To the absolute shock of no sports fans... referees aren't unbiased!

To the absolute shock of no sports fans... referees aren't unbiased!

But they aren't in the way you'd assume, where they always seem to be against your team and instead support the opponents...

Now that soccer, baseball, hockey, and basketball games have been held without fans over the past few months, data scientists have been able to measure new trends. Late last month, The Economist compared data from the 2020 season against previous years to see what has changed.

For example, statisticians can determine if the presence of a cheering crowd affects the ruling of the referees. In European soccer leagues, studies have shown that refs are consistently less likely to give penalty cards to away teams with the absence of crowds. Some experts speculate this trend is because officials fear a riot during a game.

Next time you're at a home game, know your cheering counts for something!

However, even as refs are less susceptible to bias without crowds, home teams will still win more often without a crowd to cheer them on. As referee bias isn't to blame, it must be that teams simply play better at home... Possibly through a better night's sleep in their bed, familiar warm-up facilities, and other unmeasurable factors.

Through removing one data point, sports fans have been able to answer a question that has left them scratching their heads for years. While a ref is biased by the cheering of the crowd, he's only one small part of the home field advantage.

While this lack of an officiation bias will hold for now, it will be worth watching how quickly this trend reverses once fans are allowed back in the stands.

We've all significantly changed our lives over the past months... We've been forced to forgo attending sporting events, concerts, and other large gatherings. And yet, we can learn more about the world through seeing it in such a different light.

The coronavirus pandemic has enabled us to answer many questions that were difficult to answer before due to the lack of a "counterfactual" – meaning it was impossible for us to recreate the situation with only one different variable, with everything else remaining the same.

Are there any other burning questions you've seen answered thanks to the pandemic? Let us know at [email protected].

In today's Altimetry Daily Authority, we'll look at another reader request from Nancy...

In today's Altimetry Daily Authority, we'll look at another reader request from Nancy...

In order to sustain outperformance versus a peer group, a company usually needs a competitive advantage. This can come from many different places: highly skilled labor, access to proprietary technology, a unique geographic location, or even business processes that are hard to replicate. Without some type of sustained edge, a reversion to the mean is nearly inevitable.

That competitive advantage can sometimes even mean a company doesn't just outperform peers... It can survive downturns that have crushed the industry as a whole. For example, Walmart (WMT) has sustained high earnings thanks to its competitive advantages... even while its peers have struggled.

The discount retailer has invested heavily in its supply chain, which has allowed it to increase efficiency and keep costs low. Thanks to this, Walmart has maintained superior returns despite the disruption in the broader retail space.

