Several household names all have something in common with some of the highest-upside stock ideas in the market right now...

Several household names all have something in common with some of the highest-upside stock ideas in the market right now...

Even the largest companies have small beginnings.

Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Disney (DIS), Mattel (MAT), and Hewlett-Packard – now known as HP (HPQ) – all started in a garage. Facebook (FB) started in a campus dorm room, as anyone who's watched The Social Network knows. Even the retail monolith Walmart (WMT) started with a Walton's 5 & 10 store in Bentonville, Arkansas.

Many investors assume you can't get in at the ground floor of massive mega-cap companies. They believe that these businesses will be controlled by venture capitalists early on... and are only available in the closed-off, exclusive private markets. Then they assume those companies will go public after already reaching a massive size... like Facebook did when it was worth more than $40 billion.

But there's a secret that no one talks about...

If you know where to look, you can get access to the mega-cap names on the ground floor. You don't have to battle institutional investors, or try to sweet talk yourself into a "Series B" funding round to get access.

The off-the-radar area where you can find those future "home run" investing opportunities – and mega caps in the making – is in the microcap world.

Institutional investors can't operate in the space, since these tiny stocks don't trade enough volume for the big firms to build sizable positions. And the U.S. Securities and Exchange Commission ("SEC") doesn't police the "Wild West" of microcaps – there's just too many companies for the agency to supervise.

But when those microcap names eventually become mega caps, the returns are massive. Medical-devices firm Intuitive Surgical (ISRG) saw a 23,077% return over the past 17 years, as its market cap rose from $120 million to more than $50 billion today. For context, that would turn every $10,000 invested in ISRG shares into $2.3 million.

Or look at streaming giant Netflix (NFLX)... Over the past 18 years, as the company's market cap rose from $115 million to more than $200 billion, a $10,000 investment in Netflix would have turned into $7.8 million.

Of course, not every microcap name will become a mega cap. But if you can find the ones that will, you can get in before Wall Street does... and that can mean huge rewards.

You just need to have the right system that can avoid the "hype" companies that are playing games with investors... and that can identify the firms with real business models and massive growth opportunities.

That's what we've done here at Altimetry. We've built a system that uses:

- The Uniform Accounting data we highlight each day in Altimetry Daily Authority...

- Forensic accounting...

- Analysis of management alignment...

- And getting a window into management's real thinking using "Earnings Call Forensics."

This means that for the first time, we can help individual investors like you identify which microcaps to avoid, and which ones could be the next home run opportunity.

It's all in our brand-new Microcap Confidential monthly newsletter. We've put together a video explaining it all... Learn more about Microcap Confidential – and how to gain immediate access to seven high-upside microcap recommendations – right here.

We often talk about 'the market' as a single number to follow...

We often talk about 'the market' as a single number to follow...

When you turn on CNBC or read investment research, you often hear phrases such as, "the market rallied today" or, "the market was spooked." Even here at Altimetry, when you read one of our macro articles, we often refer to market as a whole.

This shorthand is useful to talk about large trends, especially in a bull market. When times are good, stocks tend to rise in unison as the money flows. And yet, all companies never move entirely the same.

Over the past six months, this relationship has broken down as different industries are transforming due to the coronavirus pandemic.

For example, travel companies such as Expedia (EXPE) and TripAdvisor (TRIP) have been hammered by travel restrictions. Meanwhile, firms such as Netflix (NFLX) and Zoom Video Communications (ZM) have seen demand for their online services explode.

When only talking about the market, it's easy to miss these large stock swings in individual companies. For the financial media, it's simpler to look at the movement of the S&P 500 Index or Dow Jones Industrial Average – there's only one number to talk about.

Last month, we used our Earnings Call Forensics framework to analyze the entire market. This allows us to detect emotional signals in company management teams' statements during their earnings calls.

Considering the winners and losers in the current market environment, it can be valuable to understand management's confidence across different sectors. This way, we can get a better understanding of each facet of the broad market.

