Joel's note: Stocks are now officially in a bear market across U.S. indexes. It's more critical than ever to stay calm when approaching your investments... so we'll take some time today in Altimetry Daily Authority to keep things in perspective.

'The value of my home just fell 20%. I'd better sell it right now!'

'The value of my home just fell 20%. I'd better sell it right now!'

Home prices fluctuate. However, it's hard to imagine a homeowner speaking like this. The long-term focus on the value of the home makes him ignore such temporary changes in valuation.

And yet, this panic selling is exactly the same type of thinking being used by investors today who sell as the market officially enters bear market territory – down more than 20% – simply because stock prices have fallen.

When an investor owns the broad market index through a mutual fund or exchange-traded fund ("ETF"), he is a business owner of the greatest, most profitable, and innovative companies on the planet. That's why these firms were added to the index in the first place.

If you have a long-term view on business ownership, as you do with your home, why would you sell your ownership based on near-term fluctuations?

And over the long haul – studying decades and decades of data – stocks prove to be far more valuable than real estate and all other readily available asset classes. After all, the business not only increases in value... it also provides regular profitability and cash flows. A home doesn't do these things.

Feel good that you are ignoring the temporary fluctuations of the stock market. Don't get caught up in the market having a "down day" – just as you shouldn't get too excited when the market has a big "up day."

Taking it a step further, asset allocation is critical to getting your investments right. The money you have in the market should only be what you can keep there for a long-term period of time.

So, what's the "long term"? The market has consistently outperformed all other asset classes over just about any 10-year period. In the past 130 years, we've seen just one instance where it took 11 years for the market to have the best performance of any asset class.

Investors shouldn't have money in the stock market that they need in the short term. A monthly mortgage payment or food budget shouldn't be dependent on the temporary whims of the market.

Assuming you don't need the money you have in the stock market in the near term, the long-term orientation of the business owner – you, the investor – allows you to focus on your family and your work, and let the market experience its own mad emotionality without you.

Is the credit market under stress?

Is the credit market under stress?

Our institutional clients and regular Altimetry Daily Authority readers know that a big focus of our macro analysis is centered around understanding credit signals.

We have repeatedly highlighted our credit analysis and what it means for the macroeconomic picture over the past few months. We summarized all our thinking on February 26, when the current turbulence was just starting to escalate... and again earlier this week.

And over the past two weeks, we've received many questions about credit signals. U.S. Treasury yields have collapsed, and because of this, bond spreads have widened. Also, the rout in oil has led to significant concerns about credit issues for exploration and production (E&P) companies and other energy firms.

We had a surge in people checking in with us after Wednesday, when reports came out about Boeing (BA), Wynn Resorts (WYNN), and Hilton Worldwide (HLT) drawing down their revolving credit lines and about private-equity firms directing their portfolio companies to do the same.

To many investors, that sounds an awful lot like 2008 – when people were concerned about liquidity drying up because the banks didn't have that liquidity.

But the data say something different...

Boeing has been a mess for a year, with its recurring problems over the 737 MAX, among other issues. The company's drawdown isn't a sign of credit markets seizing – it's a sign that the company has made some bad decisions.

Similarly, the reason why Wynn, Hilton, and private-equity firms are drawing down isn't because of seizures in the credit market...

It's a demand-side issue, not a supply-of-credit issue. These companies are thoughtfully preparing for the potential that with reduced travel for a short period of time (due to global quarantine barriers rising), they may need liquidity.

This is actually a good thing for the economy and market. These companies drawing down this cash before they need it means they're less likely to run out of it, if and when there's any disruption.

