So much for bitcoin being 'digital gold'...

So much for bitcoin being 'digital gold'...

In the midst of a market crash, investors often talk about safety assets. Whether it's U.S. Treasurys, gold, or real estate, people seek investments to park their cash to preserve capital when the markets tumble.

For years, we've heard about bitcoin as an inflation hedge and a secure asset in the face of paper fiat currencies. It's supposed to be "digital gold." When the market dropped or the economy looked to be at risk, bitcoin would be the safe-haven asset. But so far, that hasn't been the case...

In fact, during the recent sell-off, bitcoin has fallen even further than the market has... At one point, the cryptocurrency fell by more than 50%.

Bitcoin has been anything but a safety asset.

It's just another reminder that at this point, bitcoin and cryptocurrencies in general are really a "risk on" asset, and should be treated as such.

With so many big economic shifts and policy changes recently, sometimes it's hard to take the long view...

With so many big economic shifts and policy changes recently, sometimes it's hard to take the long view...

It's easy to forget that we've been through similar events in the past... and that while some parts of the economy might change, many others will stay the same.

Thinking back to the Great Recession, we had to reconsider how much risk banks should be allowed to take, how the mortgage industry should work, and how the U.S. Federal Reserve should handle bailouts in the future.

That said, most other industries were unaffected in the long term and have bounced back exactly to where they were prior to 2007.

This time around, we might need to consider what changes to make to the health care industry or how we work from home in the future, and we may find that we need to change the way we support small businesses during extended shutdown periods – it's too early to tell for sure.

Either way, it may feel like the ongoing pandemic and economic shakeup are going to dramatically change our economy... But history shows us it won't be as dramatic as you think.

Eventually, workers will be able to return to their offices, hospitals will return to normalcy, and most businesses will reopen.

Furthermore, many of the economic trends we've discussed in the past will return.

This is a great opportunity for us to discuss a topic we haven't explained in detail – the difference between "cyclical'" trends and "secular" trends.

You're probably familiar with the idea of business and market cycles. Most people understand concepts like product life cycles, bull and bear stock market cycles, and the inherent fluctuations we see in the economy.

These are all cyclical trends – they shift between highs and lows in a somewhat predictable fashion (cycles always come to an end).

That said, if cyclical trends were the only trends in the market, we would never make progress as a society. In order to continuously grow and innovate, we rely on a different type of trend – a secular trend.

These are much longer-term trends that describe how society, the economy, and markets evolve over time.

Technology is a great example of a secular trend – businesses continue to innovate new technologies, adopt those technologies, and improve their operations as a result.

We're not likely to see this reverse at any point, which is a good indicator that it's not a cyclical trend.

Recently, many investment shops have started referring to secular trends as "megatrends." Some firms even base their entire investment philosophy on identifying megatrends early in the process and realizing returns as those trends play out.

It's important to consider both cyclical trends and megatrends... but right now, we find that most investors are overly focused on the current business cycle.

This poses a great opportunity for us to discuss a niche company that's at the center of a major technological megatrend – lasers.

Many industries are finding clever ways to integrate lasers and laser technology into their operations. Industries like telecom, aerospace and defense, life sciences, and semiconductors can improve the quality, accuracy, and scale of their operations by using high-precision lasers.

For example, this megatrend is driving telecom companies to replace traditional cable networks with high-speed fiber-optical networks which make use of lasers and optic cables to transmit information faster.

And one company supplies lasers and optical equipment to each of the industries listed above, but the market doesn't seem to notice...

II-VI (IIVI) is a leading producer of high-precision lasers for applications in fiber optics, consumer electronics, automotive equipment, and many other industries. The company's customers include major corporations like Ford Motor (F), Nokia (NOK), Cisco (CSCO) and Lockheed Martin (LMT).

Despite II-VI's strong list of customers and significant support from the laser megatrend, investors appear concerned about the company's potential.

