Consider what the economic disruption of the coronavirus outbreak potentially means for credit in the coming years...

Consider what the economic disruption of the coronavirus outbreak potentially means for credit in the coming years...

I had an interesting conversation with a colleague last week. He was having a bit of a "sky is falling" moment of panic last Thursday as the market was dropping like a rock.

As often happens in major market corrections, he was questioning all the data we normally look at. As he said...

We talk about how recessions are credit-driven... What if the economy is largely closed down for two months, or more? And if people are fired and run out of money and have to declare personal bankruptcy, and companies also run out of money, then this could cause a credit-driven recession!

These are the type of comments that are blurted out in the middle of someone capitulating to their emotions. They're the exact type of things that you hear before people hit the "sell" button in a panic...

But talking him off the cliff was actually helpful to think out the longer-term potential impact of this current environment.

We're fortunate that corporate and consumer income statements were healthy coming into this short-term disruption. We've talked about this before: Both consumer credit and corporate credit are robust right now.

This means that companies and consumers have the ability to use credit to help weather the short-term storm. In Friday's Altimetry Daily Authority, we mentioned that Boeing (BA), Wynn Resorts (WYNN), and Hilton Worldwide (HLT) have already drawn down their credit revolvers. This timing of this preparation now is part of why we believe this isn't going to be a more serious disruption for the economy.

But if companies and individuals need to draw down access to credit during this disruption, it also means that corporate and consumer balance sheets will be in worse shape when another disruption crops up. So we'll be watching the data in the future to see how this impacts the outlook for the economy in the next few years... even if we're not concerned now.

A close friend of mine is a successful travel agent...

A close friend of mine is a successful travel agent...

Considering how often I travel, I'm fortunate to know him.

Whether it's finding the most cost-effective way for me to travel between the Philippines and the U.S. or coordinating one of my multiweek client sprints up and down the East Coast, he always finds me the best solutions.

This isn't always easy. I recently had to find a new route from the U.S. back to Manila that avoided my usual stopover in Hong Kong, since the Philippines canceled flights in and out of the area due to the coronavirus.

Thankfully, I was able to find alternative routes through Japan and the Middle East.

It's also important that the flight I choose has certain amenities that will allow me to be productive while I'm in the air. This mean some airlines are off limits, and I typically try to avoid the "low cost" airlines when possible.

Not all low-cost airlines are bad, but a certain few get a deserved bad rap...

When you hear "bad budget airline" you might think of Spirit Airlines (SAVE) and its many hidden fees – including a separate charge for choosing your own seat and printing your boarding pass at the airport.

That said, I trust my friend when he says one of his top "laughingstock" airlines is Allegiant Travel (ALGT)...

The company is another low-cost operator that doesn't offer any on-board entertainment, flight connections, or Wi-Fi.

And beyond its lack of amenities, Allegiant has appeared all over the news in recent years regarding a slew of serious safety concerns.

In 2018, 60 Minutes ran a report on the company's safety record – which included more than 100 incidents from January 2016 to October 2017. Some of the stories included smoke filling the cabin, pieces of the plane's body literally falling off, and mid-air engine failures.

Allegiant has thankfully avoided any fatal crashes over the past 20 years, but these stories are concerning enough to make anybody question the value of the company's cheaper tickets.

Many of the problems stemmed from Allegiant's planes. Until 2018, the company's fleet was primarily comprised of MD-80s – despite the fact that production of these was discontinued in 1999. The planes were well beyond their useful life... This wasn't great for safety, but it was for profitability.

Allegiant also offers many flights that its competitors don't – often targeting smaller destinations in warmer climates. The company was able to keep the costs of these flights far lower than a large competitor could, while also having much lower costs due to its fully depreciated fleet.

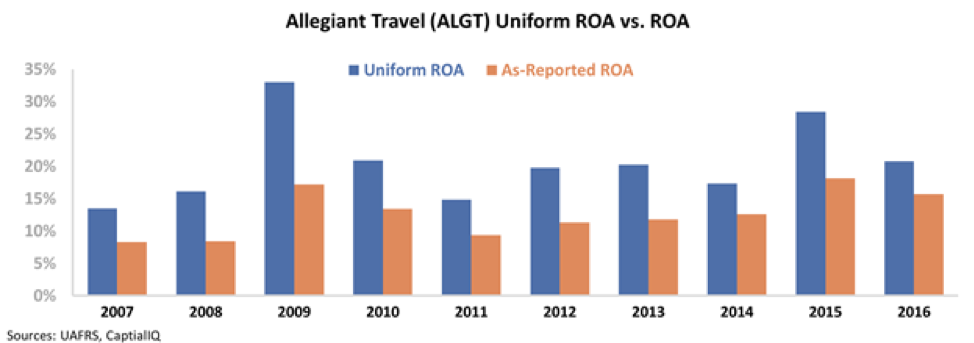

This led to industry-leading returns for the better part of a decade, both on an as-reported and a Uniform Accounting basis.

With its dominance of certain routes and relatively low cost to operate its planes, Allegiant was able to maintain a return on assets ("ROA") well above corporate averages. For nearly a decade following the Great Recession, the company's Uniform ROA never fell below 15% – more than twice the long-term corporate average of 6%.

This was a great success... while it lasted.

