Dear reader,

The filmmaking industry is a fickle, uncertain business.

Casablanca, a film expected to flop, went on to become a sleeper hit and a boon for the nascent Warner Brothers. It helped fuel Warner Brothers to become the premier studio it is today.

However, Gone with the Wind – the highest-grossing film of all time, adjusted for inflation – did nothing to save Selznick International Pictures from liquidating a few short years later.

Studios like Warner Brothers, Universal, and Paramount have stood the test of time and delivered great content again and again. However, the filmmaking business is inherently a boom-or-bust enterprise for the most part.

I regularly fly from the U.S. to Asia and back to meet with clients and work with our Philippines and U.S. teams. Over the last few years, I have noticed one exception to that rule... Disney (DIS) has become a content-generating machine.

The choices of films to watch on the plane are always filled with Marvel, Pixar, Star Wars, and other Disney content, for young and old viewers.

But for the most part, other studios – like Lionsgate, STX Entertainment, MGM... and even Sony, Warner, Paramount, and Universal – see much more volatility in the successes of their movies and the trends of their profitability.

In the world of content, many people think the movie business stands alone in this volatility.

The advertising revenue of basic cable companies and the visibility of affiliate fees for cable programming give TV broadcasters clearer returns. Radio may be reliant on advertising, but stations generally have good visibility with their listener bases, and therefore their value. The stations' content doesn't change radically from month to month.

The print business is in secular decline, but People magazine is not going to see make-or-break swings in its revenue because of one cover story.

And yet, there is one media industry that has that same tendency towards volatility that the movie business does. Many don't think of it immediately as a media business, but it fills the same need as all the content I described above.

The fledgling video-game industry looks a great deal like the movie business. The uncertainty of success, from video game to video game, can cause significant volatility in returns. And only a few companies have built franchises strong enough to provide visibility to investors.

The challenge for investors in 2019 is to identify the Warner Brothers of the current video-game space: The video-game studio that will be able to survive for the long run.

According to a recent study by GlobalData, the video-game industry is expected to more than double from $130 billion to $300 billion by 2025. With video games here to stay – and growing fast – it is important for investors to understand which companies they should trust.

At first glance, you might write off Take-Two Interactive Software (TTWO) as a choice to invest in. The company owns two major publishers, 2K and Rockstar Games, that have historically seen weak profitability. Up until 2013, Take-Two's return on assets ("ROA") oscillated between positive and negative returns... until one game-changing launch.

In 2013, Grand Theft Auto 5 (also known as GTA 5) took the gaming world by storm and launched Take-Two into the spotlight and the green. The title broke seven Guinness World Records after its launch day, including best-selling video game in 24 hours and fastest entertainment property to gross $1 billion.

Through word-of-mouth marketing after the Grand Theft Auto series' sleeper hit GTA 4 – and a long development cycle that built hype among consumers – GTA 5 arrived at the perfect time for its struggling video-game publisher. Since the GTA 5 launch, Take-Two has ramped up its releases with recent successes such as Red Dead Redemption 2 and Borderlands 3.