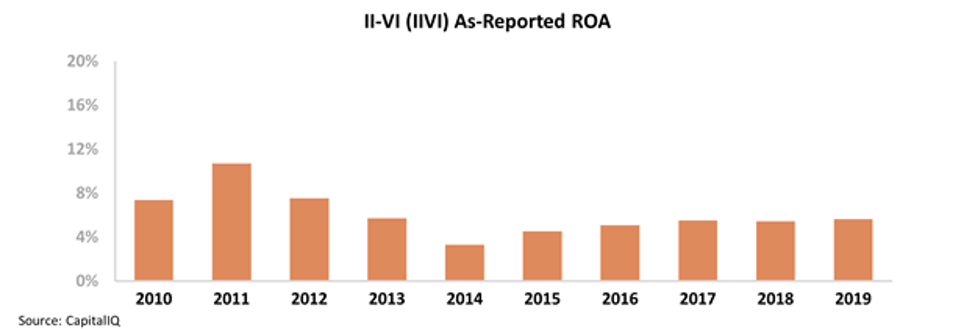

Over the past decade, II-VI has only maintained average profitability – with its return on assets ("ROA") falling from a high of 11% in 2011 to just 6% last year.

This may give investors the impression that II-VI has significant client demand, but no competitive moat.

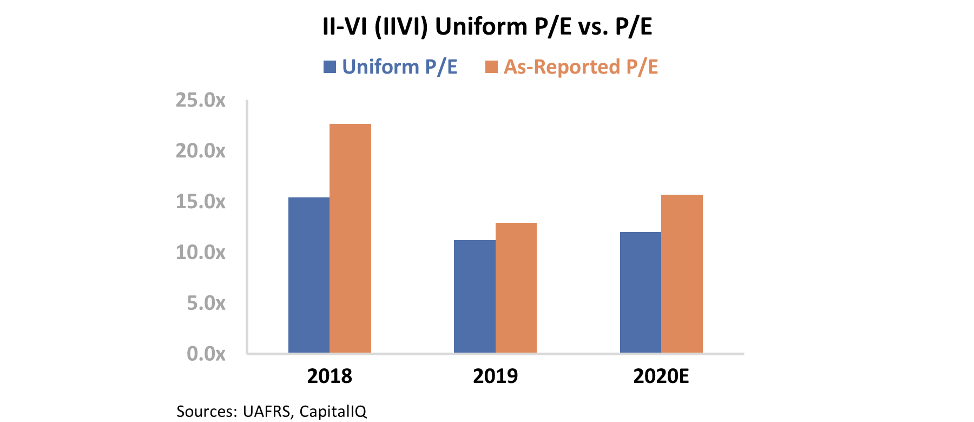

As a result, valuations have come under pressure. The company's Uniform price-to-earnings (P/E) ratio has fallen to 12, which is well below market-average levels near 20.

Investors may not be paying attention to how much momentum II-VI has to gain from the laser megatrend, and they may be understating the company's competitive moats.

But once we apply our Uniform Accounting metrics, we can see that the company's returns are much stronger than as-reported metrics suggest...

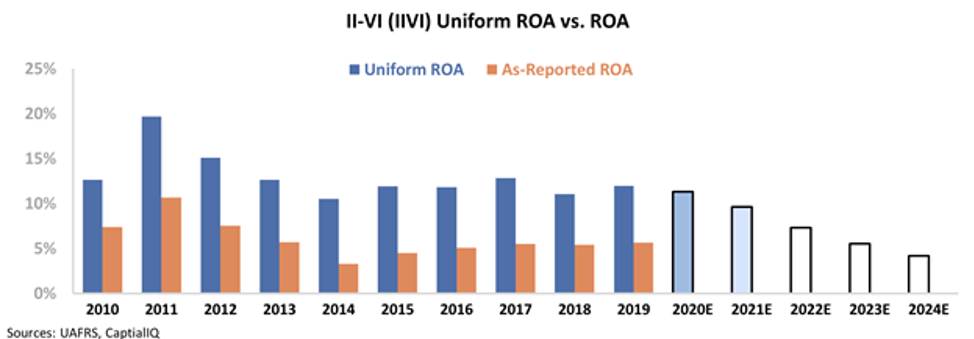

The chart below shows II-VI's historical profitability based on Uniform ROA (dark blue bars) compared to analyst estimates for the next two years (light blue bars) and market expectations at current stock prices (white bars).

As you can see, II-VI is twice as profitable as the GAAP numbers suggest. Not only that, but at current valuations, investors expect to see the company's ROA fall to just 4% – levels that II-VI hasn't seen in the past decade. Take a look...

But while investors are so pessimistic, these megatrends ultimately won't be disrupted in the long term by the coronavirus pandemic or any other disruption in the current market cycle.

As investors begin to realize II-VI's real performance, that these trends are around to stay, and how bearish current expectations are, the company's stock is likely to rise.

Regards,

Joel Litman

April 2, 2020

So much for bitcoin being 'digital gold'...

So much for bitcoin being 'digital gold'...