While working at home has some negatives, it's important to keep the positives after the pandemic recedes...

While working at home has some negatives, it's important to keep the positives after the pandemic recedes...

The coronavirus pandemic has affected workers across the globe, in every industry. If companies had the capability, they shifted legions of employees to remote work.

Spending so much more time at home has driven a huge change in spending habits. It's a shift that we've termed the "At-Home Revolution."

Some folks might think that things will revert right back to the old "normal" once the pandemic has calmed. The reality is, the At-Home Revolution has opened the door for both employees and employers to see work improve well beyond the pandemic, by balancing the benefits of working at home with those of being in the office.

Some work activities – such as corporate training, team meetings, dinners, or happy hour get-togethers – are much more natural in person.

Years ago, when I was posting 75-hour weeks in management consulting, I was working for a great manager. Even with those long business hours, he required everyone to have dinner together twice a week. During the dinner, we weren't allowed to discuss work-related topics.

At first, I found the idea of it wasteful. Given the long hours we were working already, why not allow us the free time to relax individually? Or allow the team to take advantage of being together and discuss important issues with a project?

Initially, I complained... but then I realized after a few dinners that this socialization was great for our team's empowerment. The success of the project and the satisfaction of the team members went hand-in-hand with getting to know each other personally.

That non-work engagement made us a stronger team overall. It resulted in more business success.

Physical offices and in-person events do facilitate communication – among those in the office. However, the problem is that when people can't make it to these events or aren't in the right office on the right day, they can be left out.

Sometimes, office environments can even become tribal. When an employee walks into a different department, sometimes people are less welcoming than they should be.

The fact is, offices and in-person gatherings can still create physical barriers to otherwise necessary and beneficial communication channels.

The fact is, offices and in-person gatherings can still create physical barriers to otherwise necessary and beneficial communication channels.

Virtual events may actually allow businesses to be far more inclusive of all relevant personnel... not just those who have the ability to be on-site.

We've been finding new ways to incorporate these types of socialization events. In a world where so many folks are working remotely, we need to be creative and capture the best of both the physical and virtual worlds.

Hopefully the At-Home Revolution, coupled with our ability to innovate and foster non-physical work environments, will in some ways make the ties between employees even stronger.

As more businesses begin to embrace the idea of integrating remote workers into the company culture, both employees and employers will benefit...

As more businesses begin to embrace the idea of integrating remote workers into the company culture, both employees and employers will benefit...

And with the big shift to working at home and fewer folks coming back into offices, companies certainly don't need as much space.

Some of the companies that have been the fastest to embrace this trend are tech firms, such as Facebook (FB), Alphabet's (GOOGL) Google, and Twitter (TWTR).

However, that means some of the businesses most at risk from this change are office real estate investment trusts ("REITs").

Today, Hudson Pacific Properties (HPP) is one REIT particularly exposed to these types of tech companies. Hudson Pacific has office space in major tech hubs on the West Coast, including Seattle and the Bay Area. Hudson Pacific leases out space to firms like Google, Netflix (NFLX), Square (SQ), and Uber (UBER).

While investors may assume this situation means the company has banner returns, it has never been a license for Hudson Pacific to print money...

While investors may assume this situation means the company has banner returns, it has never been a license for Hudson Pacific to print money...

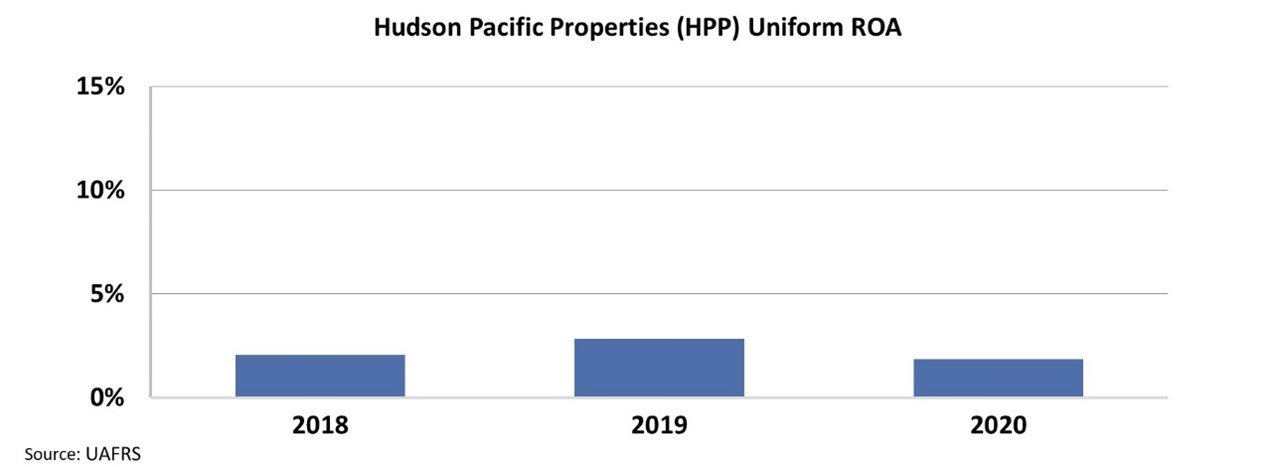

When we clean up its financial statements using Uniform Accounting, we can see that Hudson Pacific's Uniform return-on-asset ("ROA") levels haven't even reached 5%, which is the current cost-of-capital level. Take a look...

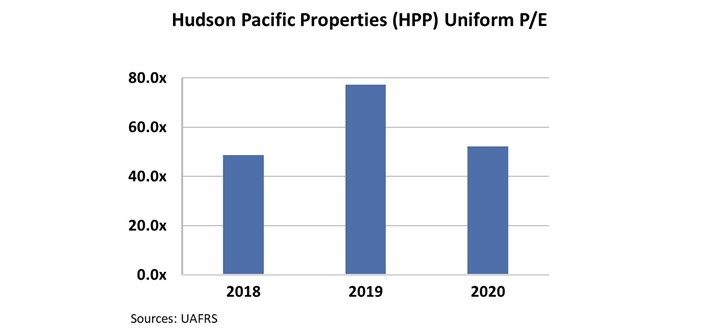

And yet, investors are paying a premium price for the stock, hoping that Hudson Pacific will find a way to turn this situation around.

Specifically, the company's Uniform price-to-earnings (P/E) ratio has been greater than 45 times in recent years. This is more than twice the average market P/E ratio of just 20 times.

If Hudson Pacific's tenants continue to use less office space as the pandemic recedes, investors betting on this REIT's cash flows and asset growth may be sadly disappointed.

With such high premiums for a company not even making back its cost of capital, the new work-from-home world may be the trigger that drives Hudson Pacific's valuations to come crashing back down to reality.

Regards,

Joel Litman

March 19, 2021

P.S. The "At-Home Revolution" is creating plenty of losers like Hudson Pacific, but it's also creating winners. A few of these companies could potentially become the tech giants of the next decade... and that means you have a chance to position your portfolio ahead of time, as we get an idea of how the post-pandemic economy will unfold. Learn more here.

While working at home has some negatives, it's important to keep the positives after the pandemic recedes...

While working at home has some negatives, it's important to keep the positives after the pandemic recedes...