The coronavirus pandemic emptied out the streets of Manhattan...

The coronavirus pandemic emptied out the streets of Manhattan...

With all the news you've likely read about Manhattan in the past 24 months, it's not surprising that people left the city in droves when the pandemic hit.

From empty subway stations to a high incidence of violence to floods stranding passengers underground, transit has gotten treacherous. Office towers that remain mostly vacant in big office districts have hurt the local restaurants that make their money at lunch time.

With COVID-19 variants making waves, the city's cultural draws such as Broadway, sports games, and museums have all been forced to navigate a challenging environment.

At the beginning of the pandemic, people migrated away from the city as remote work became the standard. As social events and activities also came to a standstill, the apartment vacancy rate in New York reached well above 10%.

However, as the omicron variant abated, this story has been changing. The vacancy rate dropped back to pre-pandemic levels and has been below 2% for the past four months.

This surge in demand can be tied to lightening COVID-19 restrictions as employers return to offices and the city's social life livens up.

Manhattan apartment rents are at record levels as well. According to Miller Samuel, an independent residential real estate consulting company, tenants paid a median of $3,644 per month on new leases signed in March.

Since July and August are typically when the market is its busiest, the housing market may even continue to heat up from here.

Cheap housing in the city has sailed...

Cheap housing in the city has sailed...

So, if you or a loved one is trying to make it in the city that doesn't sleep on the cheap, unfortunately, your door has closed.

However, there is one group that is celebrating – apartment real estate investment trusts ("REITs") like AvalonBay Communities (AVB).

AvalonBay Communities has apartment buildings across major cities like New York, Boston, Silicon Valley, and elsewhere. It has also expanded its portfolio by investing in housing in surrounding suburbs.

Folks returning to the cities strengthens the company's position as the demand for housing increases the value of its investments.

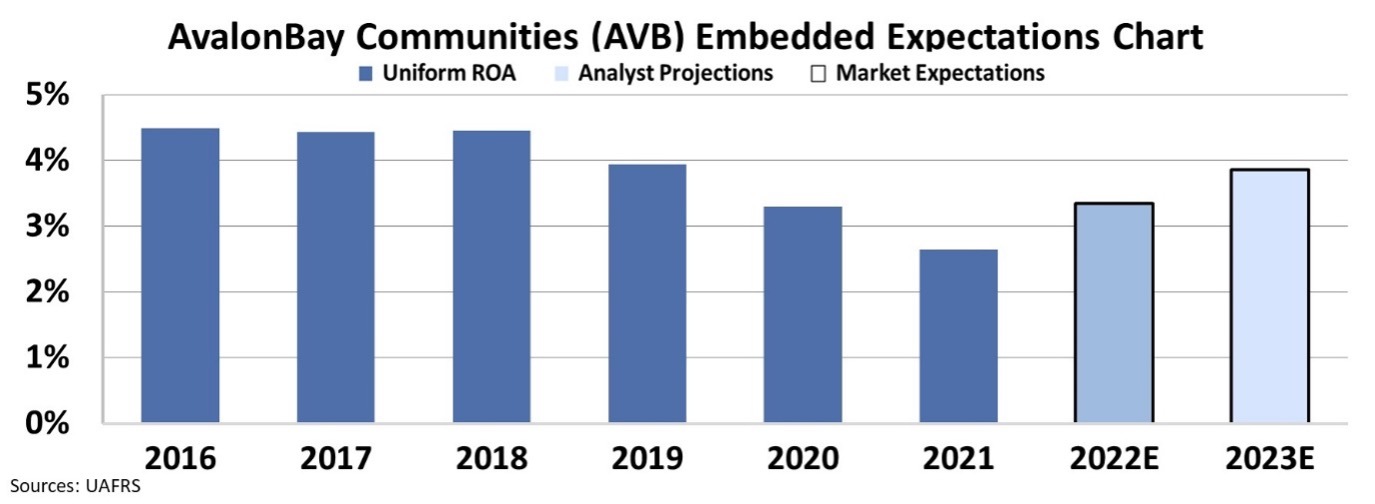

When we look at the Uniform return on assets ("ROA"), we can see that the past couple of years have been challenging for AvalonBay Communities. Profitability stumbled, and ROA dropped from close to 5% in 2018 to merely 3% in 2021.