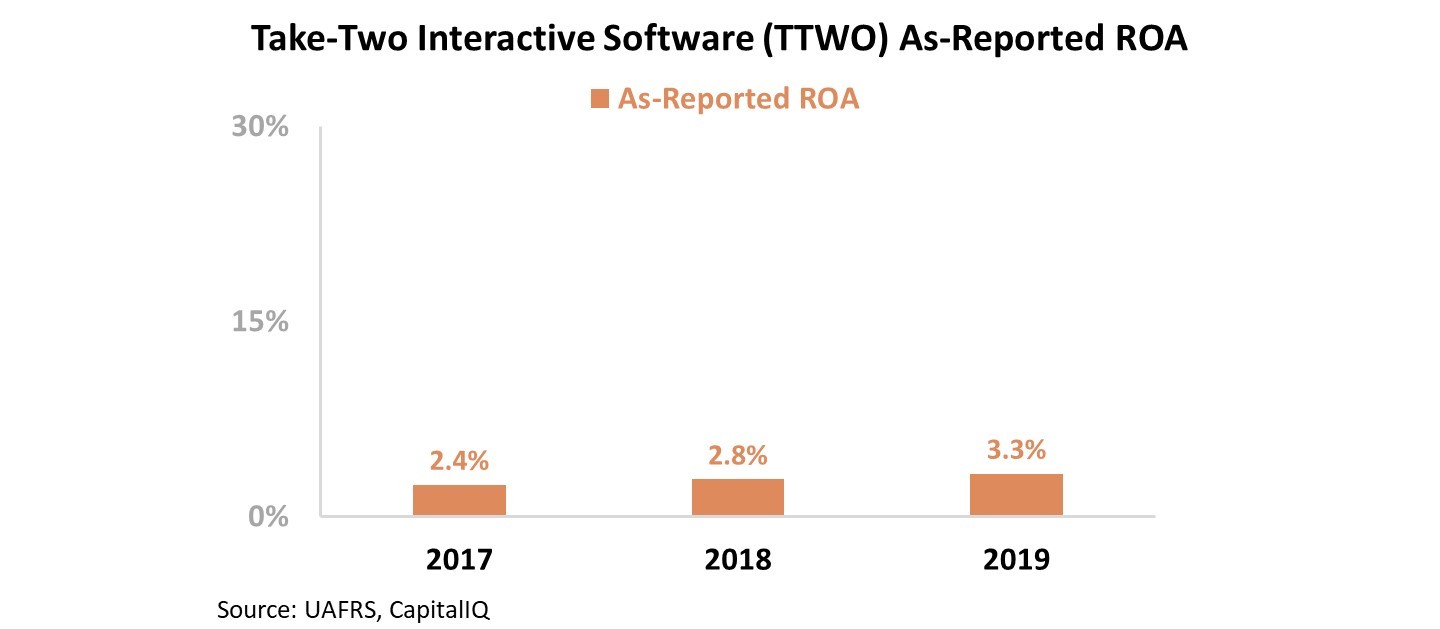

But to investors, it appears that Take-Two has failed to profit off its newest launches, with paltry 3% returns over the past three years. Furthermore, Take-Two currently trades for a price-to-earnings ("P/E") ratio of around 25, leading investors to think they are overpaying for a failing company.

Looking at this information, it would make sense for investors to view Take-Two as another Selznick Pictures – an interesting historical footnote in the golden age of video-game development.

Instead, this is just another example of how as-reported metrics have deceived investors.

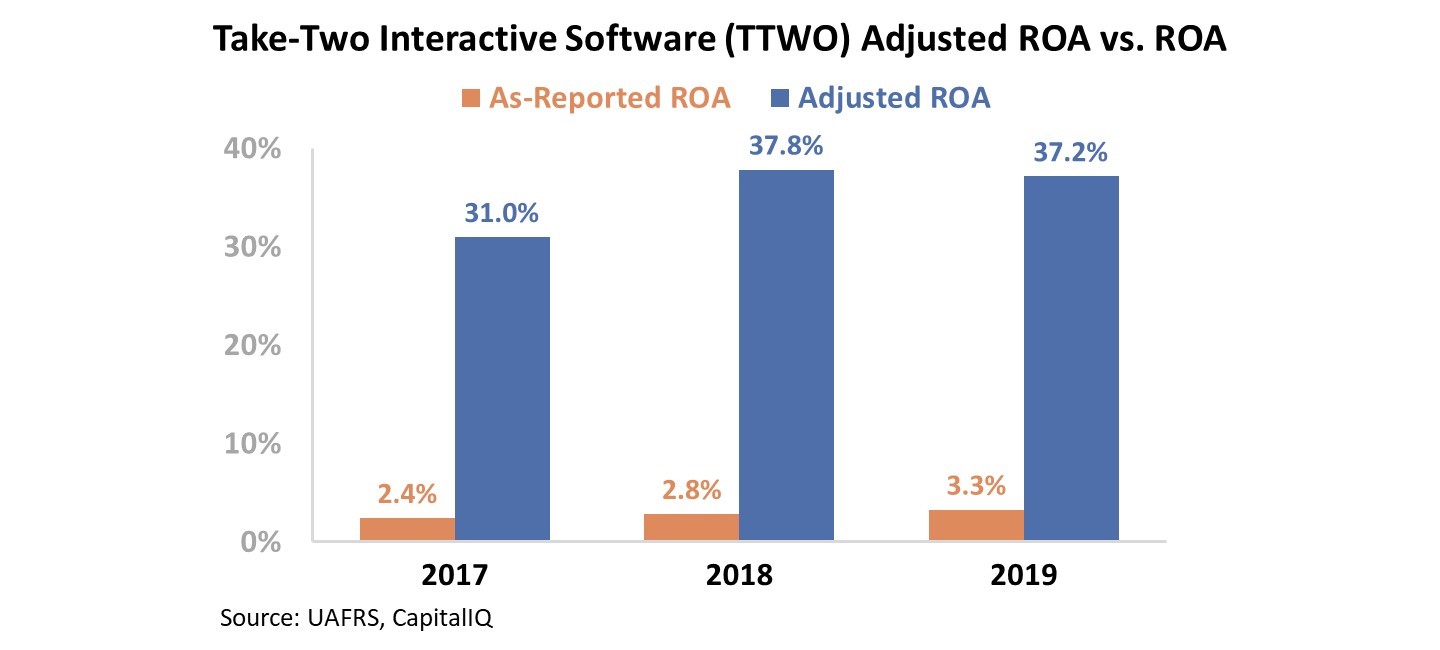

Rather than a low 3% return, over the past three years Take-Two has experienced robust returns of more than 30%. What's more, from fiscal year 2017 to fiscal year 2019, returns have increased significantly to 37%. Take a look...

