With a critical waterway blocked, many experts feared the worst for global trade...

With a critical waterway blocked, many experts feared the worst for global trade...

When the massive container ship Ever Given got stuck in the Suez Canal for six days until last Monday, trade between Asia and Europe ground to a halt. Dozens of ships loaded with goods were caught in a traffic jam.

These two markets have traded for thousands of years, though the historic Silk Road trade route connecting Europe and China has long since been replaced by cargo ships. However, one trade good that many folks expected to be disrupted by the Ever Given situation didn't come from East Asia, but the Middle East.

Europe is a huge importer of Middle Eastern oil. With trade halted, analysts expected a spike in crude oil prices. That didn't pan out, but oil prices stabilized slightly after a drop in early March. Right now, crude prices are near $59 per barrel – close to early 2020 highs after historically low oil prices throughout much of last year.

But as the Ever Given was dug out and set on its way, other longer-term price drivers are back at work... which may mean the rally after the collapse last year in the wake of the coronavirus pandemic won't last.

For example, the International Energy Agency ("IEA") doesn't see any huge price swings on the horizon.

And oil cartel OPEC, which sets production quotes for its member countries, held 9.3 million barrels per day of spare production thanks to pandemic shortfalls last February. By artificially constricting supply, the group hoped to keep prices high. Despite this, oil inventories are at recent highs... which will eventually be a headwind for prices.

Due to reduced demand during the pandemic, developed countries hold a sizable reserve of 110 million barrels above last year's levels. And that was before OPEC announced late last week that it was going to start winding down its production curbs and returning to normal volumes.

Combined with news of the pandemic worsening in big oil consumer India – which may further stifle demand– this was enough to send oil prices lower.

Those folks – as well as oil and gas companies – hoping for a "supercycle" of a period of sustained oil prices above averages might be disappointed. The economics just don't back it up, in either the short or long term.

Profits at oil and gas companies are directly affected by the price of oil. The IEA's expectation for steady oil prices means investors should be reevaluating the oil and gas industry.

To get a better understanding of the entire market, we can turn to The Altimeter for the breakdown of the real financials...

To get a better understanding of the entire market, we can turn to The Altimeter for the breakdown of the real financials...

Using the power of Uniform Accounting – which eliminates the distortions in as-reported financial metrics – The Altimeter shows users easily digestible grades to rank stocks based on the actual numbers.

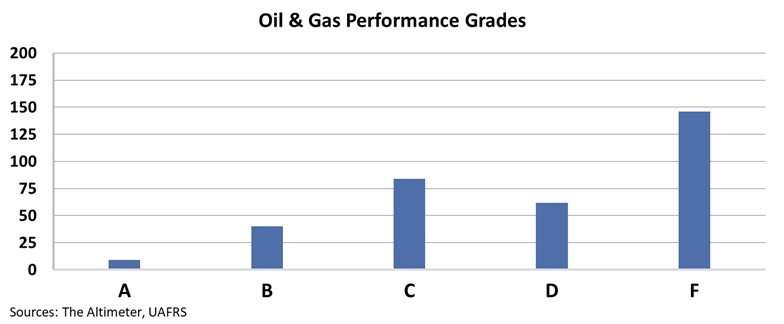

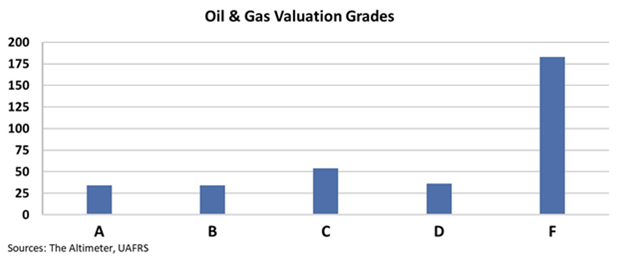

After making our Uniform adjustments, we can break down the oil and gas industry by letter grade to get a snapshot of the performance and valuation for the entire market. This "eagle eye" view of the industry shows the pain.

Companies with "A" grades are doing things well based on the different metrics they're graded on. Companies with an "F" grade are doing poorly.

Looking at the 341 energy companies in The Altimeter, only nine get an "A" for their operating performance, in terms of both profitability and trend in profitability. Forty get a "B," 84 get a "C," 64 get a "D," and a whopping 146 get an "F."

With such low earnings power across the board, these companies need an oil supercycle just to produce half-decent profitability in the future.

And while these companies are struggling, it's clear on the whole that investors are betting on outperformance ahead. More than half of the energy companies in The Altimeter get an "F" for valuations, which means investors have incredibly high expectations for future performance.

If the IEA is right, the price of oil won't see a huge spike or slide in the next few months. And without a big move, oil stocks will be primed for a correction as investor expectations come back to earth.

But regardless of a supercycle, a select few oil and gas companies have strong fundamentals based on their Uniform numbers...

But regardless of a supercycle, a select few oil and gas companies have strong fundamentals based on their Uniform numbers...

And this could prime their stocks for upside ahead. Altimeter subscribers can access the full database right here – to see the top-ranked oil and gas companies, just set the filter for the Energy sector.

If you aren't an Altimeter subscriber, click here to find out how to gain immediate access to the Uniform Accounting data you're missing out on for the oil and gas industry... along with the thousands of other publicly traded companies available in the database.

Regards,

Rob Spivey

April 8, 2021

With a critical waterway blocked, many experts feared the worst for global trade...

With a critical waterway blocked, many experts feared the worst for global trade...