It's safe to say GLP-1 drugs are one of the biggest breakthroughs in modern health care...

It's safe to say GLP-1 drugs are one of the biggest breakthroughs in modern health care...

GLP-1s started as a powerful treatment for diabetes. But unlike traditional drugs, these treatments can target multiple conditions at once.

Today, they're showing promise for everything from weight loss to cardiovascular disease, and even Alzheimer's disease. And every few weeks, new research emerges... adding yet another condition to their ever-expanding list of uses.

When you hear about GLP-1s, two companies in particular probably come to mind – Novo Nordisk (NVO), the maker of Ozempic and Wegovy, and Eli Lilly (LLY) with Zepbound.

While Ozempic is the best-known of the bunch, it would be a mistake to sleep on the competition. So far this year, Zepbound has gotten good results for its ability to treat sleep apnea... and it's showing promise at reducing chronic kidney disease, too.

Transformations like these are extremely rare. Investors are taking note of all this demand. And yet, as we'll explain, they're still underestimating the potential of GLP-1 drugs.

Through Zepbound, Eli Lilly has turned GLP-1s into a $730 billion opportunity...

Through Zepbound, Eli Lilly has turned GLP-1s into a $730 billion opportunity...

Every time research reveals a new use, the pharmaceutical giant finds itself with a fresh market to address... fueling demand in a way few can match.

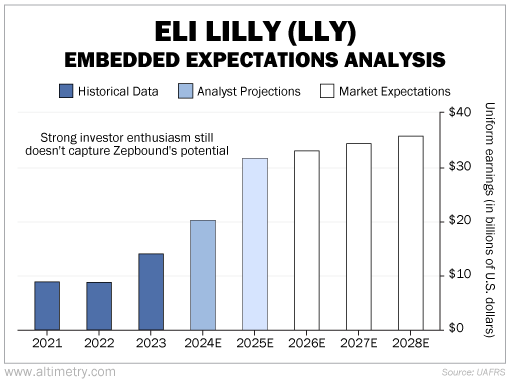

The numbers show how transformative this drug has been. Eli Lilly's Uniform earnings skyrocketed from $8.8 billion in 2022 to $14 billion the year Zepbound was approved for weight loss. That number is expected to reach $31 billion by 2025.

Investors are already catching on to Zepbound's potential. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA works a lot like a betting line in a sports bet. We use Eli Lilly's current share price to calculate what investors expect from future earnings... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Investors expect earnings to reach an impressive $36 billion by 2028. But even that estimate is underestimating Zepbound's potential.

Take a look...

As you can see, the market is calling for unmistakable growth in Eli Lilly's earnings. But the cardiovascular drug market alone was worth around $145 billion last year. Diabetes treatments reached $68 billion.

If GLP-1s can capture even a portion of these markets, it would represent huge growth.

So far, one of the biggest barriers to accessing these drugs has been the high price tag...

So far, one of the biggest barriers to accessing these drugs has been the high price tag...

Back when they were the only approved drugs on the market, the major GLP-1s cost as much as $1,000 per month depending on the brand.

But rivals are racing to improve the technology behind GLP-1s. They're working on monthly injections instead of weekly, and even creating oral versions to eliminate needles altogether.

Costs are dropping fast. Eli Lilly has already slashed the price of its injections by 50%. And by the end of the decade, the cost in the U.S. could fall to around $3,000 per year – putting these treatments within reach for millions more people.

It's no wonder that Bloomberg Intelligence projects global spending on weight-loss drugs to surge from $15 billion this year to $94 billion by 2030. With more than 1 billion adults classified as obese worldwide, that's a massive potential customer base.

These drugs are driving a seismic shift in health care. Eli Lilly is helping pave the way. With each new ailment GLP-1s help treat, the market for the entire industry keeps growing.

And while investors expect a lot from Eli Lilly, if it keeps growing its market at this rate... it has a lot more room to run.

Regards,

Joel Litman

November 19, 2024

It's safe to say GLP-1 drugs are one of the biggest breakthroughs in modern health care...

It's safe to say GLP-1 drugs are one of the biggest breakthroughs in modern health care...