I felt a first small step back to normalcy on a recent trip...

I felt a first small step back to normalcy on a recent trip...

When I flew through Boston's Logan Airport, I was surprised and happy to see that the American Airlines (AAL) Admirals Club lounge was actually open.

I walked in and saw familiar faces I've known for years. We were able to recognize each other through our masks, even though I haven't seen many of these folks for some time.

While I waited an hour or so to board the flight, I had the pleasure of catching up with the front desk check-in staff and the bartenders. Once, I ran into one of the bartenders and his family at Boston's Museum of Science. The other bartender uses his flight permissions to visit the Red Sox spring training camp every year in Florida.

The lounge was even serving the same lobster sandwiches and chocolate chip cookies, just as I remembered them from many times before. (For the record, the lobster sandwiches at this Admirals Club lounge are possibly the best in New England... and this is coming from someone who grew up in Maine!)

It was nice to see somewhat of a return to normalcy, even if it was just an airport lounge being back in action. It's a small step toward a world we remember.

I have such a close connection to the Logan Airport Admirals Club because I have good status and loyalty for flying American Airlines and the OneWorld air carrier alliance, given my decades of flying on that particular group of airlines. They treat me well, and the loyalty status provides some great conveniences when flying.

Unfortunately, a good loyalty program and great service at an airport lounge don't always translate into a good stock pick...

Robust loyalty programs still haven't been able to save the airline industry from multiple bankruptcies...

Robust loyalty programs still haven't been able to save the airline industry from multiple bankruptcies...

Over the decades, the airline industry has been one of the lowest-returning corners of the market for investors of all stripes. As business magnate Richard Branson famously said, "If you want to be a millionaire, start with a billion dollars and launch a new airline."

Airlines only do well when there are short-term tailwinds to prop up performance – such as consolidation in the industry, declining oil prices, or unusually strong demand.

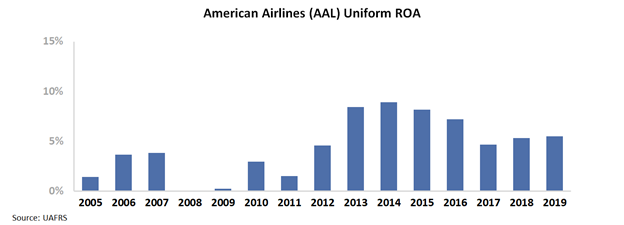

This phenomenon did occur in a short burst for American Airlines from 2013 to 2016. Thanks to a wave of consolidation and low oil prices, these were some of the best years for airline profitability. This stretch was also the only time American Airlines has been able to sustain a Uniform return on assets ("ROA") greater than 5% over the past 15 years, let alone the last 50-plus years.

In the mid-2000s and early 2010s, the company consistently failed to even approach that 5% level. Take a look...

Without some external driver to suddenly boost short-term returns again, it's hard for investors to justify putting their money to work in American Airlines...

Without some external driver to suddenly boost short-term returns again, it's hard for investors to justify putting their money to work in American Airlines...

And none of those traditional potential tailwinds – in terms of consolidation, strong demand, and declining oil prices – are lined up right now. So, near-term expectations for American Airlines' ROA to jump higher seem like a pipe dream.

And yet, it looks like the market is already pricing in a significant recovery from the disaster that the pandemic has made of the industry.

To gain greater insight into what market expectations are for the future of American Airlines, we can use our Embedded Expectations Framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes future assumptions and produces the "intrinsic value" of a particular stock.

However, models with garbage-in assumptions only come out as garbage. Here at Altimetry, we turn the DCF model on its head. We use the current stock price to determine what returns the market expects a company to generate.

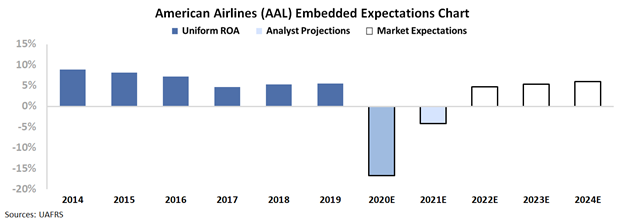

In the chart below, the dark blue bars represent American Airlines' historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how American Airlines' ROA will shift over the next five years.

As I said earlier, American Airlines' returns slid from 2014 to 2019 as the company slowly lost its short-term tailwinds. This shows the fleeting nature of success in the airline industry, even before the pandemic limited air travel.

Wall Street analysts project American Airlines' Uniform ROA levels to collapse through 2020 and 2021. This makes sense given that the number of people travelling has fallen off a cliff because of the pandemic.

And yet, coming out of the pandemic, the market is pricing in American Airlines' profitability to rebound quickly in the next few years – anticipating the company's Uniform ROA to reach 6% by 2024. Take a look...

Despite a historic headwind to performance, the market expects American Airlines to exceed profitability levels seen over the past three years... That's a level only achieved with the help of tailwinds to the entire industry, which aren't likely to reappear anytime soon.

Considering the long road airlines have to get back to "normal" and have everyone comfortable flying again, it appears the market is already pricing in the absolute best-case scenario for American Airlines. Investors should continue to be skeptical... These are huge expectations to meet.

Regards,

Joel Litman

January 22, 2020

I felt a first small step back to normalcy on a recent trip...

I felt a first small step back to normalcy on a recent trip...