However, analysts expect ROA to recover in the next two years, coming close to pre-pandemic levels and reaching 4% in 2023.

As housing demand returns to normal for cities across the U.S., AvalonBay will begin to recover.

Is this the time to get in and buy the stock?

Is this the time to get in and buy the stock?

The business will probably get back on its feet in the next few years with a full recovery likely in the works. The company may even ride the wave of rising housing costs to see all-time-high profitability levels.

However, this doesn't necessarily mean the stock is a buy. We need to look at what the market expects from the company before making a decision.

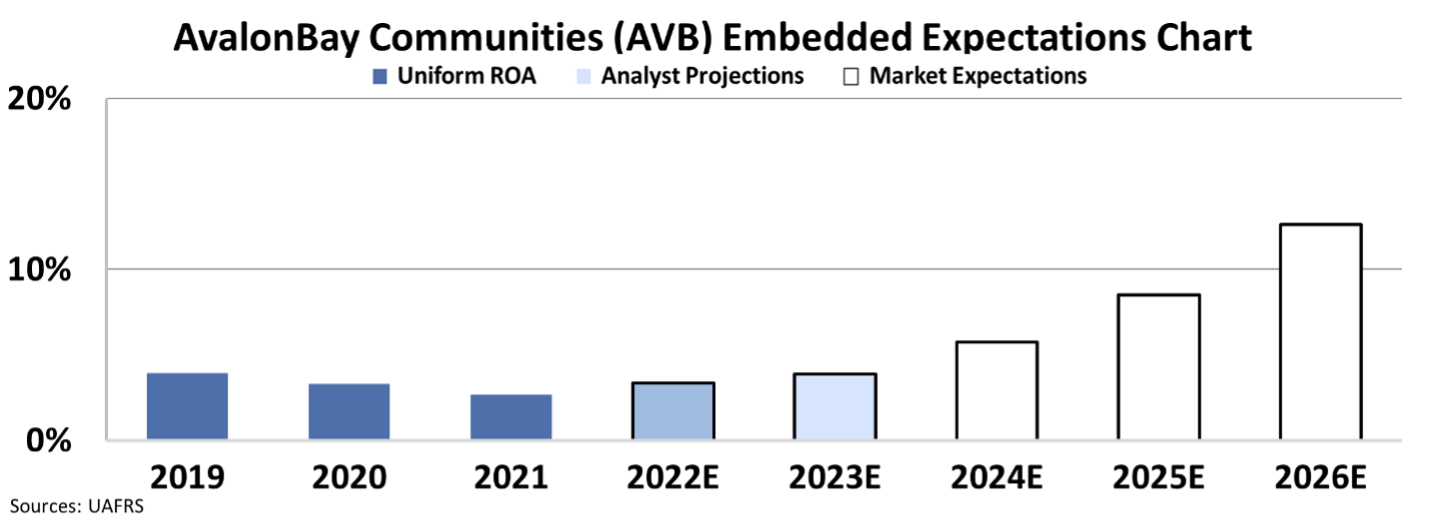

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our EEA to determine what returns the market expects.

The stock is currently priced to completely rebound to reach all-time highs, with Uniform ROA jumping to 10%.

Even though AvalonBay has a great opportunity with rising rents and housing prices ahead, the market is already overly excited, making the stock one to pass on. For there to be any possible upside, the market would have to exceed these already lofty valuations.

This just goes to prove that a good business is not always a good investment. Instead, it is important to get in on a good business at good valuations.

Regards,

Joel Litman

May 4, 2022

The coronavirus pandemic emptied out the streets of Manhattan...

The coronavirus pandemic emptied out the streets of Manhattan...