Last week saw the first significant sell-off since March... so now what should you do?

Last week saw the first significant sell-off since March... so now what should you do?

On Thursday, the markets pulled back sharply. The Dow fell 7%, the S&P 500 was down 6%, and the Nasdaq was down 5% because of a few different factors...

- We're seeing signs that coronavirus cases are starting to spike again in the U.S., and the pandemic continues to be a serious issue in the southern hemisphere.

- The Senate has not indicated it's open to another stimulus bill.

- Many institutional investors expected the Fed to pull more tricks out of its bag of monetary tools, and it didn't.

Though stocks rallied on Friday, a continued pullback is possible... And in that event, we want to remind you about the playbook we laid out a few weeks ago. This is a natural part of any market cycle, as a harsh sell-off leads to short-term exuberance before an eventual retest.

In fact, we specifically highlighted four potential catalysts in that piece...

The first – a slower economic reopening than everyone was hoping for – hasn't been the case. In fact, the economy has reopened faster than many expected. This has actually helped contribute to the second issue appearing recently (a second wave of coronavirus infections).

Also, as we highlighted in Forbes late last month, we're about to come to terms with that third issue (realizing how bad March, April, and May were for the global economy and for corporate earnings).

Lastly, the fourth issue – weaker companies in pressured sectors starting to go bankrupt – is starting to occur. Already, we've seen car-rental firm Hertz (HTZ), struggling retailer JC Penney (JCP), and several oil companies declare bankruptcy.

That being said, the S&P 500 is unlikely to retest its March levels around 2,200 again.

As we noted a few weeks ago, the credit situation just isn't likely to deteriorate that much based on everything the Fed has done, and because of the amount of long-dated debt companies have been able to issue the past two months while markets have been open for business.

We could continue to see a near-term market pullback. If so, we recommend using that as an opportunity to continue to buy the dip. Because unless we see credit signals change, that's acting as a floor for the market.

That doesn't mean go all-in the next day the market's down. But if the market drifts lower, it makes sense to add to your positions.

As our macro analysis tells us, this is a healthy, natural cycle for the markets, thanks to human behavior. It may be hard not to panic while it's happening, but our friend Enrique Abeyta at Empire Financial Research has reminded his readers of a common market saying: "Plan the trade, trade the plan."

Speaking of Enrique and buying a market dip... until midnight, you can still sign up for a charter offer for his Empire Elite Growth newsletter, his service focused on finding high-growth, multi-bagger stock ideas. After tonight, the price will more than double. Get the details here.

Management teams show a lot of restraint during their earnings calls...

Management teams show a lot of restraint during their earnings calls...

As CEO or CFO of a publicly listed, billion-dollar corporation, you need to maintain your composure when communicating with stakeholders.

With the exception of a few "personality" executives – like Elon Musk at Tesla (TSLA) or Marc Benioff at Salesforce (CRM) – most are reserved and answer in specific ways when presenting at conferences and answering questions during quarterly earnings calls.

It doesn't reflect well on the company if management appears flustered, emotional, unprepared, or overly robotic. These can come across to shareholders as reasons for concern, which can hurt the share price in the short term.

Management teams like to keep things close to the vest so that investors don't overreact to things, and so competitors can't get too good a window into their strategy.

Thus, most executive teams receive extensive training on what to say, what not to say, and even how to say their words. On occasion, a CEO will fly off the handle and say something regrettable. The Cleveland-Cliffs earnings call from the third quarter of 2008 we discussed in the October 2 essay is more the exception than the rule.

Gaffes like this are largely avoidable, which often forces managers to stick to limited scripts and canned answers during their earnings calls.

Lucky for investors, not everything can be trained away.

Back on February 24, we explained how at Altimetry, we have a type of "forensic fact-checking" analysis we call Earnings Call Forensics.

Rather than relying on the words management says during an earnings call, we look between the lines to detect untrainable elements in the way management delivers their words. These can give us powerful signals to confirm or question management's confidence in what they're saying.

While Earnings Call Forensics analysis can be valuable for a specific company, it's just as powerful in the aggregate.

We analyze more than 500 earnings calls per quarter, including the majority of the S&P 500. With that amount of data, we can draw powerful conclusions about corporate sentiment in the U.S.

In February, we noted that management teams were growing more confident through the end of 2019. To us, this was a signal that management teams were optimistic about 2020.

Even through the first two months, U.S. management sentiment remained strong...

Then, the coronavirus hit.

Obviously, nobody could have predicted the current pandemic. It caught the public off-guard and has forced management teams to scramble, cut costs, and innovate.

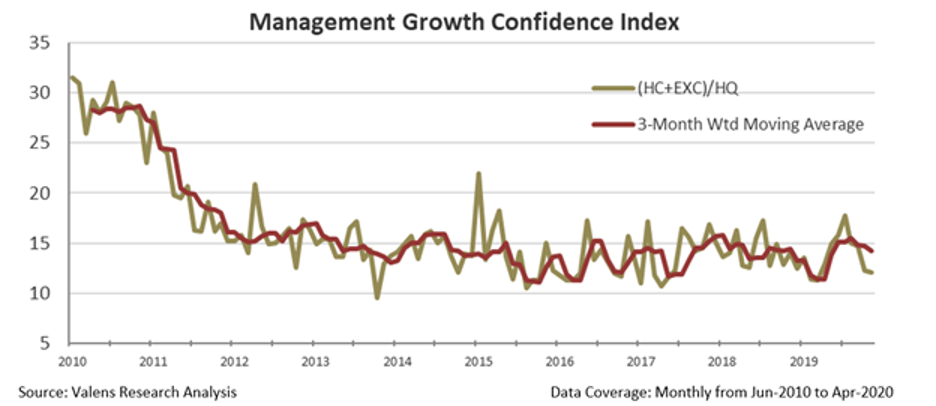

A few months in, it's clear managements' tone shifted in March. The chart below highlights the monthly ratio of confidence markers relative to questionable markers since 2010.

As you can see, over the last few months, management teams have (unsurprisingly) lost confidence...

On the surface, it appears we have good reason to be worried about our economic outlook. Management is losing confidence, which likely spells trouble for the future. But in reality, it's less of a concern than you might think.

March and April were the most uncertain times we've seen in years. Unemployment was skyrocketing, just about everything was shut down, and more coronavirus cases were popping up every day.

Management teams reacted by mostly shutting down corporate investment toward the end of the first quarter, and as we covered in the Forbes article, earnings are going to be much worse in the second quarter.

Although management may not be talking about stopping their investments in the second quarter, sentiment suggests they're significantly curtailing it.

It sounds like management expects the second quarter to have limited growth and investment, yet we still have plenty of reasons to believe this is temporary. While the markets will likely continue to be volatile over the next several months, we'll monitor sentiment for positive inflections in confidence as a signal for when the worst is behind us.

Regards,

Joel Litman

June 15, 2020

Last week saw the first significant sell-off since March... so now what should you do?

Last week saw the first significant sell-off since March... so now what should you do?