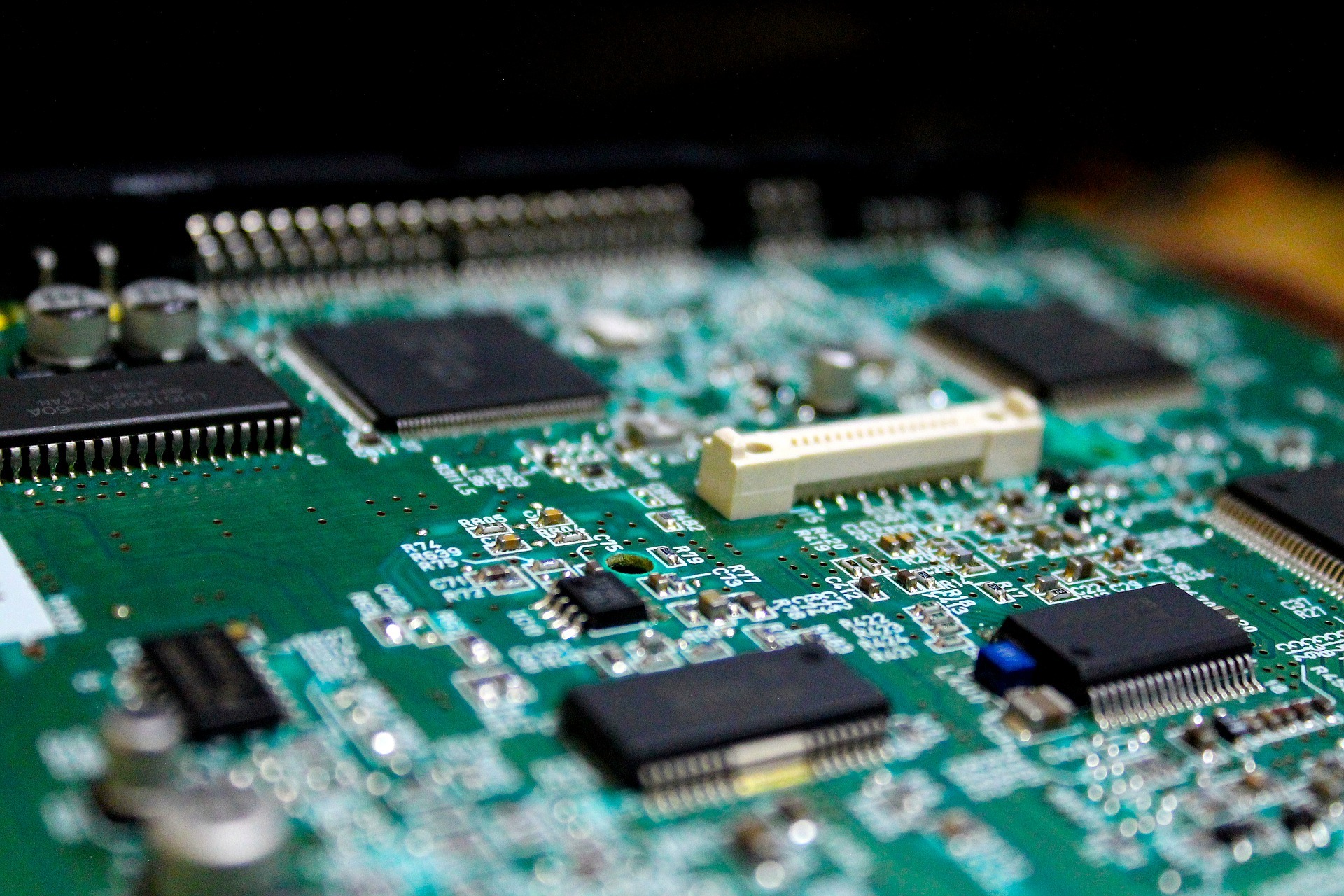

Another company that has historically been able to buck its industry's trends is tech giant Intel (INTC). For decades, it has maintained consistent profitability levels even as the semiconductor space has gone through numerous cycles.

But today, investors are spooked. Intel is one of the only chipmakers to be involved in almost all facets of semiconductor production. And not only in every single step of the production process... Intel is also involved in almost every major kind of semiconductor end market.

That diversity lets Intel spread out costs better than peers, keep costs low, and also lets the company benefit from trends in different end markets to keep returns more stable than more monoline competitors.

However, many investors think Intel's ability to innovate and leverage scale is finally running out. They think the company is losing to competitors like Taiwan Semiconductor Manufacturing (TSM). As such, Intel's stock has been under pressure this year.

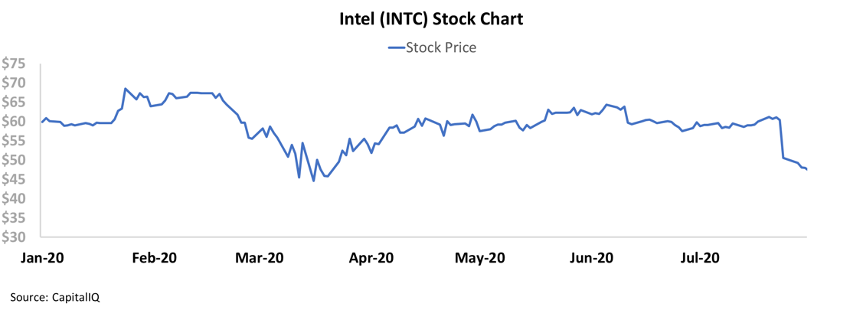

INTC shares traded for as high as $68 as recently as late January, but now have fallen below $50.

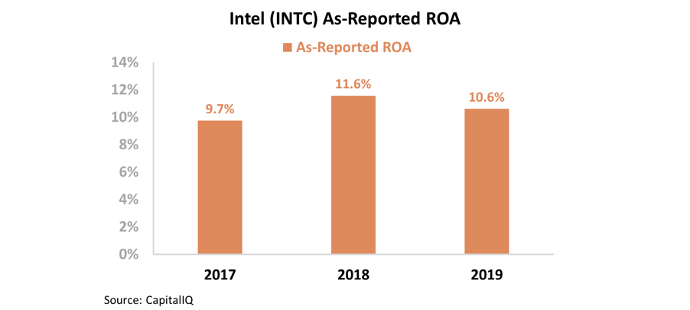

Yet even as the stock price has fallen, Intel's return on assets ("ROA") has stayed well above cost-of-capital levels. The company's as-reported ROA has ranged between 10% and 12% over the past three years – slightly below the company's ROA from a decade ago, but well in line with the recent profitability levels.