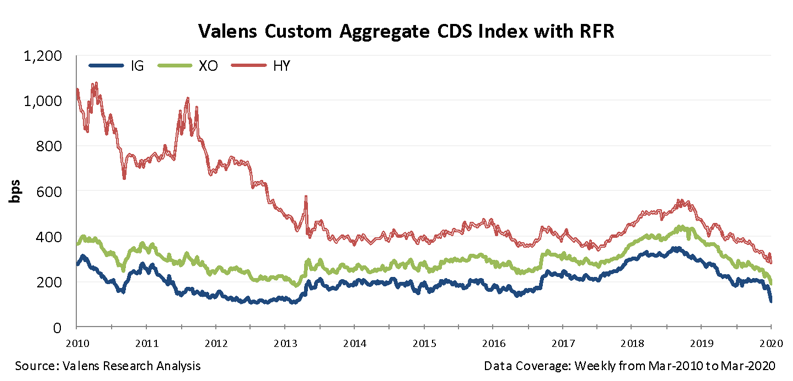

None of our other credit signals have massively changed. The entire conversation about credit spreads rising? Take a look at the chart below in that context – it shows the total cost to borrow for corporate high-yield and investment-grade credits.

As you can see, even if credit spreads widen, the actual cost to borrow for high-yield bonds would be right in line with where it was for most of 2015 through 2017. And the cost to borrow for investment-grade bonds would still be below 2017 levels. Take a look...

It's easy to panic about the headlines. But we're not actually seeing credit collapse – the type of signal that would tell us "we're on our way to this getting much worse." It isn't fun to live through... but this will pass.

It's always important to keep things in context...

It's always important to keep things in context...

A well-known parable is relevant at a time like this. It starts along these lines... You may have heard it before:

A philosophy professor once stood up before his class with a large empty jar. He filled the jar to the top with large rocks and asked his students if the jar was full.

The students said that yes, the jar was indeed full.

He then added small pebbles to the jar, and gave the jar a bit of a shake so the pebbles could disperse themselves among the larger rocks. Then he asked again, "Is the jar full now?"

The students agreed that the jar was still full.

The professor then poured sand into the jar to fill up any remaining empty space. The students again agreed that the jar was completely full.

The professor went on to explain that the jar represents everything that is in one's life...

The big rocks are the things that are important to you: your family, your health, and yourself. The smaller pebbles are the less important things: work, travel, etc. The sand is everything else.

The point of the parable is that if you first fill up the jar with sand (the things that don't matter), then there's no room for the things that do matter. Focus on spending less time on those less important things.

However, that's not the message we're pointing to with the parable today... It's a bit more specific to the current environment.

It's hard to not react to everything on the news with panic, uncertainty, and real concern. It causes a lot of stress, will lead to you become less productive... and can literally cause you to get sick.

There's nothing that you can do about what's on the news... what's happening in Italy... or what our government is deciding to do. There's also nothing you can do about the market being up or down for a given day or given week.

Those things you can't control? That's the sand. Right now, for many people, the sand is all that's in the jar – you can't think of anything else.

A way to stay sane in times like this is to step back and focus on what you can control... and what matters.

Are you worried about the coronavirus news coming out of Italy, Boston, or other areas that aren't places you visit every day?

Instead of worrying, be smart. Wash your hands, use social distancing, and make smart choices about your health. Focus on the things you can actually impact.

Are you worried about the market?

Instead of worrying if the market is going up or down in the next week or month, focus on your financial plan. Make sure you look at what money you need in the next one year, five years, or 10 years... and that you have the right liquidity in the right places.

Money you need now – or even in the next year – probably shouldn't be in the stock market in the first place. It should be in cash, where you can always access it.

Money you need in five years or so should likely be in some mix of bonds and stocks. And money you don't need for the next 10 years should likely all be in stocks – it's where you get the best returns. That's always the case, not just when there's a market panic.

These are things you can control (the "big rocks"). If you focus on the things you can control first, it puts all that other stuff – the noise on the news (the "sand") – in context.

As always, your health is your first wealth. And as always, listen to the data and not the noise when making any of your investment decisions.

We'll keep you informed about the real data we see here at Altimetry.

Regards,

Joel Litman

with Rob Spivey

March 13, 2020

'The value of my home just fell 20%. I'd better sell it right now!'

'The value of my home just fell 20%. I'd better sell it right now!'