We're running out of accountants...

We're running out of accountants...

According to the American Institute of Certified Public Accountants ("AICPA"), roughly three-quarters of its members are at or near retirement age.

The AICPA has gone from a total of 430,000 members in 2017 down to about 415,000 in 2023. And it has missed membership targets in four out of the past five years.

Pretty soon, we'll need new accountants to fill that void. Unfortunately, students just aren't willing to enter the field today...

For one, becoming a certified public accountant ("CPA") requires an extra year of schooling. That's a total of 150 college credit hours. On top of that, the CPA exam is pricey. Depending on which state you're in, it costs anywhere from $1,000 to $5,000.

States such as Minnesota are considering altering their CPA requirements... though it's unlikely anything will come to fruition due to the problems it would cause. For instance, there would be an inconsistency of CPA requirements across the nation. That could lead to some CPAs not being recognized in certain states.

And yet, we simply can't do without accountants...

Companies need to adhere to accounting standards to ensure their books are consistent and accurate. If they don't, they could face major legal fines. They could also lose the trust of their shareholders and customers.

So they need people (i.e., accountants) who understand accounting standards. As we'll explain today, that's good news for one business in particular...

Staffing companies love a tight labor market...

Staffing companies love a tight labor market...

Unemployment rates haven't budged much since the Federal Reserve started its rate-hiking campaign. They're still only around 3.7%, which means there aren't many folks searching for jobs.

Meanwhile, companies are looking to hire...

Job openings are still at record highs and outnumber candidates 2-to-1. In other words, there are roughly two openings for every job-seeking person.

This setup is perfect for companies like Robert Half (RHI)...

Robert Half is one of the largest staffing companies in the world. It primarily focuses on filling temporary and permanent roles in finance, administration support, information technology... and accounting.

Robert Half helps fill tens of thousands of finance and accounting roles every year.

That means the company is perfectly positioned to benefit from the current shortage of accountants...

However, investors seem to be pricing in a different story for the staffing giant...

However, investors seem to be pricing in a different story for the staffing giant...

They expect Robert Half's returns to trend downward in the coming years, eventually reaching pandemic-era lows in 2027.

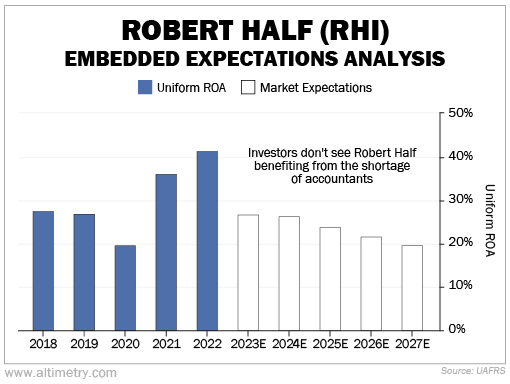

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

As you can see, Robert Half's Uniform return on assets ("ROA") averaged about 30% between 2018 and 2022. Returns dipped to a low of around 19% during the pandemic... which is still good, just way lower than normal. In 2022, they rebounded to a high of roughly 41% as the labor market started to tighten.

At current valuations, investors think Robert Half's Uniform ROA will fade back to about 19%...

That's incredibly bearish, considering the last time returns were that low was during a global pandemic.

Investors don't seem to understand that Robert Half's business is in great shape today due to a tight labor market and the shortage of accountants.

Its Uniform ROA could easily remain near the high end of its five-year range... if not head even higher.

Shares will likely soar as Robert Half impresses. And savvy investors have a chance to buy the stock while it's cheap.

Regards,

Joel Litman

January 30, 2024

We're running out of accountants...

We're running out of accountants...