Here at Altimetry, we spend a lot of time thinking about our corporate culture...

Here at Altimetry, we spend a lot of time thinking about our corporate culture...

It drives the success within companies, as it dictates attracting and retaining employees. It's what gives any business its identity.

In particular, we focus on inclusiveness along with an open-door policy.

This allows all employees within Altimetry to be aware of initiatives in the company. Furthermore, all employees can see the effect they have on the company's success.

In the current work-at-home environment, it has become more difficult – but more important than ever – to foster an inclusive culture.

We continue to try and uphold our values as a firm while also thinking of creative solutions to keep improving.

We wrap up our Friday afternoons during normal business hours by unwinding and talking about other topics than business.

This allows us to make sure we have a natural and non-business touchpoint with the team. It can also be something of an "end of business" countdown for some folks in the team to look forward to as we end the week.

We specifically avoid eating up our employees' free time during the weekend by having it at the end of the business day as opposed to after hours. As we've said many times here at Altimetry Daily Authority, working from home makes it harder for many folks to compartmentalize work and play... and we try to avoid fueling that issue.

And we're certainly not the only company striving to keep our employees engaged in their work. As Bloomberg recently explained, according to data collected earlier this year by the U.S. Census Bureau, more than half of employed U.S. adults report feeling nervous, anxious, or on edge frequently throughout the week.

Meeting employees' psychological needs is far from an easy task. Many companies are trying to create a community environment without being overbearing.

It's a balancing act to keep employees informed and enable them to feel a sense of ownership in their tasks, all while improving as an overall business.

Part of that improvement as a business is how developing a positive corporate culture can lead to profitability...

Part of that improvement as a business is how developing a positive corporate culture can lead to profitability...

One way a strong corporate culture can boost returns is through investing in employees and teaching new skillsets.

Today, a wide swath of customizable education is available from companies like Khan Academy, Coursera, and Udacity. Thanks to the Internet, employees have access to vastly more training material than ever before.

These training videos and courses range from the most 101 introductory levels of training for things like how to use Microsoft Excel to highly focused, niche topics like how to construct python-based artificial intelligence ("AI") programs for process automation.

Today, Kaplan is a brand synonymous with supporting this kind of training for corporations. The company also provides other types of instruction and teaching methodologies.

Kaplan's history traces back to 1938, when founder Stanley Kaplan started tutoring students in his parents' home in Brooklyn. However, in recent decades, the Kaplan brand was obscured by its former owner: the Washington Post newspaper.

Now, after the Post was broken up from the other firms in the holding company it was part of, the Kaplan business is under diversified conglomerate Graham Holdings (GHC), which also owns online magazine Slate and a collection of TV broadcasting businesses.

When analyzing Graham Holdings, investors might believe that the big Kaplan division's offerings hasn't led to strong returns for the conglomerate...

When analyzing Graham Holdings, investors might believe that the big Kaplan division's offerings hasn't led to strong returns for the conglomerate...

