Investors are worried about a horde of 'zombies'...

Investors are worried about a horde of 'zombies'...

By now, we all know the pandemic story by heart. In mid-March 2020, panic about COVID-19 caused the stock market to plummet. The economy basically shut down.

But despite what many people think, the market didn't tank because companies lost a few months' worth of earnings. Instead, it was about cash.

Investors feared that companies with debt would run out of cash and go bankrupt if they had to suspend operations for months. Back in April 2020, we highlighted the problems that could arise if cash flows dipped too much.

Understandably, with potential mass bankruptcies on the horizon, credit markets panicked. But governments around the world weren't going to let that happen...

They handed out bridge loans and dropped borrowing costs to historic lows. Practically any company that needed to refinance was able to do so. But this posed a new issue for the market.

With so many companies taking on cheap debt, investors became concerned that the bailout spending was creating "zombie companies" – businesses that couldn't afford the interest on their debt. Said another way, companies took on debt because it was so cheap... regardless of their ability to pay it back.

However, data from Janus Henderson shows these fears may be overblown...

Last month, the asset-management group reported that 51% of companies have reduced the debt on their balance sheets. As interest rates have risen and borrowing has become more expensive, companies have actually been paying down their debt obligations.

This is the first time in seven years that debt levels have fallen instead of risen.

It's true that high rates can slow economic growth, since companies will be able to borrow less to fund new projects. But borrowing less gives companies the opportunity to improve the health of their balance sheets. This lowers the risk of a 2008-style meltdown.

Cash flows are showing encouraging signs...

Cash flows are showing encouraging signs...

Despite recession concerns, the economy has held strong. Even in the face of inflation, earnings have actually been positive.

And between strong company performances, high interest rates, and low borrowing rates, debt should be manageable for most corporations.

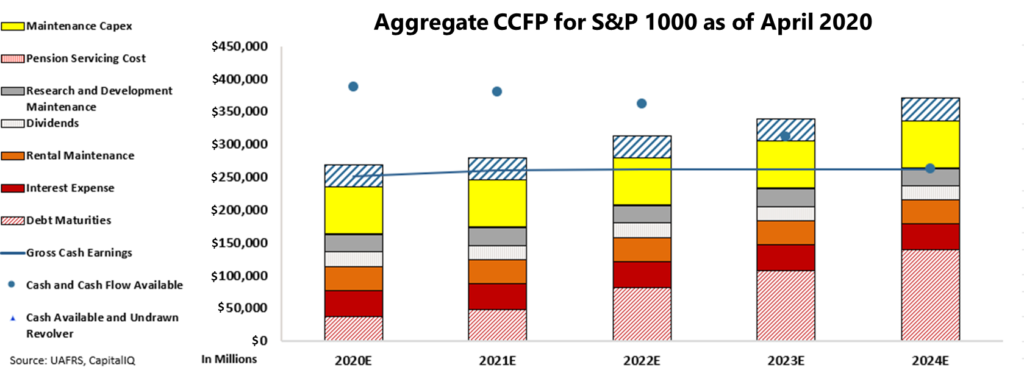

We can see how these cash flows measure up against debt obligations using our aggregate Credit Cash Flow Prime ("CCFP") analysis.

Our macro CCFP takes the Uniform cash flows and cash reserves for all nonbank and non-real estate businesses in the U.S. and compares them to their yearly obligations.

The chart below shows the 2020 aggregate CCFP for the S&P 1000, which tracks 1,000 small- and mid-cap U.S. stocks.

(This gives us a more accurate image of the companies likely to struggle in a downturn than the S&P 500. Banks are always more willing to lend to large-cap companies, as they have more room to raise equity. If the dominoes start to fall, the smallest businesses topple first.)

Back in 2020, projected cash flows weren't enough to cover obligations, signaling the potential for mass defaults. Significant debt headwalls in 2023 and 2024 only worsened those issues...

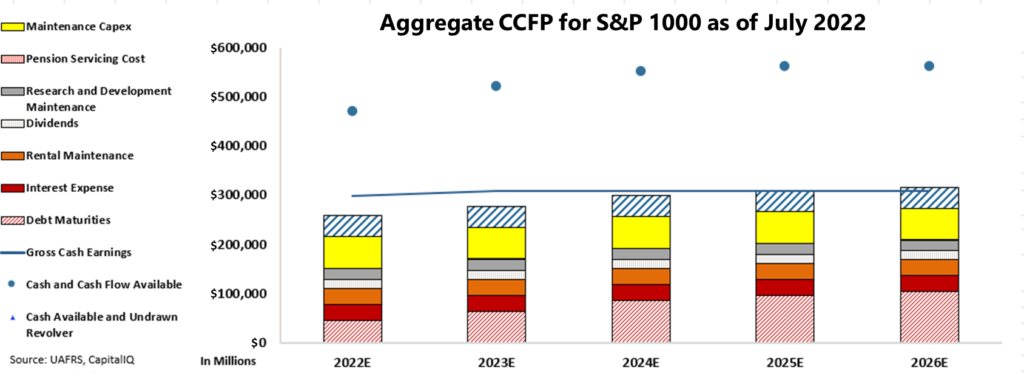

Two years later, our CCFP tells a much better story. Companies today are making enough cash to pay for their expenses in the next few years The chart also shows that corporations have already begun addressing these "headwalls" ahead of their maturities.

This is a great sign that we aren't setting ourselves up for a wave of defaults. In fact, the first year that cash flows alone won't cover obligations is 2025...

Remember, that's with interest rates currently at historically high levels... So it's encouraging to see that companies are making the most out of the situation by addressing their current outstanding obligations.

While this is important for banks and credit investors, it's also a positive signal for equity markets.

Once rates drop and borrowing becomes cheaper, companies will be well-positioned to increase their borrowing again. That, in turn, will boost economic growth.

Regards,

Joel Litman

August 22, 2022

Investors are worried about a horde of 'zombies'...

Investors are worried about a horde of 'zombies'...