We've received a lot of questions from clients about bankruptcy risk in the oil and gas industry...

We've received a lot of questions from clients about bankruptcy risk in the oil and gas industry...

Specifically, they want to know about stock opportunities in the wake of oil contract prices literally reaching negative levels for the first time in history last Monday.

The current slowdown in oil demand is nearly unprecedented, and everybody from oil exploration and production ("E&P") companies to commodity traders felt it.

When we see this kind of major shock to oil prices, a lot of businesses will have to stop their operations or risk running at a loss. They aim to "wait out the storm" and help stabilize prices. When we see this happen, dozens (if not hundreds) of oil stocks begin trading at massive discounts.

Not every company will be able to survive... But historically, those with excellent financial positioning and superior management teams tough it out and recover.

It's possible that'll be the case today... but we're a bit cautious to tell anybody to look at oil and gas stocks in the near-term.

One of investing legend Warren Buffett's many quotes aptly describes our hesitation...

When a manager with a reputation for brilliance tackles a business with a reputation for bad economics, the reputation of the business remains intact.

In other words, it's a bit of a fool's errand to bet on management teams when the key product they're selling is so uncertain.

This won't always be the case – there will be winners in the oil and gas industry... eventually.

So that's why we are looking at oil and gas bonds in earnest for some of our institutional clients. Some value is likely to be found there, with asset backing.

But we've learned lessons from the last two oil shocks in 2008 and 2015. In a fickle industry like oil and gas, it's best to wait for some wind in the sails before getting involved.

We have to wait for two quarters of data to be certain...

We have to wait for two quarters of data to be certain...

But there's almost no doubt that the U.S. is already in its first recession since 2008.

While that may be the case, as we've highlighted in the last few weeks of our Monday macro essays, we generally remain bullish on the market.

For example, last Monday we noted that market valuations are now below average compared to historical levels.

The week before that, we discussed how credit markets as portrayed by credit default swaps ("CDSs") are still flashing "all clear" signals.

This week, we're revisiting the indicator we highlighted in our first Monday macro essay back in September.

We've always stated that it's incredibly important to understand and monitor credit markets to understand the likelihood of a recession.

In most cases, a lack of credit forces big pockets of the economy into default and bankruptcy – which then leads to rising unemployment, a market sell-off, and extended periods of fear. This then amplifies debt issues.

But the economic impact of the coronavirus pandemic may go down as one of the only examples in history of a recession not preceded by a credit crisis...

This time, we're putting the cart before the horse. Unemployment is rising rapidly, many industries are calling for massive bailouts, and yet the credit markets still seem fairly healthy.

As we mentioned two weeks ago, corporate borrowing costs are still near historically low levels, which is a positive sign for the credit markets. However, we're now starting to get our first quarterly results from companies.

It shouldn't be surprising to know that many corporations and Wall Street analysts have started "revising" their estimates for revenues and earnings. For most businesses, these are negative revisions.

That's obviously concerning for companies without cash reserves who need their cash flows to pay for the business. If cash flows dip too far, companies might need short-term financing until their businesses fully recover... and nobody knows for sure when that will happen.

Given the uncertainty, banks may be uncomfortable extending generous loans, which could lead to a tighter credit market.

We can measure how likely this is to happen by revisiting what we call our aggregate Credit Cash Flow Prime ("CCFP") analysis.

Our macro CCFP aggregates the Uniform cash flow and cash reserves for all non-bank businesses in the U.S. and compares them to their yearly obligations.

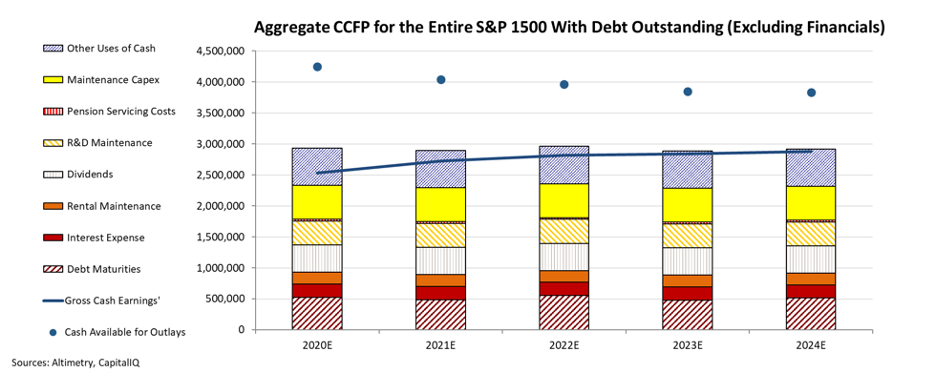

The chart below is the aggregate CCFP for the S&P 1500, which represents 90% of the market cap of U.S. stocks (a good proxy for the U.S. economy).

As you can see, even with cash flow estimates starting to come down, the economy as a whole should generally have enough cash flow – and more important, cash on hand – to handle its near-term obligations.

It's worth noting that the S&P 1500 is somewhat skewed by the most successful companies like Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT), which all have massive cash balances and somewhat resilient business models.

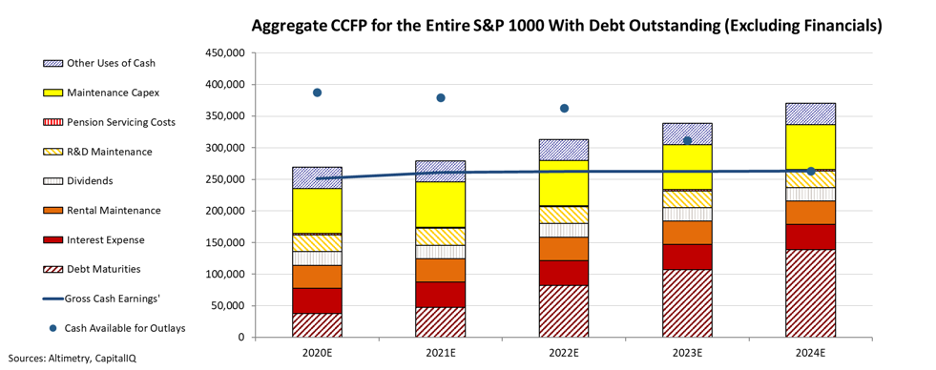

So we can also look at the S&P 1000, which is essentially the S&P 1500 minus the S&P 500 (the largest 500 companies). This is a more accurate way to think about how healthy our economy is once we've removed the impact of major outliers.

As you might expect, it's not as positive... but we're still encouraged by what we see.

Importantly, while cash on hand is lower once we remove the largest companies, it's actually higher than it was just a quarter earlier. This indicates that corporations recognize the importance of saving where possible.

Furthermore, corporate cash flows are still expected to remain above all obligations except for other uses of cash (primarily share buybacks) through 2022 thanks to a recent string of debt refinancing.

And finally, aggregate cash reserves don't fully deplete until 2024. Take a look...

Though we expect companies to have to dig into their reserves in the coming quarters, the economy is generally well-prepared to continue paying its debt even with extended shutdowns.

With that in mind, banks have reasons to remain confident in their ability to continue lending as needed. The current CCFP doesn't indicate any imminent credit freezes, which means we should be able to return to "business as usual" as more people can return to work. And that isn't just important for banks... It's also a positive signal for equity markets.

Regards,

Rob Spivey

April 27, 2020

We've received a lot of questions from clients about bankruptcy risk in the oil and gas industry...

We've received a lot of questions from clients about bankruptcy risk in the oil and gas industry...