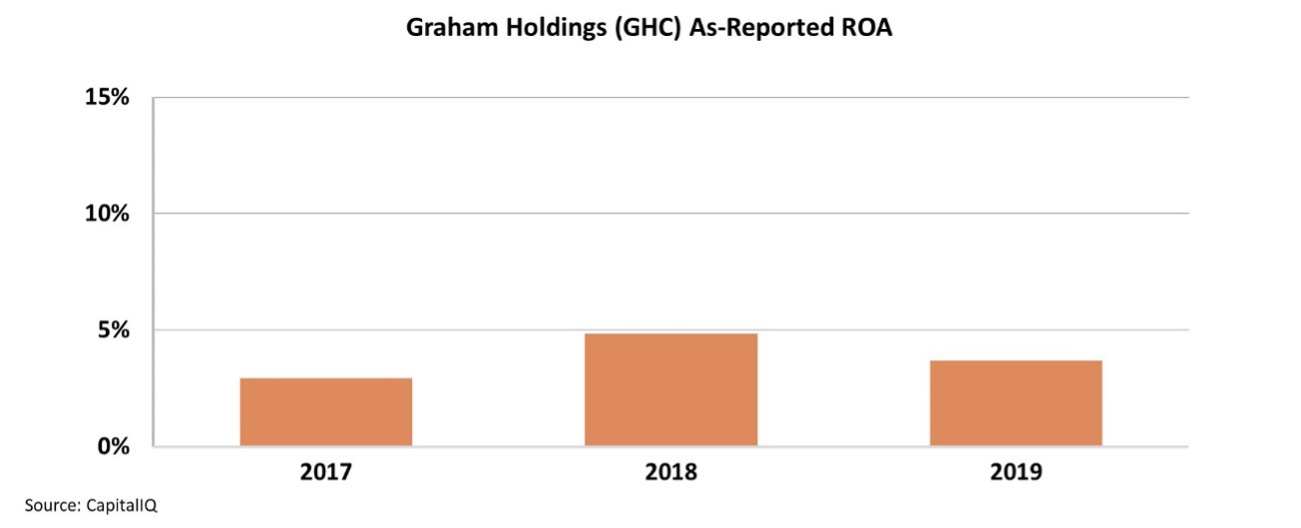

Specifically, the as-reported metrics show that Graham Holdings suffers from weak profitability levels. Since 2017, the company's return on assets ("ROAs") struggled to hit 5%. Graham Holdings' profitability hasn't come close to the 10% average return for U.S. corporations. Take a look...

In reality, these apparent weak ROA levels are just "noise" from bad accounting.

For a more accurate picture, we need to clean up Graham Holdings' financials using Uniform Accounting...

For a more accurate picture, we need to clean up Graham Holdings' financials using Uniform Accounting...

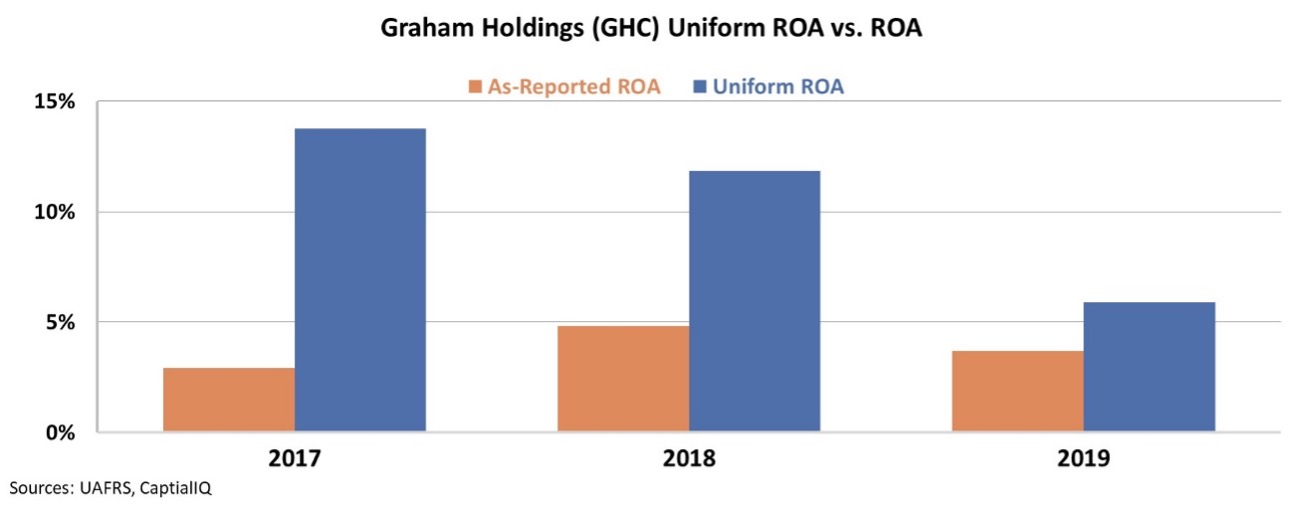

After adjusting for special items, excess cash, and other distortions in the financial statements, we can see the company's real performance.

Specifically, since 2017, Graham Holdings' Uniform ROA has regularly sustained levels greater than the as-reported metrics would have you believe. Take a look...

Aside from a dip in 2019, Uniform Accounting shows that Graham Holdings' education business with Kaplan has translated to strong returns. Looking ahead, with online enrollment up over the past year, Graham Holdings' Uniform ROA is expected to jump back above 10% for 2020.

And as these educational offerings become more important in a remote world, regardless of the recovery from the coronavirus pandemic, Graham Holdings will likely continue to benefit.

Regards,

Rob Spivey

March 17, 2021

P.S. Happy St. Patrick's Day! And as a reminder, if you want to hear Joel talk about the issues with Wall Street research and our outlook for 2021, make sure to attend our free event tonight at 7 p.m. Eastern time called "The Fall of Wall Street: High Alpha in the K-Shaped Recovery." If you're interested, you can register here and we'll send you a Zoom link for it.

Here at Altimetry, we spend a lot of time thinking about our corporate culture...

Here at Altimetry, we spend a lot of time thinking about our corporate culture...