Rather than squander the capital and goodwill that Take-Two realized after GTA 5, the company has been launching successful and profitable products. Its most recent launch, Borderlands 3, sold a record number of copies in five days. And Take-Two's next big launch, The Outer Worlds, is the long-awaited release from popular studio Obsidian Entertainment.

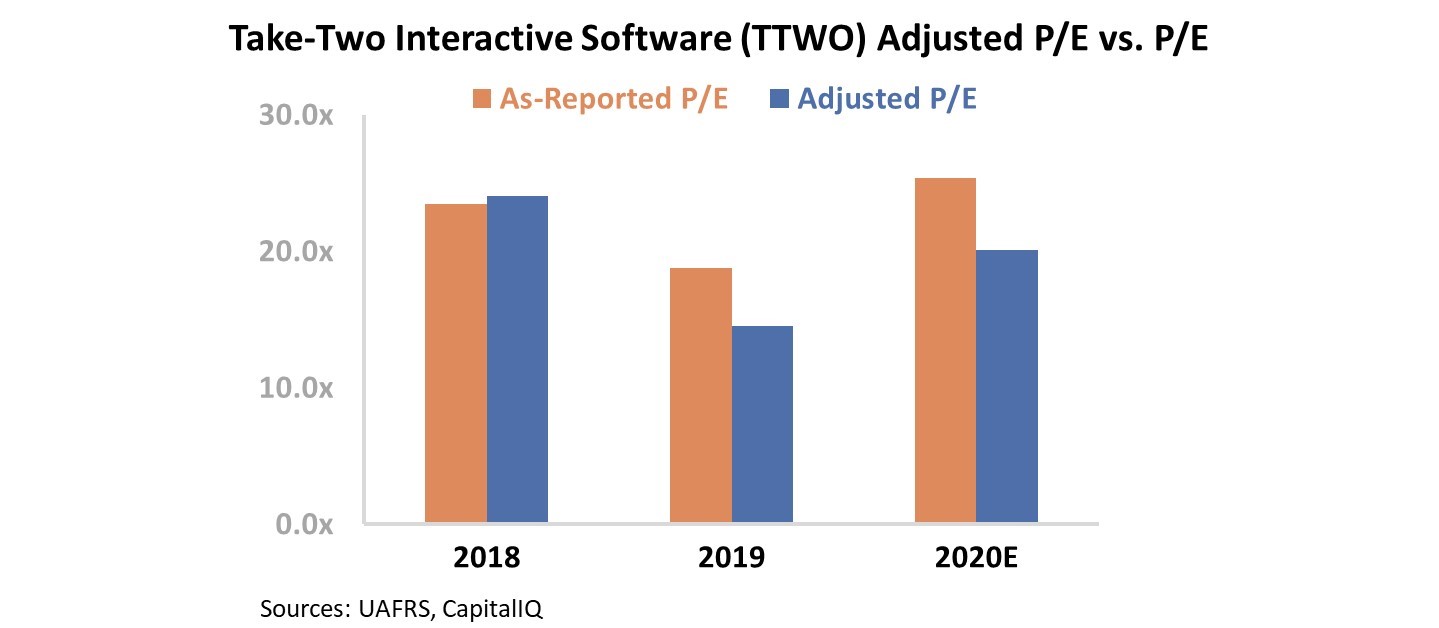

A misrepresented ROA is not the only reason for investors to be hesitant about the company... As-reported metrics show Take-Two priced well above market averages at a P/E ratio of around 25. The company looks expensive.

But once again, these numbers do a disservice to Take-Two. Using our Uniform Accounting metrics, we can see that the company trades for a Uniform P/E ratio of around 20 – right near corporate averages.

Not only does Take-Two boast higher returns than the market thinks, but the company is trading well below as-reported levels. These distortions mean investors view Take-Two as a loser in a cutthroat new industry, rather than the improving company it actually is.

With Uniform Accounting, investors can spot the difference between a content-generating machine like Disney and a struggling Selznick Pictures... and realize which one Take-Two really is.

Regards,

Joel Litman

October 22, 2019