Coronavirus concerns hit close to home this week...

Coronavirus concerns hit close to home this week...

I spend a lot of time flying between Asia and North America... I'm often meeting with our clients in the U.S. and making sure our operations in Manila are running smoothly.

The world has been blessed over the past 30 years as it has gotten smaller at a faster rate than ever before – thanks to reduced trade barriers... global telecommunication... the Internet breaking down communication barriers... and, most important, the continued ease of travel.

One of my main transit points for my travels tends to be Hong Kong. Cathay Pacific is a great airline, and Hong Kong is a perfect waypoint for traveling globally. Customs is seamless, it's a big international hub, and you can find a flight to almost anywhere.

With the Hong Kong protests last year, travel there was sometimes challenging and uncertain... as was the political climate. But even with that volatility causing short-term airport shutdowns, Hong Kong never had a concern about being cut off from the world.

Knowing that resilience for the past 15 to 20 years, I was very surprised as I almost boarded a flight on Saturday night heading to Hong Kong, and then on to Manila. I got notice that the Philippines had canceled all flights from not just mainland China, but also Macau and Hong Kong, because of Coronavirus concerns.

I was lucky enough to be able to re-route through Narita, Tokyo's main international airport. But more important, the travel disruption just shows how much of a concern the coronavirus is across the globe.

No matter how the disease continues to evolve, the strength of the global health care response – and in particular, epidemiology efforts – has been impressive. Nevertheless, it's an important reminder that as poet Ralph Waldo Emerson said, "The first wealth is health."

Safe travels to you all, and may everyone continue to have their best health.

We've talked about mergers and acquisitions (M&A) since we began Altimetry Daily Authority...

We've talked about mergers and acquisitions (M&A) since we began Altimetry Daily Authority...

One of our first articles was about the "winner's curse" – the idea that being the highest bidder often means that you have overpaid.

This is why charitable auctions make for such great fundraisers, and why marketplaces like eBay (EBAY) exist.

In that September 13 article, we mentioned the $60 billion merger between pharmaceutical giants AbbVie (ABBV) and Allergan (AGN) and gave our thoughts as to why AbbVie was able to avoid the winner's curse.

Today, we're going to roll back the clock and talk about another spinoff that also involves AbbVie.

But first, it's worth taking some time for quick a lesson on acquisitions and spinoffs. Companies could have many motivations to acquire another business.

One of the most obvious is to grow – following the time-tested economic theory of "economies of scale."

Companies often talk about "synergies" as a reason to acquire another business. This might mean that the combined firm can generate more sales than the individual businesses could because of cross-selling or better penetration into competitive markets.

Lastly, a company could acquire another firm for defensive reasons, for example, if the smaller company may pose a threat in the future.

Conversely, companies will split or "spin off" parts of their businesses for some of the opposite reasons...

As companies become multibillion-dollar corporations, they often get more complex. By spinning off an unrelated business, these giant firms can simplify their structure.

Similarly, these businesses can streamline by growing separately, which is similar to the concept of synergies.

Prior to the AbbVie and Allergan merger, AbbVie was part of a blockbuster spinoff from medical-devices company Abbott Laboratories (ABT) in 2013...

While spinoffs are generally thought to create value, they can often cause growing pains for both the parent company and the new entity.

For the parent, it can take a few years to replace the lost profit centers with new, lucrative investments. Meanwhile, without the support and resources of the larger company, the newly created entity often needs time to get its feet on the ground.

This was certainly the case with Abbott and AbbVie. While Abbott is a medical-devices firm, AbbVie is the former biopharmaceutical arm of Abbott.

The two companies split at the start of 2013... and each experienced some of the typical growing pains you might expect after a spinoff.

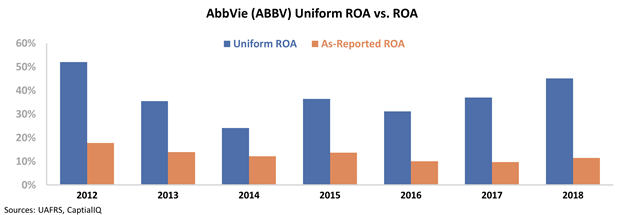

As a reminder from our September 13 essay, the chart below shows AbbVie's return on assets ("ROA") since 2012. After faltering from 2013 until 2016, the company has finally been able to begin expanding profitability thanks to its simplified structure, reaching 45% ROA in 2018...

At the time of the split, many analysts were concerned about Abbott's legacy business – biopharma can be a more profitable business than medical devices... when it's done right. The logic was that Abbott would never be able to return to prior levels of profitability, and thus could hurt the company's stock indefinitely.

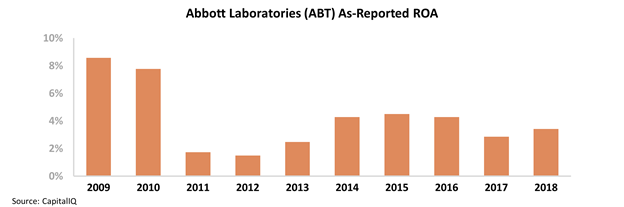

It appears market concerns were right... Following the spinoff, Abbott's returns have consistently remained below long-term corporate averages. With Abbott's current 3% ROA, it looks like there are many better places to invest.

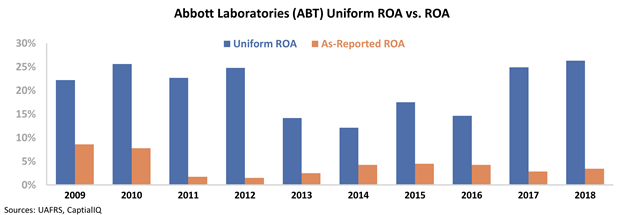

However, once we make the proper adjustments to the as-reported numbers, we see a different picture...

Under Uniform Accounting, we adjust for inconsistencies in financial data – like the treatment of goodwill, research and development (R&D), and non-cash stock option expense. When we apply our Uniform metrics to Abbott, we can see that while the company's ROA fell from 25% in 2012 to just 12% after the spinoff, it has since expanded to a new peak of 26%...

This is in direct contrast to the as-reported data, which show ROA declining over the same time frame.

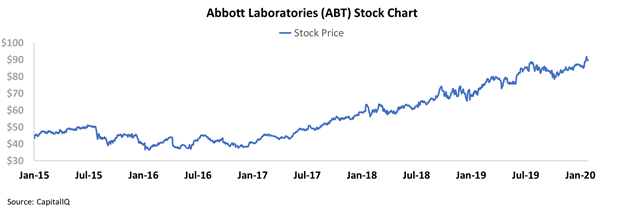

It appears investors have already been pricing in this improvement – Abbott shares have nearly doubled over the past five years. Take a look...

When the as-reported numbers aren't even directionally correct, it's impossible to trust them for any worthwhile financial analysis.

As-reported accounting is bad enough without the added confusion of mergers and spinoffs. These activities only make matters worse... and end up rendering traditional stock analysis completely useless – just look at Abbott.

Regards,

Joel Litman

February 6, 2020

Coronavirus concerns hit close to home this week...

Coronavirus concerns hit close to home this week...