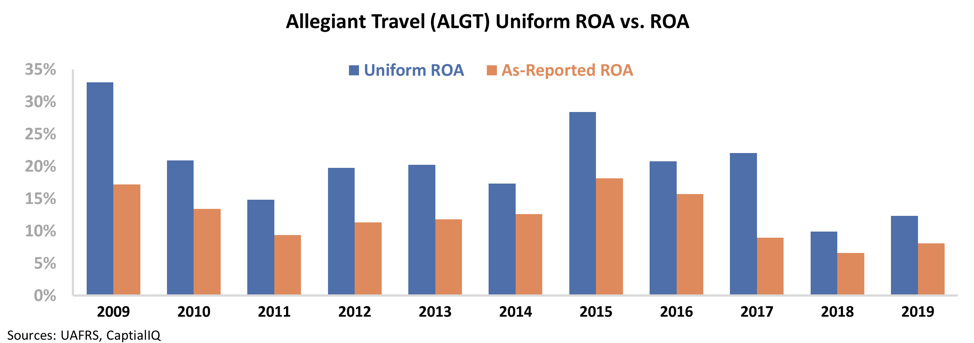

As I mentioned above, Allegiant started seeing significant backlash in 2017 and 2018 for its poor safety record, and the company had no choice but to address these problems.

Over the past few years, the company has invested heavily in transitioning its outdated MD-80 planes in favor of newer (but still used) Airbus models.

But even used aircraft are a huge expense for an airline. The upfront costs are one thing... but the Airbus planes came with a host of new expenses for Allegiant to deal with. Furthermore, since the company is still dealing with the negative press from its safety issues, it's not in a position to raise ticket prices to help pay for higher costs.

As a result, Allegiant's returns have taken a hit in recent years. In 2018, the company's Uniform ROA fell to just 10% – the lowest level in more than a decade. Since then, returns have only improved to 12%.

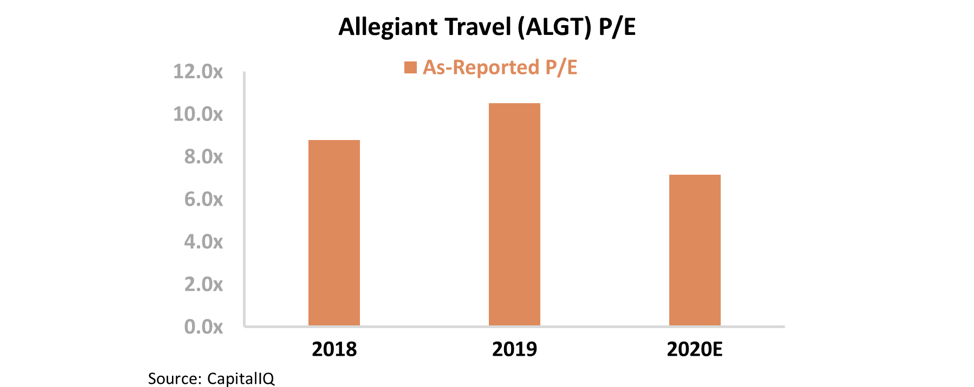

Falling returns have also sent valuations lower. The company's as-reported price-to-earnings (P/E) ratio has fallen to 7, which is well below market averages near 20.

This may indicate that if Allegiant is able to see its ROA move back towards previous highs, valuations could also rise.

But this is unlikely. The company had a competitive advantage with its fleet of cheap-to-operate planes... but considering the cost of new planes and ever-increasing safety standards, it may not be able to get that edge back.

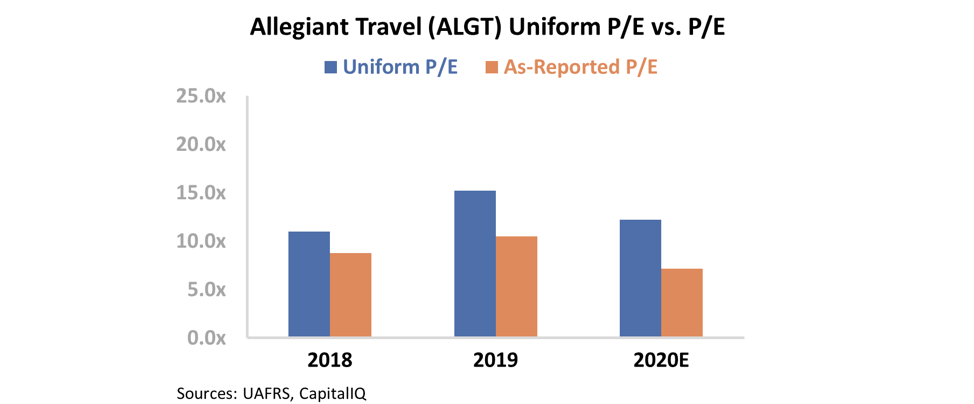

Furthermore, valuations may not be as low as they look...

Once we apply our Uniform Accounting metrics, we can see that Allegiant's P/E ratio is actually 12 – much closer to average airlines valuations.

At these levels, Allegiant's upside is likely limited... even if the company is able to restore its ROA to previous levels.

The airline industry remains a tough and competitive one, but the as-reported metrics don't always reflect that. If the data don't make sense, there's probably a reason for it... In this case, the as-reported numbers are wrong.

Regards,

Joel Litman

March 17, 2020

Consider what the economic disruption of the coronavirus outbreak potentially means for credit in the coming years...

Consider what the economic disruption of the coronavirus outbreak potentially means for credit in the coming years...