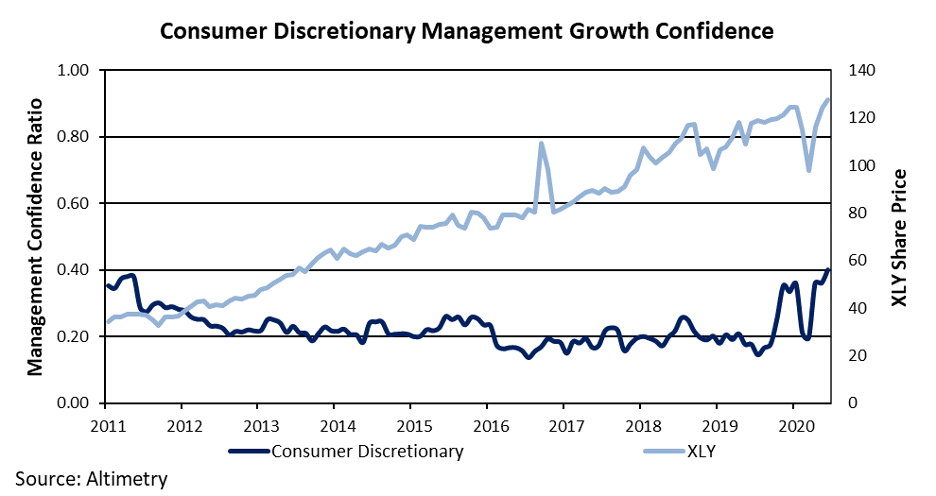

Surprisingly, the Consumer Discretionary sector saw the largest rebound in management confidence over the past few months. This sector includes autos, homebuilding, consumer electronics, apparel retail, travel, and restaurants, among other industries.

As you can see in the chart below, management confidence (the dark blue line – higher is "more positive") reached decade-high levels in the second quarter of 2020. You can see this compared to the Consumer Discretionary Select Sector SPDR Fund (XLY), which tracks a basket of companies across the sector...

Considering how the retail, restaurant, and travel industries in particular have been disrupted since March, this sharp rebound initially seems like a surprise.

It appears that something else is happening instead. For those industries not exposed – or the ones benefiting from the "At-Home Revolution," such as homebuilders, Internet retailers, online education, and consumer electronics – the recent period has been bullish.

Just as important, the signs of a successful acceleration in re-opening in May and early June appeared to have led management teams to feel more bullish in their outlooks.

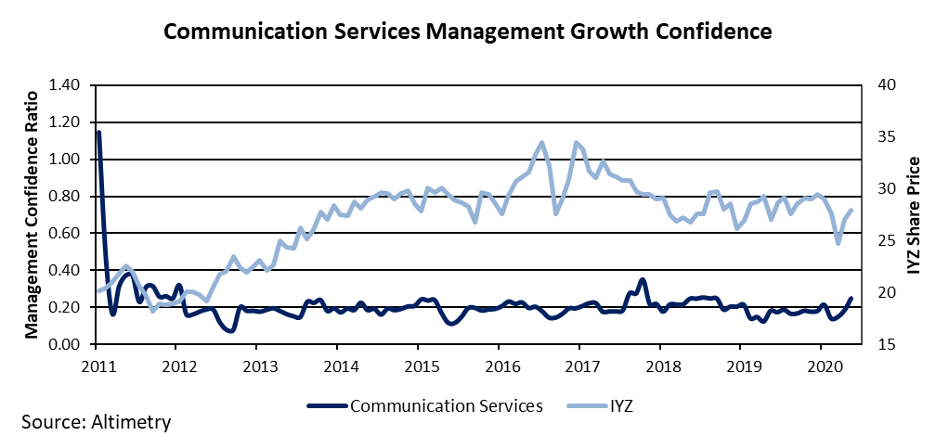

Meanwhile, management confidence in the Communication Services sector has also recovered to 2018 highs.

