It's fun to run a business when everything is going well...

It's fun to run a business when everything is going well...

When the economy is strong, interest rates are low. Access to capital is cheap. Customers are happy to buy products and services.

Companies can take on low-interest debt to invest, fuel growth, and make acquisitions. And when the debt comes due in a few years, they can refinance it with "easy" credit.

Everyone is happy... from lenders and shareholders to suppliers and management. Continued investment means higher returns and a bigger scale for everyone involved.

This virtuous cycle of leverage leads me to one of activist investors' favorite moves. It's quite simple, really. They tell companies to take out debt at low interest rates and buy back shares.

Wall Street refers to this move as a "leveraged recapitalization." It increases the company's leverage ratio and reduces the number of shares outstanding. And that means the remaining shareholders get a bigger ownership stake.

That's in good times. Good times don't last forever, though...

Today, we're seeing what happens in bad times. Interest rates are high, and companies face refinancing headwalls in the next three to five years. They're starting to consider unwinding these moves.

As I'll explain, the coming flood of sellers is going to drag valuations lower... and some sellers will have to face tough debt decisions. That could create hidden opportunities for savvy investors.

Business heads are no longer looking to invest...

Business heads are no longer looking to invest...

A recent EY poll showed that 44% of U.S. CEOs are preparing to make divestitures this year. They're scrambling to take apart the empires they've built.

The biggest reason for this is money. They want to raise cash to manage their debt maturities.

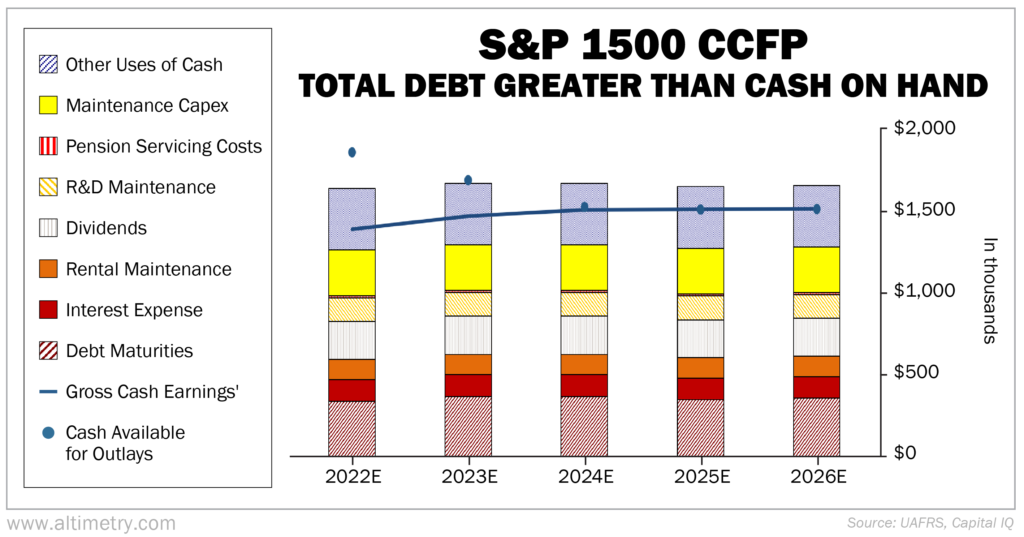

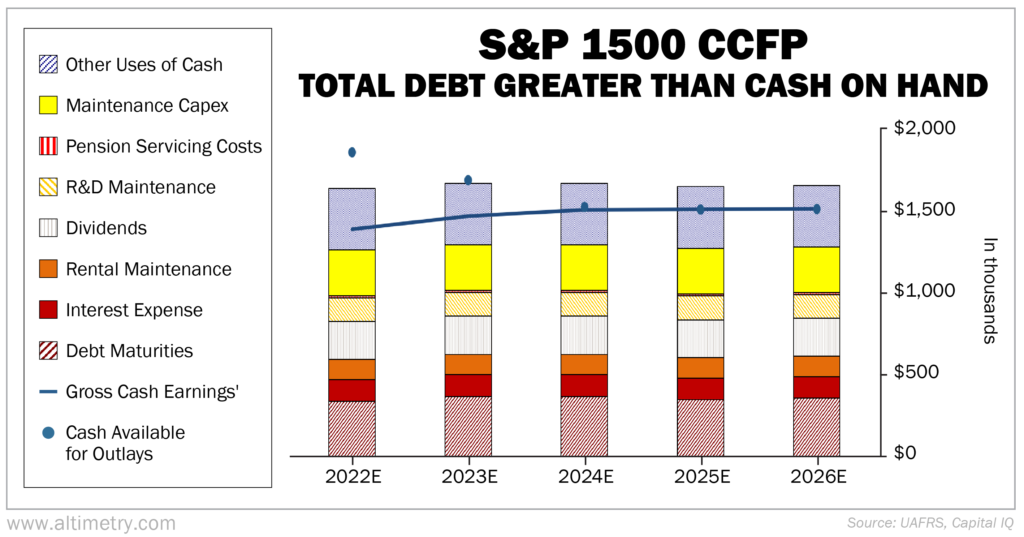

We can see this through our aggregate Credit Cash Flow Prime ("CCFP") analysis. It compares companies' financial obligations against their cash positions and expected cash earnings.

In short, it shows when U.S. companies have debt coming due.

To analyze the whole U.S. market, we looked at the CCFP for companies in the S&P 1500 Index with more debt outstanding than cash on hand.

In the following chart, the stacked bars represent these companies' obligations each year for the next five years. We compare those obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

Take a look...

The companies that need cash flow the most will run into tough decisions by 2024. Cash flows can cover all obligations besides "other uses of cash"... which represents a normal level of share buybacks.

There's enough cash on hand to keep these businesses comfortable until 2024 and 2025. All the same, management will need new ways to raise cash in order to keep shareholders happy. They'll also need cash to manage their pending debt maturities.

Regular readers will notice this chart looks a bit different from the last time we wrote about our aggregate CCFP analysis. That's because we were looking at how smaller companies would fare. This time, we're looking at the companies that are most in need of cash flows... no matter their size.

These companies need more capital. And they need it soon.

This is exactly why 44% of CEOs are looking to raise capital. It's not just a whim of the C-suite. It's necessary for survival.

That's why 2024 may be the year of divestitures...

That's why 2024 may be the year of divestitures...

And it could mean big opportunities for smart investors.

Companies will sell assets to raise capital. They often shed underperformers when they're likely to get the least value for them.

You've probably heard the mantra "buy low, sell high." Management teams, like many investors, aren't great at actually doing this.

Those divestitures tend to outperform. Research by Credit Suisse (CS) and JPMorgan Chase (JPM) shows spinoffs beat the market by upwards of 13% in the first year on average.

There's even a website dedicated to these opportunities, called The Spin-Off Report. It helps investors keep an eye on divestiture activity.

A lot of companies will face a cash crunch in the coming quarters. Looming debt maturities likely mean a lot of business sales.

Take advantage of management teams that overspent in boom times. Patient investors have a chance to pounce on some great spinoffs at a discount. Keep your eyes peeled.

Regards,

Joel Litman

April 24, 2023

It's fun to run a business when everything is going well...

It's fun to run a business when everything is going well...