Higher prices meant fewer presents this holiday season...

Higher prices meant fewer presents this holiday season...

We're still waiting for December's inflation data to be released. Yet already, it looks like we're in store for a historically high yearly average.

Inflation has risen to levels not seen in 40 years. In November 2020, the consumer price index ("CPI") – which tracks changes in the price of consumer goods – came in at 1.2%. That number was 7.1% in November 2022.

Even though inflation only started to rise halfway through 2021, the average for the year was 4.7%. That's a 30-year high. You can expect the 2022 number to be much worse.

We're seeing some promising signs that the Federal Reserve is winning its battle against rising prices. The CPI is down significantly from the 9.1% peak in June. Still, you're probably not surprised to hear that inflation is hurting consumers today.

A study from market-research company the Harris Poll showed that about 60% of shoppers planned on buying fewer presents in December. Some even skipped holiday shopping altogether.

And holiday shoppers aren't the only ones feeling the pressure. As I'll explain, one key sector is feeling the pain more than most... and investors would be wise to steer clear.

Companies typically see the most traffic when the holiday season is in full swing...

Companies typically see the most traffic when the holiday season is in full swing...

Many folks are splurging on holiday gifts. Some are taking much-needed vacations. That's why the fourth quarter is usually the best time of the year for the consumer-discretionary industry.

These are companies that sell nonessential goods and services... anything from luxury apparel and appliances to cruise lines and hotels.

Yet this holiday season wasn't such a jolly time for most retailers.

As earnings calls for the third quarter wrapped up, it became clear that management confidence was low.

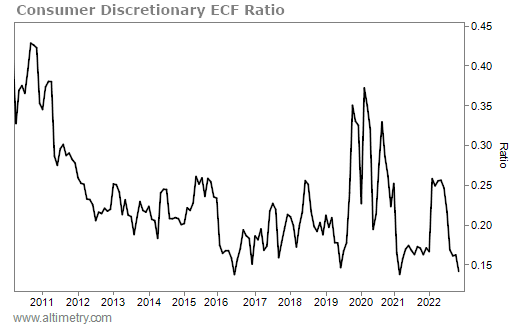

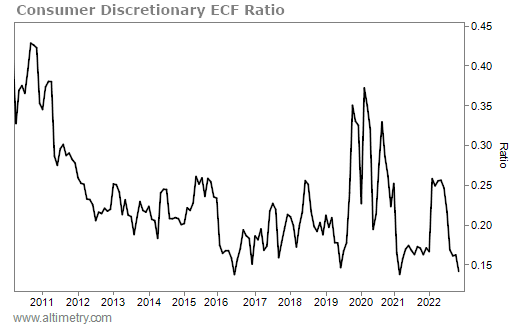

We can take a deep dive into sentiment using our Earnings Call Forensics ("ECF") analysis.

We use advanced audio technology to analyze management's voices on earnings calls. Our software measures inflections in the speakers' speed of speech, tone, hesitation levels, and even changes in "breathiness."

Then it compares that against their spoken words to generate two types of markers – "questionable" and "confident."

It doesn't stop with one company, either... We can also compile earnings calls to see aggregate ECF results for entire industries. This lets us see the ratio of questionable and confident markers generated across a sector.

The lower the ratio, the less confident management teams are.

Confidence was low for the consumer-discretionary industry as a whole at the end of 2022...

Confidence was low for the consumer-discretionary industry as a whole at the end of 2022...

The ratio was among the lowest we've seen in the past two decades. And that happened just as we entered the most important consumer season.

Take a look...

Consumer-discretionary management teams generated more than seven questionable markers for every confident marker. That's about as low a ratio as the sector has seen in the past decade-plus.

When management isn't confident in its own operations, that's a problem. Clearly, folks at home aren't the only ones worried about inflation.

The Fed is taking the right steps to combat rising prices. Eventually, inflation will come back down. However, we're not there yet.

Until inflation falls to comfortable levels and demand returns, consumer-discretionary stocks will be under a lot of pressure. It's best to stay away from this sector for now.

Regards,

Joel Litman

January 4, 2023

Higher prices meant fewer presents this holiday season...

Higher prices meant fewer presents this holiday season...