Wall Street just punished Alphabet (GOOGL) for spending too much on AI...

Wall Street just punished Alphabet (GOOGL) for spending too much on AI...

It didn't matter that the tech giant reported strong 2024 earnings, with annual revenues up 14% and net income up 36%.

Investors latched on to one number in the company's latest earnings report – $75 billion.

That's how much Alphabet is planning to spend on capital expenditures ("capex") this year... an eye-watering figure that sent the stock down about 7% in after-hours trading.

Overall, shares are now down 15% since the report on February 4.

That's because to short-term investors, it looks like reckless spending.

However, history tells a different story... See, Alphabet isn't making a mistake. As we'll explain, it's making the exact kind of investment that built the world's most valuable tech businesses.

Big Tech has always won by spending first, profiting later...

Big Tech has always won by spending first, profiting later...

Take Amazon (AMZN) during the early 2000s, for example.

At the time, Amazon wasn't the e-commerce, streaming, advertising, and cloud-computing behemoth it is today. It was just an online bookstore... struggling to turn a profit while competing with big-box retailers.

Then, it made a decision that confused Wall Street: It started pouring billions of dollars into cloud infrastructure.

In 2006, the company launched Amazon Web Services ("AWS").

For years, it was an expensive project with little return. And analysts criticized Amazon for burning cash.

Despite revenue exploding into the tens, and eventually hundreds, of billions of dollars... the company's net income didn't consistently surpass $1 billion until 2016.

When it finally did, though, everything changed...

AWS became the backbone of the modern Internet – and a true pioneer in the global cloud-computing industry.

Today, it generates more than $100 billion in annual revenue and accounts for nearly two-thirds of Amazon's total operating income.

Alphabet is doing the same thing with AI...

Alphabet is doing the same thing with AI...

The company has been utilizing and investing in the technology for decades, though it has been ramping things up in recent years.

It introduced a number of new AI products, including its Gemini AI assistant, its Duet AI productivity software tool, and its Imagen 3 text-to-image model.

Most of Alphabet's AI services fall under its Google Cloud business. And the company's latest results show that Google Cloud demand remains strong, even though revenue came in slightly below analyst expectations last quarter.

Chief Financial Officer Anat Ashkenazi even admitted that the company doesn't yet have enough AI capacity to meet demand... which is exactly why it's ramping up spending.

As Ashkenazi said during the company's recent earnings call, the $75 billion in capex will go toward "technical infrastructure, primarily for servers followed by data centers and networking."

Now, we recommended Alphabet to our Hidden Alpha subscribers way back in 2020 – before the company was openly making huge bets on AI.

And while the stock has more than doubled since then, investors still don't fully get the picture.

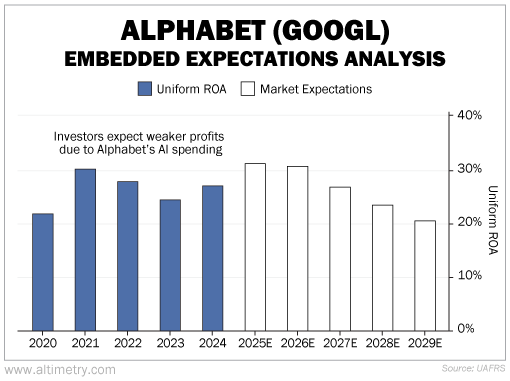

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Alphabet's Uniform return on assets ("ROA") has averaged about 27% over the past four years. However, investors seem worried that all this AI spending will drag the company's profitability down to around 20% by 2029.

Take a look...

While investors panic over short-term spending, they're missing the bigger picture.

This is how every major tech shift has played out... We saw it with Amazon and cloud computing in the 2000s, and it's happening again with Alphabet and AI.

In other words, AI spending today will drive Alphabet's profitability tomorrow.

Alphabet has done this before...

Alphabet has done this before...

It spent billions of dollars building Google Search, YouTube, and Android before these businesses became massive profit machines.

Now, it's repeating the process with AI – and the market is still underestimating its long-term upside.

Investors see Alphabet's rising capex and assume it will be bad for the business. History suggests otherwise...

Alphabet is laying the foundation to dominate the AI race. And those who recognize this shift early could have a rare opportunity to "buy the dip" before the market catches on.

Regards,

Joel Litman

March 11, 2025

Wall Street just punished Alphabet (GOOGL) for spending too much on AI...

Wall Street just punished Alphabet (GOOGL) for spending too much on AI...