This corner of the market includes cable and telecom companies, as well as the online and regular media companies that have benefited significantly from more people spending time at home, using more Internet, and needing to get wired at home to work remotely. Take a look at sentiment compared to the iShares U.S. Telecommunications Fund (IYZ), which tracks the sector...

Management within the Communication Services sector appears to be seeing that demand in their companies' products has remained steady – and for some, demand has surged – in the At-Home revolution.

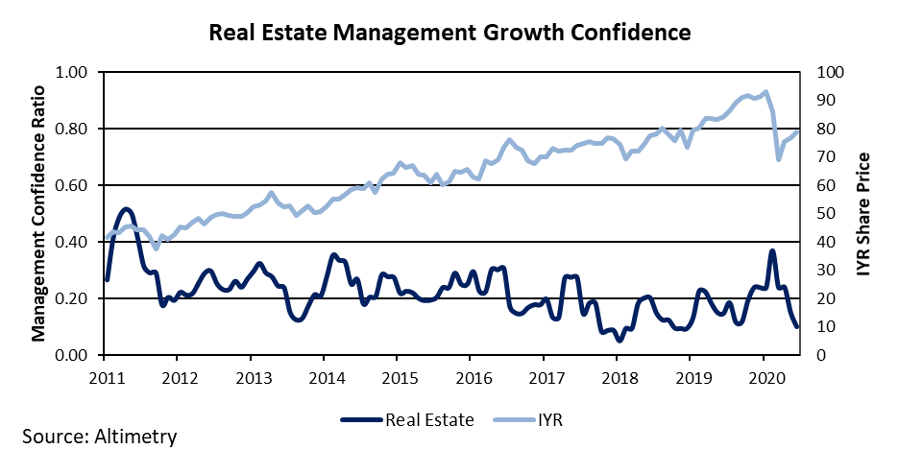

On the other hand, unsurprisingly, one of the areas that has seen the biggest dip in management confidence has been the Real Estate sector.

Since the pandemic started, management confidence in the sector has fallen from nine-year highs to historical low levels. In the chart below, you can see the drop in sentiment compared to the iShares U.S. Real Estate Fund (IYR)...

As we mentioned, this isn't surprising. The Real Estate sector is currently under massive pressure...

The commercial real estate universe is being thrown into upheaval. Real questions have entered the discussion about ongoing demand for office space after the pandemic recedes, as more people continue to work from home.

For retail, restaurant, and hotel real estate investment trusts ("REITs"), similarly, investors are concerned about the viability of their tenants. Many restaurants and brick-and-mortar retailers have closed, and hotels might see a slower recovery than many people initially hoped for.

And residential REITs are suffering from two different pressures... First, in the near term, rents are being disrupted as many people are still unemployed. And second, over the longer term, the same surge in demand for homebuilders is a negative for residential REITs.

The pandemic has shown how challenging it is to live in shutdown cities. Additionally, with more employees working from home, many people are more interested in moving out of the city and out of apartment complexes if they don't have to worry about a commute. This could be a secular headwind for the residential REITs.

Looking at the recent rallies in the major indexes, many investors are scratching their heads on how to allocate their funds. Less important than the moves in the overall market is to understand the moves in the smaller parts of the market where money can be made or lost.

To understand how the broad market is moving, it's crucial to also determine management's feelings about their industries. While many management teams are confident about the future, just as many see the At-Home Revolution as a curse rather than a blessing.

When CNBC talks about how much the market moved, you should also be thinking about the effect of how individual sectors have shaped the changing overall trend... and then re-think how to allocate your money accordingly.

Regards,

Rob Spivey

July 13, 2020

Several household names all have something in common with some of the highest-upside stock ideas in the market right now...

Several household names all have something in common with some of the highest-upside stock ideas in the market right now...