essential – and often overlooked – commodity that electric vehicles and solar energy need...

Lithium, silicon, and even copper may come to mind. And it's true that these metals are critical to the manufacturing behind clean-energy projects.

However, the biggest issue isn't making green-energy-producing systems. If we're going to move toward a green-energy world, we'll have to get power from where it's produced to where it's consumed.

The Northeastern part of the U.S. is a great example. It's a massive consumer of energy. There just isn't enough land or sunlight to build as large of a solar industry as we see in other parts of the country.

So we're going to need wire systems. They can transport the energy produced in windy or sunny places to people's homes all over the U.S.

Now, most would expect the high-tension, high-capacity wiring that's essential for connecting a green-energy world's grid to be made of copper... But these wires are actually made of aluminum.

Electrical wiring makes up about 10% to 15% of total aluminum use globally.

The greener our world gets, the more demand for aluminum is going to increase. And typically, when demand for a commodity increases, so does its price.

But that hasn't been the case for aluminum...

The market is ignoring the importance of aluminum – for now...

The market is ignoring the importance of aluminum – for now...

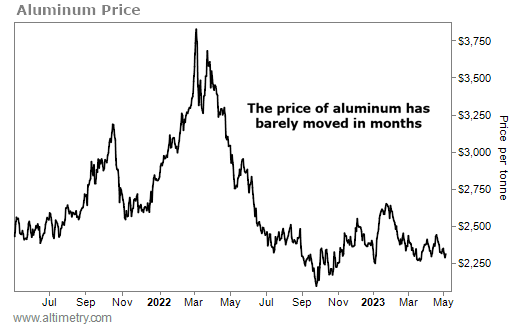

Take a look at the chart below. It shows the price of aluminum over the past two years.

As you can see, prices started rising when Biden was trying to push the IRA through Congress. But ironically, aluminum prices have remained relatively low since the IRA was signed...

It seems like investors understood the story... until the story became reality.

Even though the IRA boosted spending in the clean-energy space, the market isn't recognizing the boom in demand. Fears about inflation and a recession have people thinking too short term.

But the IRA is only one of the drivers of aluminum demand. We're at the start of decades of investment in green-energy projects. That means we'll need the commodity more and more.

Keep an eye on aluminum prices. It's only a matter of time until people remember how important the metal is.

We expect prices to start pushing highs once the market comes to its senses... and that could drive huge upside for aluminum mining and processing stocks.

Regards,

Rob Spivey

May 9, 2023

Editor's note: When investors catch on to the potential in aluminum, prices could soar. But in the meantime, another catalyst is all but guaranteed to mean huge moves – up and down – all across the market...

It's not a recession or some sort of "black swan" event. But Altimetry founder Joel Litman says a critical change next month will be just short of life or death for dozens of stocks.

On Wednesday, May 10, at 8 p.m. Eastern time, he's going on-air to share his urgent warning for investors... and to explain exactly how you can prepare. Plus, he'll reveal the name and ticker symbol of one stock that he believes could go bankrupt in the coming months. Learn more and reserve your spot for free right here.

The fight against inflation continues on all fronts...

The fight against inflation continues on all fronts...