Donald Trump has made no secret of his frustration with China...

Donald Trump has made no secret of his frustration with China...

From pledging to impose tariffs to boosting domestic manufacturing and ramping up energy production, the president-elect has made many pledges to challenge China when he returns to office.

Energy in particular has been a key front for the U.S. and China... and specifically, carbon emissions.

Back in 2021, China promised to align with global efforts to curb coal-based emissions, including halting the construction of coal plants in other countries.

Chinese President Xi Jinping said the country would support developing nations in adopting green energy. And he said China wouldn't build new coal-fired power plants abroad.

The U.S. and Europe have made strides in reducing their emissions since then. Europe's annual emissions peaked all the way back in 1990, and the U.S. in 2007. However, China doesn't seem to have the same priorities...

Instead of scaling back, the country has ramped up its coal projects. Annual emissions are sitting at unprecedented levels, more than double those of the U.S. and more than the U.S. and Europe combined.

Trump isn't pleased with China's approach to energy. He has promised a harsh response many times. So today, we'll discuss how he plans to push back against Chinese energy policy when he takes office again.

The incoming Trump administration has made it clear – the U.S. won't compromise its competitive edge in the name of reducing emissions...

The incoming Trump administration has made it clear – the U.S. won't compromise its competitive edge in the name of reducing emissions...

Especially with China continuing to ramp up its own.

Trump's choice for energy secretary, Chris Wright, embodies this perspective with his "all of the above" energy game plan. Wright is advocating for the development of every viable energy source in the U.S.

This means doubling down on traditional energy sources like oil and natural gas alongside advancing newer energy technologies.

Trump's administration plans to make the energy sector a central priority. And that could open up significant opportunities for growth and investment.

Put simply, bright days are ahead for the U.S. energy industry...

Put simply, bright days are ahead for the U.S. energy industry...

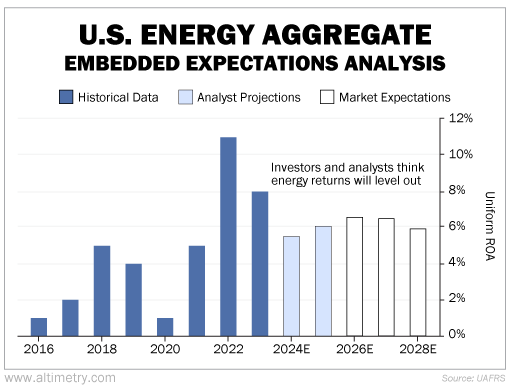

However, the market doesn't seem to recognize the full potential of this boost. We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework...

We start with the average stock price of all U.S. energy companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well the U.S. energy industry has to perform in the future to be worth what the market is paying for it today.

Energy is a cyclical industry. Uniform return on assets ("ROA") has seen its share of ups and downs related to energy prices. Returns rose from 1% levels in 2016 to 5% by 2018... before falling back to 1% again in 2020.

Uniform ROA peaked at 11% in 2022 as COVID-19 and supply disruptions caused oil and gas prices to surge.

Analysts expect that number to fall back to 6% levels over the next year. The market expects it to stay there through 2028.

Take a look...

Investors don't seem to expect significant progress from the energy sector. They anticipate a continuation of current profitability... and not much else.

Trump wants to keep the U.S. dominant on the global energy stage...

Trump wants to keep the U.S. dominant on the global energy stage...

So this industry should be going nowhere but up.

As the Trump administration pushes its agenda, we expect more drilling activity... and more focus on oil and gas as the primary energy sources.

Energy companies should see a boost to profitability in the coming years, driven by these strong tailwinds.

Regards,

Joel Litman

December 17, 2024

Donald Trump has made no secret of his frustration with China...

Donald Trump has made no secret of his frustration with China...