We've said it time and time again here in Altimetry Daily Authority...

We've said it time and time again here in Altimetry Daily Authority...

Access to credit (or lack thereof) will be a key driver of whether we recover rapidly from this economic slowdown or not.

Just last week, platform company Airbnb raised $1 billion in debt from investors. This is on top of the other $1 billion the company already raised the week beforehand.

Airbnb is a money-losing, home-sharing app that's likely to be severely impacted by the coronavirus pandemic... and not just in the short term. We can expect to see ongoing subdued demand for travel and accommodations as people hold back on traveling before (and even after) the world gets the "all clear."

And yet, Airbnb faced no issues in accessing the credit markets to give it the liquidity to make it through this trying time.

Ask yourself if, in the middle of October and November of 2008, a similar company would have had any access to the credit markets...

The answer is a resounding "no." Having been on the buy-side during that period, I saw plenty of companies that were far more safe and stable than Airbnb starved of access to credit.

This is yet another sign that credit markets remain open, and it helps to give us confidence that the economy can rebound strongly from this disruption once we're on the other side.

Context is important when looking at market valuations...

Context is important when looking at market valuations...

Regular Daily Authority readers know we often refer to "market average" valuations in our company-specific essays.

For example, in our April 7 discussion of pharmaceutical giant Pfizer (PFE) we talked about how the company's price-to-earnings (P/E) ratio was just 13 times, compared to a market average near 20.

Using market-average valuations is a helpful way to index corporate valuations.

Pfizer, for instance, is cheap relative to the market. This indicates investors have bearish expectations for the company. That said, if we had different expectations for Pfizer – perhaps that it was closer to an average company than a sub-par company – we could say that we think its valuation ought to expand closer to market averages.

Valuation expansion is just another way to say stock appreciation. For Pfizer, we said that we thought investors were understating the company's profitability. As soon as a catalyst occurs – a reason for investors to change their minds – we could expect to see Pfizer's valuations approach market averages.

But there's another part of the equation that we've spent less time on...

Market-average valuations aren't constant.

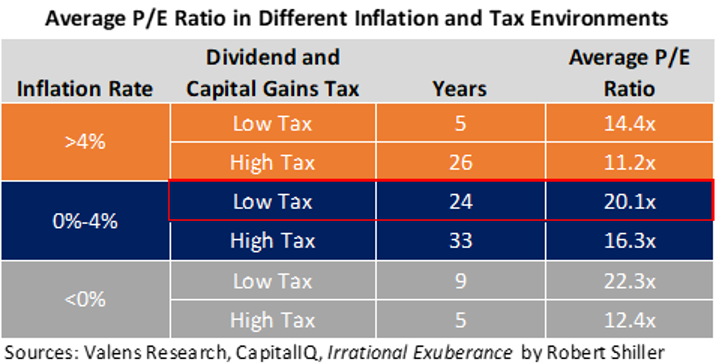

We touched on this topic briefly in the December 16 Daily Authority, but we mostly focused on the impact of inflation on valuations. In the table below from that essay, we showed how the average P/E ratio changes depending on the inflation rate. Take a look...

The truth is, when we talk about "market-average P/E levels," we should really be writing "market-average P/E levels within the current inflation rate and dividend and capital gains tax environment."

That's a bit of a mouthful... but it's important to remember, especially when we see a rapid change in valuations as we have in the last few months.

Despite all that has changed in the markets this year, so far, tax and inflation rates have stayed put. That means, fundamentally, the market valuations we'd expect to see haven't changed either.

On average, we would still expect to see P/E ratios stay around 20.

Over the past few months, market valuations have fallen from nearly 23 times at the end of 2019 to below 20 times. This is a level we haven't seen since 2013...

Back then, U.S. corporates were just starting to kick into high gear, in terms of earnings growth. The subsequent seven years saw massive earnings growth and stock appreciation, with valuations stabilizing near the levels we'd expect at current tax and inflation rates.

As we've written many times about the current coronavirus-dominated market, the overall impact will likely be transitive.

Of course, it's too early to say if we've already experienced the worst of the virus, in terms of health and economic impact...

But even if it takes another few months for things to get worse before they start improving, we expect that coming out of the other side of this disruption – for many of the reasons we've highlighted before – the strong market conditions we saw at the end of 2019 are likely to return. Remember, credit fundamentals were in a healthy position before the current pullback.

Even without significant earnings growth, the current market P/E ratio being below 20 shows that the entire market is slightly below averages we'd expect with current tax and inflation rates.

The market is already pricing in slightly negative earnings growth for the medium term. In late March, the Uniform P/E ratio was around 17, and the market was pricing significant negative earnings growth not just for 2020, but for a longer period of time.

When fear and emotion stop driving the market and logic returns to the driver's seat, we expect to see stock appreciation just based on multiple expansion – even without significant earnings growth.

Then, as companies are able to show earnings growth going forward, we see room for stocks to move even higher.

Regards,

Rob Spivey

April 20, 2020

We've said it time and time again here in Altimetry Daily Authority...

We've said it time and time again here in Altimetry Daily Authority...