What's next for Dean Foods?

What's next for Dean Foods?

In the February 20 Altimetry Daily Authority, we used the dairy producer as an example of how volatile commodity prices and changing consumer preferences can drive a company to bankruptcy.

The next day, we explained how Dean Foods was still able to produce dairy products despite entering into Chapter 11 bankruptcy. This form of bankruptcy protection is used to restructure businesses... compared to Chapter 7, which is reserved for liquidation scenarios.

After Dean Foods filed for Chapter 11 in November, the company's management announced that it was looking to reorganize the business and find a buyer for assets. And as we mentioned on Friday, that finally happened... Agricultural cooperative Dairy Farmers of America ("DFA") announced it was planning on buying the majority of Dean Foods' assets in a $425 million deal.

This is where things get interesting...

Even though Dean Foods has lost most of its negotiating leverage by filing for bankruptcy, DFA's bid opens the company up for a potential bidding war.

In bankruptcy court, DFA is known as the "stalking-horse bidder." In other words, the cooperative's bid now acts as a "floor" for all other bids – undercutting bidders looking to acquire assets for very cheap prices.

Additionally, DFA has only signed on to acquire 44 of Dean Foods' 57 facilities, leaving the remaining assets up for sale or to be restructured. Other potential buyers have until March 31 to come forward and begin the bidding process.

This is good news for the stability of the dairy industry, as well as for those of you out there who still enjoy milk in your coffee.

Understanding how management communicates is critical for evaluating a business...

Understanding how management communicates is critical for evaluating a business...

A key part of the job for an executive management team is to communicate with shareholders.

The team does this constantly throughout the year. First and foremost, management hosts four quarterly earnings calls to share the company's financial results and forward-looking guidance.

These are some of the biggest days of the year for management – these executives have the chance to share their goals, exert their confidence, and leave shareholders feeling good about the company.

However, if management doesn't do a good job conveying its message, it can have the opposite effect...

If a CEO stumbles in his delivery or gets combative with analysts, this can send bad signals to investors... and could lead to a drop in the company's stock.

And this is only the tip of the iceberg. CEOs, CFOs, and other executives publicly represent their companies at conferences, on the news, and on social media. All of the signals they give can be used for and against their company's mission.

Here at Altimetry, along with our focus on Uniform Accounting, we pay a healthy amount of attention to assessing management's communication to shareholders. While we occasionally look at conferences and news interviews, we mostly focus on those crucial earnings calls.

We call the analysis "Earnings Call Forensics."

The framework combines systems that our team have worked on for over a decade to analyze the audio from earnings calls. It's a form of "forensic fact checking."

We're able to point out specific instances where management appears confident and excited, or if they jump out as questionable when speaking on the calls. While these don't translate directly to truths or lies, these markers help us qualify other signals we see in our analysis.

In any given quarter, we analyze upwards of 500 earnings calls for various companies. In addition to using these to help us with stock analysis, it also helps us build our macroeconomic analysis.

You see, when we aggregate management sentiment across various industries and the economy as a whole, we can have a bird's-eye view of corporate sentiment.

These signals can be great indicators. For instance, if several management teams generate questionable signals around their margins and about those margins shrinking, it could be a sign that the economy is at risk of widespread expense pressures.

Conversely, we may see large pockets of the economy that generate confident signals about growth – which may indicate that management teams are committed to investing in their companies.

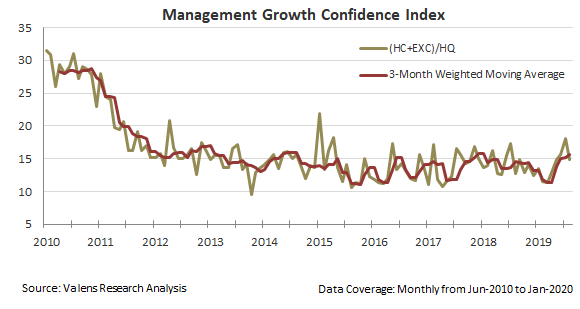

By looking at the ratio of confident markers to questionable markers, we can see how much confidence management teams across the country have in the current economy. This is yet another signal we can use to get a sense for the potential of a recession – executive management teams tend to be aware of oncoming risks.

Over the past few years, the ratio of management's confident-to-questionable signals has ranged between 1.2 confident markers for every 10 questionable markers, to 1.7 confident markers for every 10 questionable markers. Right now, we're at the higher end of that range. Take a look...

After several quarters of rising questionable markers – as management teams expressed concern for global trade, the political climate, and general economic stress – we've started to see the trend reverse.

This past quarter, the number of confidence markers has increased – and the number of questionable markers has dropped. This is a great sign of reduced concerns about visibility for businesses going forward... and it's a positive signal for the overall economy.

As we mentioned, we can also break confidence ratios out by sector to see which sectors seem the most confident or concerned. In addition to getting a gauge for the overall economy, this can also indicate which pockets may have the most favorable environments going forward.

Specifically, we've recently seen the largest positive inflections from the Consumer Discretionary, Technology, and Materials sectors.

These industries tend to be hit particularly hard during recessions, as they're heavily exposed to economic cycles. The confidence from these sectors means we're seeing positive signals for the whole economy.

This is yet another sign that the economy may not be in as much danger as the financial "scare media" would have you believe. Take it from us, management teams will reveal when they're nervous about the economy.

Regards,

Joel Litman

February 24, 2020

P.S. Our Earnings Call Forensics system is a critical tool in understanding how a company's management team can lead the business forward and deliver results to shareholders. Along with our Uniform Accounting framework, we use this analysis to help identify large-cap, safe stocks that still have the opportunity for big gains. You can get access to these recommendations with a subscription to Altimetry's Hidden Alpha... click here to learn more.

What's next for Dean Foods?

What's next for Dean Foods?