Editor's note: The markets and our offices are closed tomorrow, July 4 for Independence Day. So we won't publish our Altimetry Daily Authority e-letter that day. Please look for your next edition on Monday, July 7.

Many assume that population size is directly proportional to economic output...

Many assume that population size is directly proportional to economic output...

After all, a large population means more folks produce, consume, and contribute to the overall economy.

Yet this assumption falls apart when you look at real-life examples...

Colombia, for one, has 50 million people and a GDP of more than $360 billion. It exports natural resources, like petroleum, and agricultural products, like coffee and fruits.

Singapore's population is one-tenth of Colombia's at just over 5 million. And one of its top exports is also petroleum. Yet the country enjoys a much higher GDP of $500 billion.

What's the reason behind this economic gap? As we'll explain, the answer lies in national tax policies...

Excessively high tax rates can hinder growth...

Excessively high tax rates can hinder growth...

Colombia's tax code ranks last among the 38 members of the Organisation for Economic Co-operation and Development ("OECD").

The OECD includes market-based economies in Europe, North America, the Pacific Rim, and Latin America... such as Spain, the U.S., South Korea, and Chile.

Colombia's corporate tax rate is currently around 35%. People also pay taxes on income, capital gains, dividends, interest, and financial transactions. So it's no wonder that foreign direct investment in Colombia was only $14 billion in 2024.

For comparison, the corporate tax rate of OECD members averaged 24%. And foreign direct investment averaged $18 billion across all members.

Said another way, Colombia's tax policy is too burdensome for investors, businesses, and even workers.

Singapore, on the other hand, has lower tax rates. It also taxes consumption rather than production, which encourages businesses to set up shop.

According to the 'Laffer curve,' lower taxes can foster economic prosperity...

According to the 'Laffer curve,' lower taxes can foster economic prosperity...

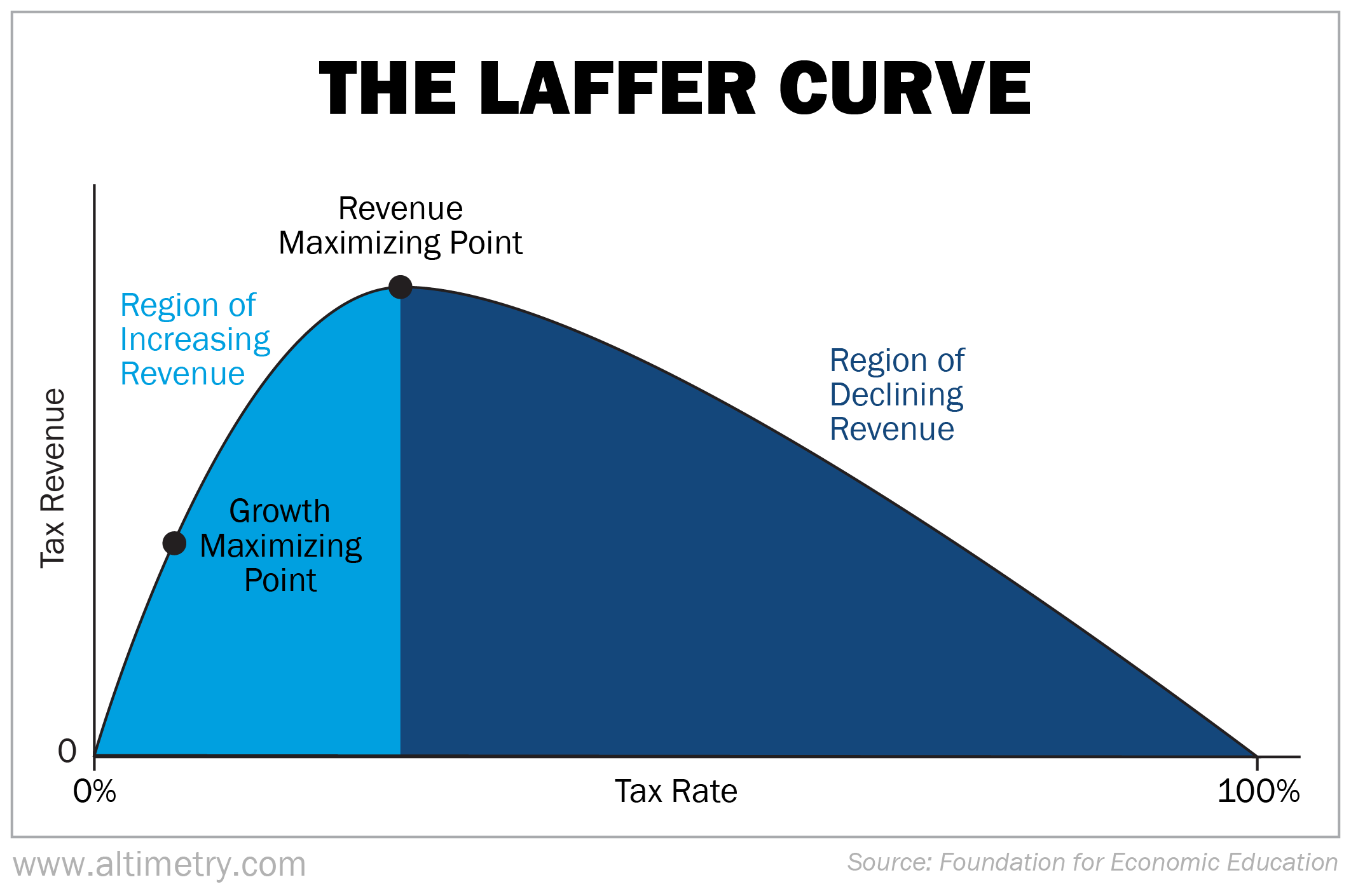

Economist Arthur Laffer came up with this theory in 1974 to explain the relationship between tax rates and revenue.

In a nutshell, there's a sweet spot for tax rates. It's not a precise figure, but it tends to fall on the lower end of the Laffer curve...

When governments slash ultra-high tax rates, individuals and businesses are more likely to spend and invest their money.

This snowballs into higher demand and higher production. It also boosts employment and business activity, leading to more tax revenue.

This is exactly why America is an economic powerhouse...

This is exactly why America is an economic powerhouse...

The U.S. understands how to create wealth.

It has cut corporate taxes several times since the 1970s, including in 2017. We're also seeing more business-friendly legislation and regulatory changes under President Donald Trump.

So, despite the shaky global economic climate, now is the time to buy into U.S. stocks.

As the Trump administration advances proposed tax cuts, the economy will continue growing. And that will allow America to dominate for years to come.

Regards,

Joel Litman

July 3, 2025

Many assume that population size is directly proportional to economic output...

Many assume that population size is directly proportional to economic output...