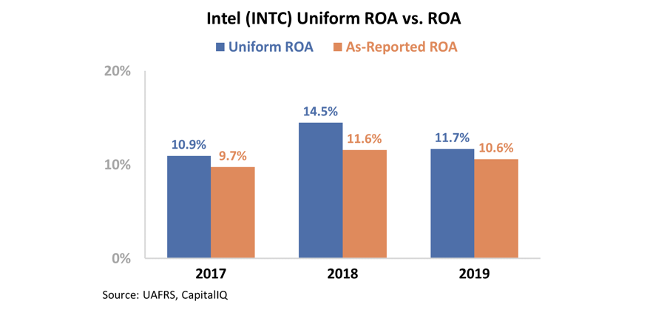

However, as-reported metrics haven't been able to tell the entire story. Misrepresentations of goodwill, research and development (R&D) expenses, and other distortions have understated Intel's profitability.

The company's Uniform ROA has actually shifted from 11% to 15% and then back to 12% over the past three years, rather than remain mostly stable at around 11%. Take a look...

This is a business that has seen a recovery... and a subsequent decline potentially due to competitive pressures that as-reported metrics aren't picking up.

We just need one more aspect to value Intel: future expectations.

For this, we can turn to our Embedded Expectations framework. It allows us to see exactly how the market expects a company to perform.

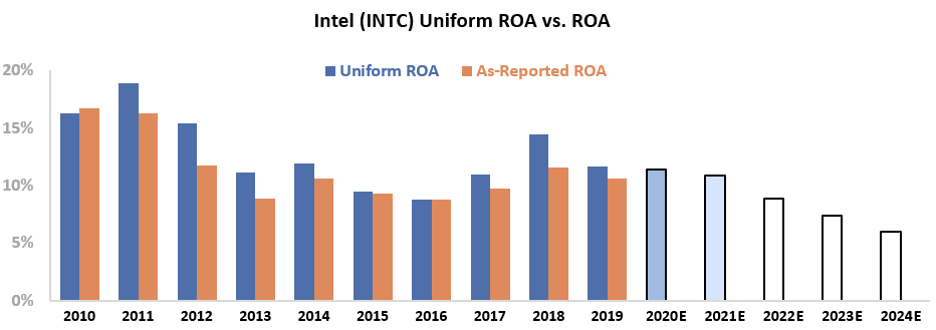

The next chart highlights Intel's historic corporate performance in terms of Uniform ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars). Finally, the white bars show what the market is pricing in at current valuations.

By expanding the time frame, we can see that Intel has seen an overall decline in profitability over the past 10 years.

That said, given the stock's current share price, the market is expecting Intel to see its ROA fall to 6% by 2024. Intel hasn't seen returns at this level for more than a decade.

Analysts have far less bearish expectations. They only believe ROA will fall to 11% in 2021.

This all implies that the market may be overly pessimistic about Intel... and it's also something we've seen before.

Prior to the 2008 financial crisis, investors began to lose faith in the company. Wall Street was concerned about Intel's inventory levels, and investors thought Intel's supply had outpaced demand.

Thanks to poor sentiment, the stock moved sideways. And yet, after the recession, Intel proved everyone wrong... Demand returned, and INTC shares began to move higher as the company was able to offload its Core Duo and Xeon processors.

Investors would miss this by looking only at as-reported metrics. The GAAP numbers only show misrepresented profitability levels.

However, looking at Uniform Accounting and the Embedded Expectations analysis can show the entire picture. Investors need to look beyond recent price movements and see what the market is pricing into a stock at current levels.

We now know expectations are extremely low for Intel. All the company has to do is maintain current profitability to outperform expectations. Intel has beaten expectations before... and this time might be no different.

Regards,

Joel Litman

August 14, 2020

To the absolute shock of no sports fans... referees aren't unbiased!

To the absolute shock of no sports fans... referees aren't unbiased!